Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 1.22 billion shares, equivalent to a value of more than 30.9 trillion VND; HNX-Index reached over 160 million shares, equivalent to a value of more than 3.2 trillion VND.

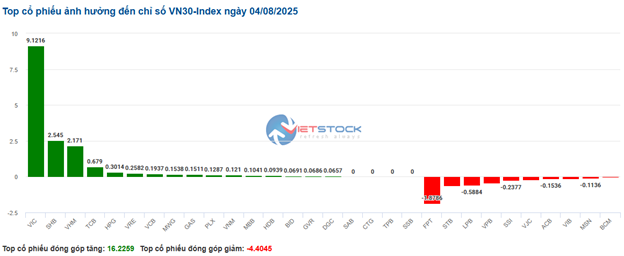

VN-Index continued to thrive in the afternoon session as buying power consistently outweighed selling pressure, pushing the index to close at the highest level of the positive session. In terms of impact, VIC, VHM, TCB, and VCB were the codes with the most positive influence on the VN-Index, with a 12.8-point increase. On the other hand, PNJ, GEE, BSR, and FPT were the codes that still faced selling pressure, but the impact was not significant.

| Top 10 stocks with the most significant impact on the VN-Index on 08/04/2025 (in points) |

Similarly, the HNX-Index also witnessed a fairly positive movement as the index was positively influenced by the codes SHS (+9.77%), NVB (+6.55%), KSV (+2.07%), MBS (+1.99%)…

|

Source: VietstockFinance

|

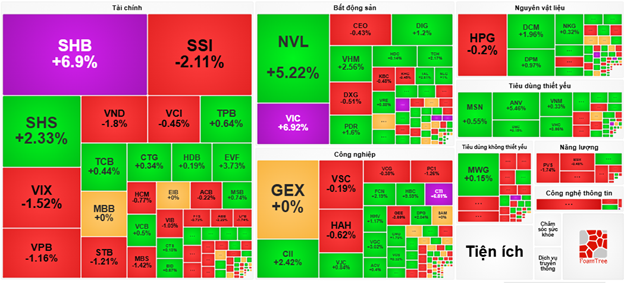

Green dominated most industry groups. Among them, the real estate industry was the group with the best market gain, up 3.35%, mainly driven by the codes VHM (+2.56%), VIC (+6.92%), NVL (+6.96%), and VRE (+2.28%). Following the recovery were the financial and non-essential consumer industries, with increases of 2.52% and 1.54%, respectively. On the other hand, the information technology and energy industries were the only two groups that recorded a decline in the market, falling by 0.36% and 0.06%, respectively, mainly due to the codes FPT (-0.37%), CMG (-0.75%), POT (-2.18%), VS (-0.29%), PVT (-0.27%), and PLX (-0.66%).

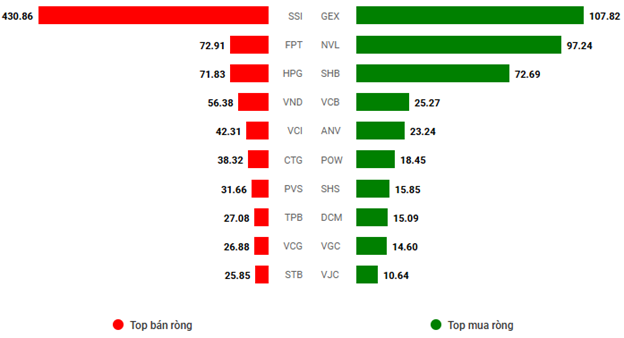

In terms of foreign trading, foreigners continued to net sell over 308 billion VND on the HOSE exchange, focusing on the codes SSI (394.38 billion), VHM (169.01 billion), FPT (109.39 billion), and HPG (106.21 billion). On the HNX exchange, foreigners net bought over 72 billion VND, focusing on the codes SHS (141.41 billion), MBS (3.43 billion), DL1 (2.01 billion), and DTD (1.83 billion).

