Transitioning to Co-Creation with Lion Japan

In January 2023, Merap and Lion Corporation (Japan) signed a strategic cooperation agreement. After over two years of partnership and value resonance, as of Q2/2025, MERAPLION officially becomes a member of Lion Japan in Vietnam, marking an M&A turning point of “co-creation” instead of traditional “acquisition.”

This deal inherits the entire system of products, factories, distribution, and personnel from Merap, while integrating technology, quality standards, and international management models from Lion. The philosophy of “Glocalization” – globalization coupled with local identity – guides MERAPLION’s development model, preserving the corporate culture, personnel, and medical ecosystem cultivated over two decades.

Mr. Dao Xuan Dinh, Chairman of MERAPLION’s Board of Directors

Elevating Standards, Preserving Vietnamese Values

At the M&A announcement, Mr. Dao Xuan Dinh, Chairman of MERAPLION’s Board of Directors, affirmed:

“Lion has chosen to invest in the long-term value of Merap’s people. The localization model is the strategic focus, and the Merap team is an irreplaceable factor.”

MERAPLION is now deeply integrating into Lion’s global value chain. This process involves standardizing production according to J-GMP standards and transferring R&D technology from Japan. Simultaneously, the company is standardizing its financial and accounting management systems according to international practices and embracing sustainable development by adopting the ESG standards, encompassing 23 groups of content related to environmental, social, and corporate governance issues.

MERAPLION’s Leadership

Amidst the Vietnamese pharmaceutical industry’s demands for high capability, transparency, and adherence to international standards, MERAPLION is charting a unique path: retaining its existing system, innovating from within, and focusing on deep investments.

According to industry experts, the MERAPLION-style M&A model of bilateral cooperation instead of acquisition could become a sustainable trend, especially as domestic enterprises shift from processing to autonomously controlling the value chain. This also proves that Vietnamese enterprises can collaborate globally while preserving their identity, local market data, and organizational capabilities.

“HDBank Secures $215 Million Syndicated Loan with Three Leading International Financial Institutions”

“Ho Chi Minh City, July 31, 2025 – HDBank elevates its financial prowess by securing a syndicated loan of USD 215 million. This significant milestone is a result of the collaborative efforts and trust between HDBank and three prominent international financial institutions: Sumitomo Mitsui Banking Corporation (SMBC), FinDev Canada, and the Japan International Cooperation Agency (JICA). This strategic partnership underscores HDBank’s strong standing in the financial landscape and its potential for exponential growth.”

KienlongBank: Leading the Way with the Dual Implementation of Basel III and ESG Projects

“With the synchronous implementation of both the Basel III and ESG projects, KienlongBank is demonstrating its strong commitment to enhancing its risk management capabilities and resilience against unforeseen fluctuations. This dual initiative underscores the bank’s proactive approach to not only meet but exceed regulatory standards, solidifying its foundation for sustainable growth.”

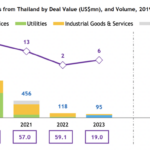

The Thai Investor: Leading the Charge in Vietnam’s M&A Landscape

After a slowdown since its peak in 2020, Thai investors have reclaimed their leading position in M&A activity in 2024.

Masan High-Tech Materials: Honored as a “Sustainable Enterprise” for Seven Consecutive Years

On November 29, Masan High-Tech Materials, a leading provider of advanced materials, was once again recognized for its sustainability efforts, securing a place in the prestigious Top 100 Sustainable Businesses in Vietnam (CSI 100). This acknowledgment underscores the company’s unwavering commitment to environmental stewardship, social responsibility, and strong governance practices.