Vietnam’s northern industrial sector is thriving, with Cushman Wakefield reporting steady occupancy rates of 69% in Q2 2025 and a year-on-year increase in average asking rent. Vietnam’s strategic location, political stability, and integration into global supply chains make it an attractive destination for international businesses seeking flexibility, efficiency, and sustainability in industrial real estate.

Core5 Vietnam, the premium industrial platform of Indochina Kajima, is at the forefront of meeting this demand. The company was recognized as the ‘Best Industrial Develop 2024’ at the prestigious PropertyGuru Vietnam Property Awards and was honored among the top 10 foreign-invested enterprises for sustainable development at the Golden Dragon Awards 2025.

Core5 Vietnam builds on the success of its US counterpart, Core5 Industrial Partners, by offering world-class factories and warehouses for lease in key locations across the country. With deep local knowledge, global development expertise, and a hospitality-focused approach, Core5 Vietnam is committed to raising the bar for service quality in industrial real estate.

Environmental, social, and governance (ESG) principles are at the core of Core5 Vietnam’s philosophy. All their properties follow a LEED action plan from construction to operations, with contractors adhering to resource and waste efficiency during the building process and prioritizing low-energy materials. Core5 projects are designed with eco-friendly features such as solar rooftops, vegetation to reduce heat islands, optimized ventilation, health and wellness areas, and digital energy meters for efficient energy management. This not only promotes the health and wellbeing of the industrial workforce but also significantly reduces operational costs for tenants.

Inheriting the hospitality legacy of founding partners Kajima Corporation Japan and Indochina Capital, Core5 Vietnam offers an integrated solution package to ease tenants’ setup and expansion. This includes pre-and-post licensing services, customization of leased areas, accounting and business development support, and fostering long-term interconnections for seamless operations and accelerated growth.

With their global industrial expertise and experience in putting Vietnam on the world map, Core5 Vietnam is dedicated to enhancing the country’s position in the global supply and value chains. By attracting FDI enterprises and facilitating the shift of production to Vietnam, Core5 is connecting localities to international businesses. Their commitment to service quality and future-proof operations capabilities increases Vietnam’s competitiveness in capturing global opportunities.

Core5 Vietnam’s current portfolio includes LEED-certified ready-built factories in strategic locations: Hung Yen (Core5 Hung Yen Factory Village in Minh Duc IP), Quang Ninh (Core5 Quang Ninh Factory Village in Deep C II), and Hai Phong (Core5 Hai Phong Factory Village in Deep C II). Visit https://www.c5ip.vn/ to explore more about Core5 Vietnam and their innovative approach to industrial real estate.

Is Industrial Real Estate Rental Price Set to Soar?

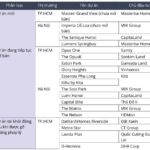

Industrial real estate rental rates continue their upward trajectory in 2024, with a projected increase of 6-8% compared to 2023. The average rental rate stands at $132 per square meter in the North and $185 per square meter in the South. Forecasts for 2025 predict a slight increase of 1-2% due to limited supply and robust demand, with the Northern region offering more competitive rental rates.

How to Find Gold While Sifting Through Sand: A Guide to Seizing Opportunities

Sharing his insights at the ‘Khớp lệnh’ program on November 25, 2024, Mr. Dao Hong Duong, Director of Industry and Equity Analysis at VPBank Securities Joint Stock Company (VPBankS), asserted that several sectors exhibit positive signals based on their profit growth prospects for 2025. These sectors are expected to be relatively unaffected by external factors and offer suitable valuation ranges.