In today’s session, foreign investors executed a trading agreement for VIC shares with two orders totaling 90 million shares. The transaction value reached nearly 10,000 billion VND. These shares were traded at 109,000 VND/share.

| Foreign trading net buying and selling movements |

Morning session: The rise narrowed, and foreigners heavily sold SSI

The upward momentum showed signs of cooling off towards the end of the morning session. From the highest increase of more than 20 points, the VN-Index narrowed its gain to 12.2 points (+0.82%), taking a mid-session break at 1,507.41 points. Meanwhile, the HNX-Index stopped at the reference level, reaching 264.87 points. The market breadth was relatively balanced, with 344 gainers and 320 losers.

The trading volume of HOSE this morning reached over 630 million units, equivalent to a value of 15.5 trillion VND, down 17.5% compared to the previous session. HNX recorded a volume of over 77 million units, equivalent to 1.6 trillion VND.

Among the top 10 stocks influencing the VN-Index, VIC is currently the code with the most positive impact, contributing almost 7 points to the increase. In addition, VHM, SHB, and VPL also added a total of 4.3 points to the overall index. On the other hand, VPB and FPT were the codes with the most negative impact, taking away more than 1 point from the index.

Considering industry groups, green dominated most stock groups. The real estate group temporarily led the market in the morning session, driven by codes such as VIC hitting the ceiling price, VHM (+2.67%), VRE (+1.05%), NVL (+5.22%), NLG (+1%), TCH (+2.17%), PDR (+1.6%), and TAL (+2.61%).

The industrial and financial groups also witnessed many bright spots, with notable liquidity in codes such as CTI hitting the ceiling price, CII (+2.42%), FNC (+2.19%), HBC (+9.59%), VGC (+3.02%), DPG (+2.04%); TPB (+0.64%), MSB (+0.74%), SHS (+2.33%), EVF (+3.73%), and SHB hitting the ceiling price. However, securities stocks are facing strong profit-taking pressure, as red dominated SSI (-2.11%), VIX (-1.52%), VND (-1.8%), MBS (-1.42%), and VFS (-1.99%).

Meanwhile, the information technology and energy groups failed to recover as selling pressure dominated the large-cap stocks in these industries, including FPT (-1.5%), CMG (-0.88%), ELC (-0.21%), VEC (-0.85%); BSR (-0.48%), PVS (-1.74%), OIL (-1.61%), PVD (-1.17%), and PVT (-1.09%).

Source: VietstockFinance

|

Foreigners continued to net sell heavily, with a value of more than 697 billion VND on the three exchanges. SSI topped the net sell list with a value of 430.89 billion VND, far exceeding the other stocks. Meanwhile, buying demand concentrated on three codes, GEX, NVL, and SHB, with values of 107.82 billion VND, 97.24 billion VND, and 72.69 billion VND, respectively.

Source: VietstockFinance

|

10:30: Money flow favors the financial and real estate sectors, VN-Index continues to thrive

As of 10:30, green continued to dominate the market, with the VN-Index rising more than 15 points to trade at the 1,510-point level. The HNX-Index increased by 1.47 points to 266 points. The positive momentum was mainly driven by the financial and real estate sectors.

The breadth in the VN30-Index basket was slightly biased towards the upside. Notably, VIC, SHB, VHM, and TCB contributed 9.12 points, 2.54 points, 2.17 points, and 0.67 points to the VN30 index, respectively. On the other hand, codes such as FPT, STB, LPB, and VPB were still under selling pressure, taking away more than 3.6 points from the overall index.

Source: VietstockFinance

|

The financial group continued to be the market’s pillar, despite the mixed performance within the sector. Specifically, on the upside, we saw codes such as SHB (+6.9%), TCB (+0.73%), VCB (+0.5%), BID (+1.08%), and CTG (+0.23%) performing well. However, some codes faced selling pressure, including ACB, which declined by 0.22%, LPB by 0.87%, STB by 0.91%, and VPB by 0.58%.

The real estate industry also witnessed a positive momentum, with the sector gaining 3.06%, the highest among all sectors. Buying demand was strong for codes such as VHM, which increased by 2.34%, VIC by 6.54%, NVL by 5.8%, and VRE by 0.35%.

