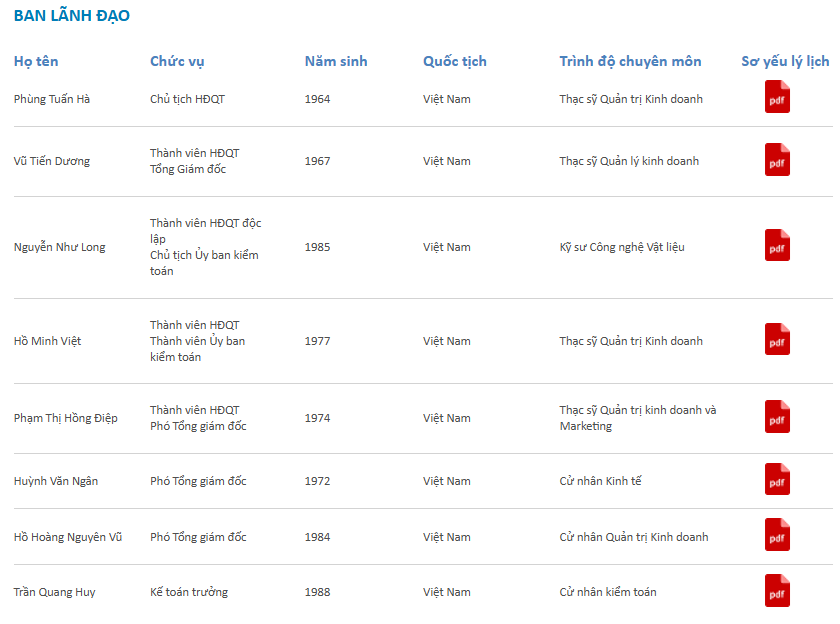

The registration list includes transactions from Board Members and Executive Directors, with Vu Tien Duong, a Board Member and the CEO, selling 399,250 shares (0.37%), Ho Minh Viet, another Board Member, selling 209,100 shares (0.2%), Huynh Van Ngan, the Vice President, selling 297,000 shares (0.28%), and Ho Hoang Nguyen Vu, also a Vice President, selling 78,020 shares (0.07%). These transactions took place between August 6 and September 4.

Prior to this, Pham Thi Hong Diep, a Board Member and Vice President, registered to sell all of her 153,300 PET shares between August 1 and August 29. Within a few days, five out of eight PET leaders had registered to offload their entire stockholdings.

Source: PET Website

|

Recently, PET shares have seen a surge in large-volume matching transactions. Specifically, HD Capital Management JSC (HDCapital) purchased 15.3 million shares on July 28 (14.34%), becoming a new major shareholder.

On the same day, nearly 20.3 million PET shares were traded via matching transactions, valued at nearly VND 568 billion, with an average price of VND 28,000 per share. Meanwhile, only over 2.6 million shares were matched through normal transactions, suggesting that the large-volume matching transactions likely included HDCapital’s purchase.

Previously, VietinBank Capital, a wholly-owned subsidiary of Vietnam Industrial and Commercial Bank, sold 7.8 million PET shares on July 23, reducing its ownership from 10 million shares (9.37%) to 2.2 million shares (2.06%), thus no longer being a major shareholder.

On July 23, exactly 7.8 million PET shares were traded via matching transactions, valued at over VND 217 billion, with an average price of VND 27,850 per share. Notably, on the following day (July 24), PET again recorded 2.2 million shares in matching transactions worth over VND 61 billion, at the same average price of VND 27,850 per share. This volume matched the remaining number of PET shares held by VietinBank Capital.

|

A series of PET leaders intend to divest their entire holdings

Source: VietstockFinance

|

|

Numerous large-volume matching transactions of PET shares have occurred recently

Source: VietstockFinance

|

These sales and registrations occurred during a period when PET shares experienced a strong upward momentum accompanied by high trading volume, following a tax shock that pushed the stock to a low of VND 16,700 per share (closing price on April 9). As of the closing price of VND 36,300 per share on August 4, PET has surged over 117% from its low.

| PET’s market price returns to its 3-year high |

The sharp rise in the share price partly reflects the positive financial results for the second quarter of this year. Specifically, the Company generated nearly VND 4,722 billion in revenue, a slight increase of 4% compared to the same period last year. However, the gross profit margin narrowed from 5% to 4.3%, resulting in a 10% decrease in gross profit to over VND 203 billion.

The highlight of this quarter was the financial performance, with a gain of nearly VND 34 billion, compared to a loss of nearly VND 7 billion in the previous year. Additionally, the ‘other income’ segment contributed a gain of nearly VND 7 billion, compared to a loss of nearly VND 3 billion in the same period last year. However, the Company faced some pressure from a 19% increase in selling expenses, totaling over VND 115 billion.

Consequently, PET recorded a net profit of nearly VND 46 billion, a 51% increase compared to the previous year, bringing the six-month cumulative profit to nearly VND 82 billion, a 25% increase. For the full year 2025, PET aims to achieve a net profit of VND 244 billion. With nearly VND 99 billion in profit in the first half, the Company has achieved 41% of its annual plan.

| PET’s quarterly financial results over the past few years |

– 4:28 PM, August 4, 2025

Insider Trading: PET Leaders’ Strategic Exit as Share Prices Peak, Welcoming HDCapital’s Influence.

Recent developments at the Joint Stock Oil and Gas Service Company (Petrosetco) have caught the attention of investors. Five key leaders at the company, listed on the Ho Chi Minh Stock Exchange (HOSE) under the ticker symbol ‘PET’, have registered to sell their entire stock holdings. This move comes as the share price returns to a three-year high. In contrast, HDCapital has emerged as a significant shareholder, acquiring 15.3 million PET shares on July 28.

The Power of Profits: How a 30.2% Rise in Earnings for Over 1000 Businesses is Impacting Stock Performance

The stock market is a vibrant and dynamic arena, where you’ll always find stocks that exhibit a disconnect between their stellar financial performance and their stagnant stock prices. These stocks often fly under the radar, belonging to the mid-cap or small-cap category, unnoticed by most investors.

KienlongBank Announces Q2 2025 Financial Results: Multiple Business Indicators Achieve Over 90% of Targets

KienlongBank (UPCoM: KLB) has announced its Q2 2025 financial results, boasting impressive performance. The bank’s consolidated pre-tax profit reached VND 565 billion, with key business indicators such as total assets, mobilized capital, and credit outstanding achieving over 90% of the year’s set plan.

“Digital Transformation Pays Off: HDBank Records Impressive 6-Month Profit of VND 10,068 Billion, with ROE Climbing to 26.5%”

“HDBank (HOSE: HDB) has announced its Q2 and H1 2025 financial results, boasting impressive profits exceeding VND 10,068 billion, a remarkable 23% increase compared to the same period last year. The bank continues to lead the industry with top-tier performance and operational efficiency, solidifying its position as a powerhouse in the Vietnamese banking sector.”