Vietnam Stock Market Surges to All-Time High

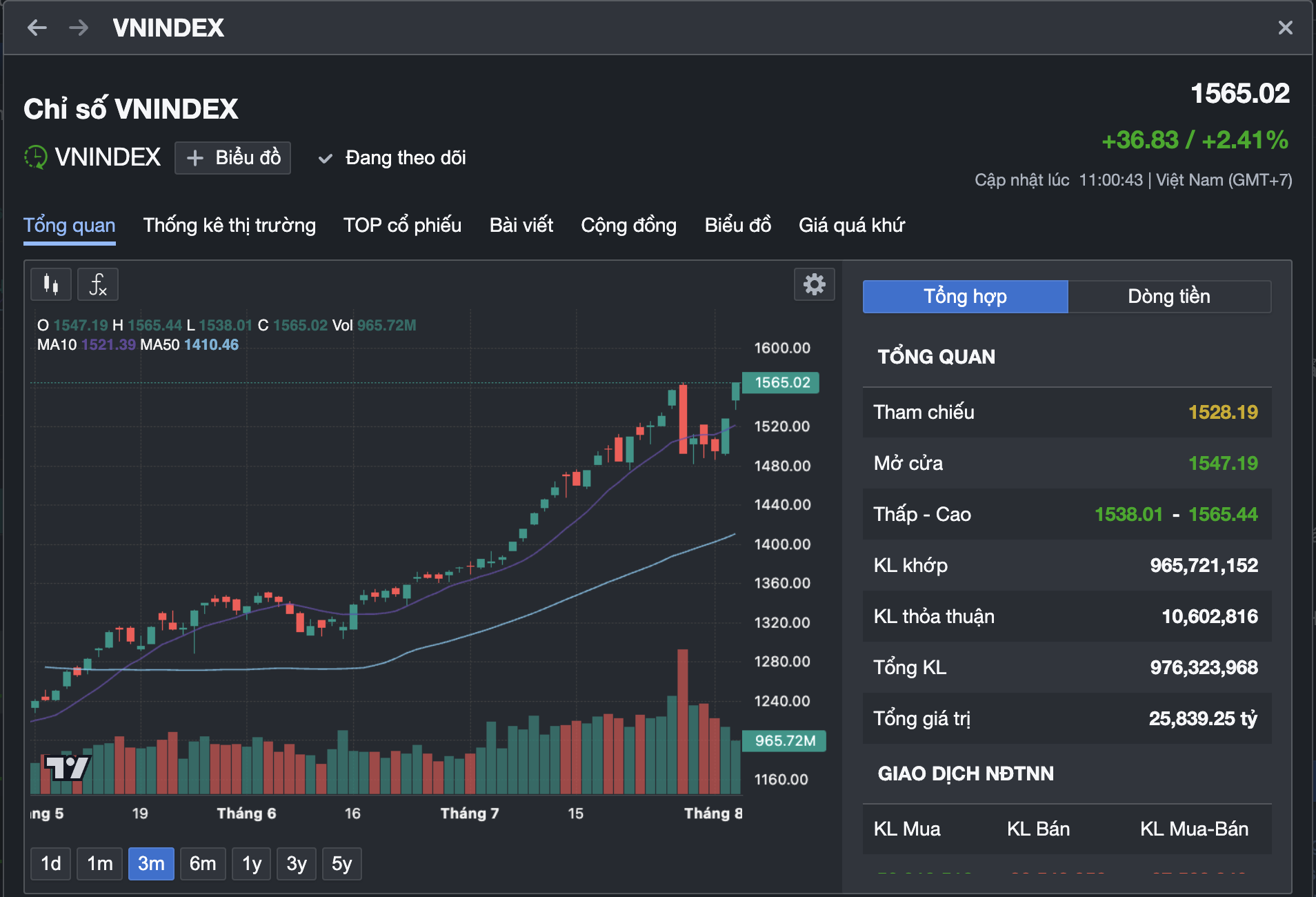

On August 5, Vietnam’s stock market witnessed a spectacular surge with widespread gains, propelling the VN-Index over 40 points to 1,569, surpassing the previous record of 1,564 set on July 29. Notably, the large-cap VN30 index, representing the country’s largest stocks, breached the 1,700 mark for the first time, climbing 58 points to a historic high.

