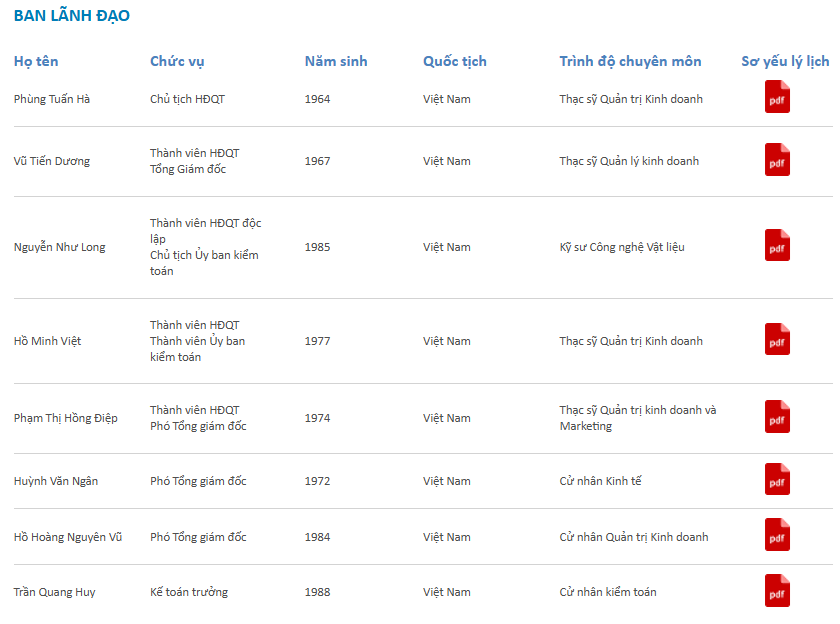

A list of registrations includes Board members, CEO Vu Tien Duong selling 399,250 shares (ratio 0.37%), Board member Ho Minh Viet selling 209,100 shares (ratio 0.2%), Deputy CEO Huynh Van Ngan selling 297,000 shares (ratio 0.28%) and Deputy CEO Ho Hoang Nguyen Vu selling 78,020 shares (ratio 0.07%), to be executed in the period of 08/06-09/04.

Previously, Board member and Deputy CEO Pham Thi Hong Diep registered to sell all 153,300 PET shares held from 08/01-29/08. Thus, within a few days, 5 out of 8 leaders of PET registered to divest their shares.

Source: PET Website

|

Recently, PET shares have witnessed a series of large-volume matching transactions. Specifically, HD Capital Management Joint Stock Company (HDCapital) purchased 15.3 million shares on 07/28 (14.34% ratio), increasing its holdings from zero shares.

On 07/28, nearly 20.3 million PET shares were traded via matching transactions, with a value of nearly VND 568 billion, averaging VND 28,000/share. Meanwhile, only more than 2.6 million shares were matched by orders. It is highly likely that the matching volume included HDCapital’s transaction.

Prior to this, VietinBank Capital – Vietnam Industrial and Commercial Bank, Limited Liability One Member Company (VietinBank Capital) sold 7.8 million PET shares on 07/23, reducing its ownership from 10 million shares (9.37% ratio) to 2.2 million shares (2.06% ratio), thus no longer being a major shareholder.

During the 07/23 session, PET recorded exactly 7.8 million shares traded via matching transactions, with a scale of more than VND 217 billion, averaging VND 27,850/share. Notably, in the next session on 07/24, PET continued to record 2.2 million shares matched with a value of more than VND 61 billion, with an average price of VND 27,850/share. This volume also matched the remaining number of PET shares held by VietinBank Capital.

|

Series of PET leaders intending to divest their holdings

Source: VietstockFinance

|

|

Numerous large-volume matching transactions of PET shares recently

Source: VietstockFinance

|

The above selling and registration of sales took place while PET has just established a strong uptrend accompanied by active trading volume, after experiencing a tax shock that pushed the share price to its bottom at VND 16,700/share (closing price on 04/09). As of the closing price on 08/04 at VND 36,300/share, PET has surged more than 117% from its bottom.

| PET share price returns to its 3-year peak |

The surge in share price somewhat reflects the positive business results in the second quarter.

Specifically, the Company earned nearly VND 4,722 billion, up slightly by 4% over the same period last year. However, the gross profit margin narrowed from 5% to 4.3%, resulting in a 10% decrease in gross profit to over VND 203 billion.

The highlight of the period came from financial activities with a profit of nearly VND 34 billion, as opposed to a loss of nearly VND 7 billion in the same period last year; alongside other activities with a profit of nearly VND 7 billion, compared to a loss of nearly VND 3 billion in the previous year. Nevertheless, the Company also faced some pressure from a 19% increase in selling expenses to over VND 115 billion.

Consequently, PET recorded a net profit of nearly VND 46 billion, up 51% over the same period, bringing the cumulative profit in the first half of the year to nearly VND 82 billion, up 25%.

In 2025, PET sets a target of VND 244 billion in after-tax profit. With nearly VND 99 billion earned in the first half of the year, the Company achieved 41% of its annual plan.

| PET’s quarterly business results in recent years |

– 16:28 04/08/2025