A robust first half-year business picture with growth doubling the market

In the first half of 2025, credit grew by 12%, and capital mobilization increased by 13% compared to the end of 2024, nearly doubling the industry’s overall growth rate. This growth trajectory indicates that MB effectively utilized the leeway gained after the mandatory transfer of a zero-dong bank (MBV).

As of June 30, 2025, MB’s consolidated total assets reached nearly VND 1.3 quadrillion, up 14.2% from the end of 2024. Customer lending neared VND 880,000 billion, marking a 13.3% increase from the beginning of the year.

Customer deposits also witnessed a 9.7% surge, surpassing VND 783,000 billion. The current account and savings account (CASA) ratio stood at 38%, a 0.6% dip from the previous year. Nonetheless, CASA continued its upward trend, reaching VND 297,000 billion.

Despite proactively reducing lending rates to support the economy, MB’s total operating income (TOI) climbed by 25% year-on-year, nearing VND 32,600 billion. Notably, non-interest income surged by 37%, reflecting a positive shift in the income structure. Consolidated pre-tax profits increased by 18.3%, reaching nearly VND 15,900 billion.

The cost-to-income ratio (CIR) witnessed further optimization, dropping by over 2% year-on-year to 27.4% (consolidated). Regarding risk management, MB proactively increased provisioning expenses by 65% to build a robust safety buffer, maintaining the consolidated non-performing loan ratio at 1.6%, consistent with the 2024 year-end level.

The ecosystem of eight subsidiary companies within the MB ecosystem operated efficiently, contributing over VND 1,550 billion in profits (up 32% year-on-year) and accounting for nearly 10% of the Group’s profits.

Vision for the second half of 2025

Screenshot

|

Mr. Dam Nhan Duc, MB’s Chief Economist, affirmed that MB remains in the top 4 in terms of asset size, mobilization, and lending; ranks first in CASA ratio (38%); and is among the top 4 in revenue and profits within the banking system.

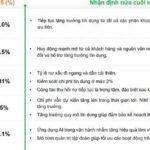

For the second half of the year, MB will focus on key solutions. The bank will continue to attract new customers and efficiently tap into existing ones. Selective credit growth will be a priority, focusing on retail and SME lending. MB will aim to improve lending rates by restructuring its portfolio and increasing the loan-to-deposit ratio. Deposit growth will be aligned with credit demand, emphasizing CASA and optimizing maturities and funding sources to maintain the cost of funds (COF) within the range of 3.1-3.2%.

The bank will maintain tight risk control, aiming to keep the non-performing loan ratio below 1.5% for the parent bank and ensure a coverage ratio above 100%. Cross-selling will be enhanced, and the performance of subsidiary companies will be improved. MB sets a target of a 10% productivity increase for the entire Group in 2025.

Screenshot

|

Sharing insights on the credit growth limit (“room”), Chairman of the Board of Directors Luu Trung Thai highlighted MB’s significant advantage. The bank has been allocated a room for the entire year of 2025, with a projected minimum growth rate of 25% (excluding MBV). Notably, due to its role in the restructuring of MBV, MB has been assigned one of the highest growth limits in the market for the 2026-2028 period. This forms a crucial foundation for the bank’s business plans in the coming years.

The Chairman also affirmed MB’s confidence in its competitive edge and scale, ensuring adaptability if the credit growth limit policy is lifted in the future.

In response to investors’ inquiries about loan portfolios, Chairman Luu Trung Thai provided reassurance that Trung Nam does not pose a significant risk for MB. All three financed projects have healthy cash flows and have been servicing their debts on time. Compared to the previous year, the Trung Nam group has repaid an additional VND 1,000 billion to MB.

Regarding Novaland, the company is undergoing a restructuring process and making significant progress. Many of their strategic projects have completed the legal framework and are ready for implementation. Novaland’s outstanding balance with MB has not increased, and MB is actively supporting the restructuring and implementing high-feasibility sub-projects. Most importantly, no non-performing loans related to Novaland have surfaced at MB thus far.

On the restructuring of MBV, Mr. Vu Thanh Trung, Vice Chairman of the Board of Directors, shared that MBV is expected to end its streak of business losses this year. MBV’s operations have a negligible impact on MB’s financial performance due to its smaller scale and separate financial reporting.

– 22:07 08/05/2025

What Fueled the Banking Stock Boom that Took VN-Index to New Heights?

As of August 5th, bank stocks surged for the second consecutive session, propelling the index to a record high of 1570 points. However, a closer look at the statistics reveals that the group’s profits are lagging compared to the broader market.

“FE Credit Bounces Back: VPBank Confident in 2025 Plan as GPBank Turns a Profit”

In the first half of 2025, VPBank recorded a consolidated profit of over VND 11,200 billion and successfully mobilized a record loan of $1.56 billion. Based on the results of the first half and the 4-pronged strategy, the leadership affirmed their confidence in achieving the set business goals for the year.

“Vietnam’s Central Bank Meets With Commercial Banks to Discuss Interest Rates”

The State Bank of Vietnam (SBV) has instructed credit institutions to follow the directives of the Government, the Prime Minister, and the SBV itself, with a key focus on maintaining stability in deposit interest rates. Institutions are also encouraged to further reduce operating expenses, embrace digital transformation, and be prepared to share a portion of their profits to lower lending rates.

The Capital Injection Rush: Banking Support for Businesses

“Despite a slight uptick in input costs and the pressure of USD/VND exchange rates, businesses are benefiting from a welcome reduction in lending rates. This positive shift in credit flow is expected to provide a much-needed boost to the economy and support its growth trajectory.”