SAM Holdings Joint Stock Company (SAM: MCK, HoSE) has just announced a related-party transaction of an insider’s related party.

Accordingly, National Securities Joint Stock Company (NSI) has just registered to buy 5 million SAM shares to increase its ownership rate. The transaction is expected to take place by matching and/or matching orders from August 6, 2025, to September 4, 2025.

If the transaction is successful, NSI will increase its ownership of SAM shares from over 5.9 million shares to over 10.9 million shares, equivalent to an increase in ownership capital from 1.56% to 2.88%.

Illustrative image

Assuming the price of SAM shares based on the trading session on the morning of August 4, 2025, is VND 8,170/share, it is estimated that NSI will have to spend about VND 40.85 billion to be able to buy the registered amount mentioned above.

It is known that Mr. Tran Viet Anh – Chairman of the Board of Directors of SAM Holdings is a major shareholder owning more than 10% of NSI’s charter capital. At the same time, Mr. Bui Quang Bach – Member of the Board of Directors of NSI is also an Independent Member of the Board of Directors of SAM Holdings.

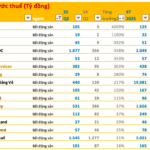

In terms of business results, according to the consolidated financial statements for the second quarter of 2025, SAM Holdings recorded net revenue of nearly VND 1,403.8 billion, down 14.1% over the same period last year. After deducting cost of goods sold, gross profit reached VND 54.7 billion, down 9%.

In this quarter, the enterprise also earned more than VND 30.6 billion in financial revenue, down 7.8% over the same period last year. Similarly, financial expenses decreased by 15.8% to VND 22.3 billion. In contrast, selling expenses increased from VND 14.9 billion to VND 15.9 billion; management expenses were at nearly VND 20.2 billion, up 2%.

As a result, after deducting taxes and fees, SAM Holdings reported a net profit of nearly VND 33.9 billion, down 27.6% over the same period last year.

For the first six months of 2025, SAM Holdings recorded net revenue of over VND 2,567.4 billion, up 13.7% over the same period in 2024; profit after tax was VND 39.5 billion, down 47.1%.

As of June 30, 2025, SAM Holdings’ total assets increased by 9.6% over the beginning of the year, to over VND 6,990.4 billion. In which, short-term receivables were nearly VND 1,500.7 billion, accounting for 21.5% of total assets; long-term assets under construction were over VND 1,162.5 billion, accounting for 16.6% of total assets; long-term financial investments were nearly VND 2,194.4 billion, accounting for 31.4% of total assets.

On the other side of the balance sheet, total liabilities were over VND 2,282.3 billion, up 34.7% from the beginning of the year. Of which, loans and finance leases were over VND 1,640.3 billion, accounting for 71.8% of total debt.

What Fueled the Banking Stock Boom that Took VN-Index to New Heights?

As of August 5th, bank stocks surged for the second consecutive session, propelling the index to a record high of 1570 points. However, a closer look at the statistics reveals that the group’s profits are lagging compared to the broader market.

Unlocking Financial Growth: BVBank’s Stellar Performance in H1

A small tweak to capture attention and showcase the impressive growth of BVBank.

(Ho Chi Minh City) – BVBank concludes the first half of 2025 on a high note, boasting impressive growth across key metrics. This testament to their successful strategy underscores the importance of a customer-centric, digital approach to retail banking, offering personalized experiences.