Conversely, the information technology group was the only sector in the red. Specifically, selling pressure was evident in most codes, including FPT, which fell by 1.4%, CMG by 0.75%, DLG by 0.29%, ITD by 0.67%, and POT by 2.16%.

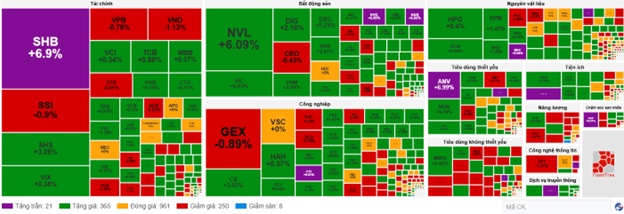

Compared to the opening, the buying side continued to hold the upper hand. There were 365 gainers and 250 losers.

Source: VietstockFinance

|

Opening: The market continued to be mixed at the beginning of the session

At the start of the session on August 4, as of 9:30 am, the major indices fluctuated around the reference level. The VN-Index slightly increased by nearly 1 point to 1,496 points, while the HNX-Index decreased by nearly 1 point to around 264 points.

Green gradually returned to the industry groups after the opening bell. Notably, the utilities group led the recovery, with some codes such as GAS rising by 1.33%, REE by 0.31%, POW by 0.7%, and PGV by 5.81%.

On the other hand, it is worth noting that the financial stock group continued to face selling pressure, with mixed movements. Some codes that increased included VCB (+0.83%), TCB (+1.03%), and BID (+1.08%)… However, codes such as CTG decreased by 0.56%, VPB by 1.55%, and MBB by 0.18%…

Large-cap stocks such as VIC, TCB, and VCB supported the market, offsetting a decline of nearly 4.8 points. Conversely, VPB, FPT, and CTG exerted negative pressure on the overall index, taking away more than 1.5 points.

– 15:20 08/04/2025

Stock Market Update for July 28 – August 1, 2025: Navigating Foreign Outflows

The VN-Index witnessed a decline during the week’s final session, concluding the week’s trading below the 1,500-point mark. Despite the medium-term uptrend remaining technically intact, the index’s failure to hold the crucial psychological support level, coupled with sustained foreign net selling pressure, presents notable signals for investors. Should this trend persist, further market adjustments are likely on the horizon.

The Market Beat: Foreigners Turn Net Buyers, VN-Index Recovers Over 14 Points

The trading session concluded with significant gains, as the VN-Index rose by 14.22 points (+0.95%), closing at 1,507.63. Meanwhile, the HNX-Index also witnessed a notable increase of 6.15 points (+2.41%), finishing the day at 261.51. The market breadth tilted in favor of advancers, with 426 tickers in the green and 337 in the red. Similarly, the VN30 basket painted a bullish picture, as 20 stocks advanced, 9 declined, and 1 remained unchanged, ending the day on a positive note.

Stock Market Insights: Can the Uptrend Persist?

The VN-Index showcases a near-Doji candle pattern, with liquidity maintained above the 20-session average, indicating investor indecision. In the short term, the index is likely to retest the historical peak around the 1,530-point level. However, investors should be cautious of potential volatility at higher price levels, as the Stochastic Oscillator indicator weakens in the overbought territory.

Market Beat: Foreigners Turn Net Buyers, VN-Index Holds Firm at 1,510 Points

The trading session concluded with the VN-Index climbing 2.77 points (+0.18%), reaching 1,512.31. Meanwhile, the HNX-Index witnessed a rise of 1.48 points (+0.6%), ending the day at 249.33. The market breadth tilted towards the bulls, as evident from the advance-decline ratio of 467:296. A similar trend was observed in the VN30 basket, with 17 gainers outpacing 13 losers.

The Market Breakthrough

The VN-Index soared to new heights, surpassing its previous record peak set in early 2022. Impressive liquidity has been sustained, with average volumes over the past 20 weeks reflecting a strong influx of capital into the market. The MACD indicator continues to widen the gap with the Signal line since the buy signal emerged in mid-May 2025, reinforcing the upward momentum in the medium term. However, the Stochastic Oscillator has begun to level off in the overbought region, suggesting a potential for technical corrections at elevated price levels in the coming weeks.