Market liquidity continued to improve, with over 1 billion shares traded and a turnover of more than VND 28 trillion on the HoSE by midday.

The robust liquidity reflects the positive sentiment among investors, particularly as large-cap stocks across sectors rallied. Vingroup’s VIC and VHM made significant strides, while prominent banks such as TCB, MBB, VCB, BID, and CTG played a pivotal role in driving the market’s upward momentum.

Can You Invest in Stocks with Just 10 Million VND?

The market’s bullish trend has captivated the attention of numerous new investors, including those with limited capital of 10-20 million VND who aspire to seize lucrative opportunities. Ms. Nga, a first-time investor from Ho Chi Minh City, shared her experience of opening a trading account with just 10 million VND in disposable funds. However, she wondered if such a modest sum was sufficient for investing and, if so, how to avoid losses in the midst of a heated market.

Financial expert Phan Dung Khanh reassured that according to current regulations, one can commence trading with a minimum lot of 10 shares. If a share is priced at VND 10,000, an investment of approximately VND 1 million would be required to acquire 100 shares. Hence, with a capital ranging from 2 to 10 million VND, investors can strategically select stocks with reasonable prices.

At present, the share prices of several prominent companies remain relatively affordable for small investors. For instance, 100 shares of BID cost approximately VND 3.89 million; ACB is VND 2.37 million; HPG is VND 2.63 million, and SSI is VND 3.42 million. These stocks boast high liquidity and transparency, making them suitable choices for newcomers.

However, Mr. Khanh cautioned that limited capital could constrain portfolio diversification, heightening risks. During market rallies, novice investors often succumb to the temptation of quick profits, leading to impulsive decisions and herd mentality. Therefore, for first-time investors, the key lies not in the amount of capital but in knowledge, patience, and a well-defined investment strategy from the outset.

Vietnam’s stock market has been on an upward trajectory, attracting an influx of new investors.

He warned against the perils of excessive leverage, emphasizing that a strong market wave could wipe out an under-capitalized investor’s entire investment if risk management strategies are neglected. “They may employ financial leverage (margin) and borrow to invest, aiming for rapid profit growth. While this approach can double their account in a short period, it also heightens the risk of losing control. Thus, small investors must exercise caution and implement risk management strategies,” Mr. Phan Dung Khanh advised.

Conversely, small investors possess certain advantages over their larger counterparts. Their flexibility allows them to invest in low-priced, illiquid stocks that larger investors might overlook due to the potential impact on prices.

Mr. Khanh underscored the importance of small investors understanding their strengths and weaknesses. If leveraging, he recommended borrowing no more than 50% of their actual capital to maintain risk control. Setting defensive thresholds for investment accounts is also crucial.

Stock Selection Strategies for Investors with 10 Million VND Capital

Mr. Tran Hoang Son, Market Strategy Director at VPBank Securities, cited the legendary investor Dan Zanger, who turned $18,000 into $42 million in 24 months. Mr. Zanger’s strategy revolves around focusing on high-growth companies.

He suggested identifying the top 50 companies on the stock exchange with impressive profit growth rates and popularity among investors. Mr. Zanger employed the CANSLIM method, which entails screening for quality stocks, timing entries at opportune prices, and incorporating technical analysis and money flow considerations.

“In a bullish market like the current VN-Index, investors can target stocks with solid fundamentals, benefiting from cyclical and high-growth factors. These are ‘golden’ stocks. By timing your entry right and investing in these golden stocks, your wealth will grow over the medium to long term,” asserted Mr. Tran Hoang Son.

VN-Index reaches historic highs

The Youngest Chairman on the Vietnamese Stock Exchange: A Tale of Success and Ambition

Introducing the youngest chairman on the Vietnamese stock exchange. While wealth is not the sole measure of success, this individual’s achievements are undoubtedly impressive. With a sharp mind and a knack for leadership, they have risen through the ranks to become a prominent figure in the financial world. Their story serves as an inspiration to all, proving that age is just a number when it comes to pursuing your dreams.