**Sacombank: A Comprehensive and Sustainable Development Journey**

Representing Sacombank, Mr. Ha Van Trung, Deputy CEO of Sacombank, received the award from the Organizing Committee.

|

A testament to its resilience, Sacombank has consistently featured in reputable rankings, showcasing its robust performance amidst an ever-changing economic landscape. With stable financial capabilities, a strong technological foundation, and a flexible growth strategy, Sacombank continuously innovates to meet the diverse needs of its individual customers, businesses, and investors.

Beyond maintaining strong business performance, Sacombank is also highly regarded for its transparency, adherence to international corporate governance standards, and commitment to sustainable development through the integration of ESG (Environmental, Social, and Governance) frameworks into its operations.

Significant Growth in Pre-Tax Profit for Q2 2025

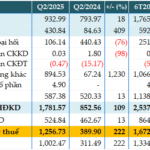

As per the consolidated financial statements for Q2 2025, Sacombank recorded a pre-tax profit of VND 3,657 billion, marking a 36% increase compared to the same period last year. For the first six months, the bank achieved a pre-tax profit of VND 7,331 billion, equivalent to 50% of the target assigned by the General Meeting of Shareholders. This growth was driven by significant improvements in net interest income and service income.

As of June 30, 2025, net interest income reached VND 13,448 billion, reflecting an 11.4% increase. Pure service income also witnessed a substantial surge of 30.8%, amounting to VND 1,647 billion. Additionally, total assets stood at VND 807,339 billion, indicating a 7.9% rise since the beginning of the year. Customer loan balances increased by 9% to VND 587,960 billion, while customer deposits grew by 10.1% to VND 624,315 billion. Adequate provisioning helped maintain the non-performing loan ratio at 2.14%, demonstrating Sacombank’s effective asset quality management during its restructuring phase.

– 11:19 04/08/2025

Sacombank Enters the Top 10 Most Reputable Commercial Banks in Vietnam for 2025

Sacombank has been recognized by Vietnam Report and VietNamNet Newspaper as one of the Top 10 most reputable commercial banks in Vietnam for 2025. This prestigious accolade further cements Sacombank’s position as a leading private joint-stock commercial bank in the country. Additionally, Sacombank has also made significant strides, climbing into the Top 5 most reputable private banks and securing a spot in the Top 50 public companies for efficiency and reputation (VIX50).

“Top 10 Banks With the Highest Profit in Q2 2025: A New Leader Emerges as VietinBank, Vietcombank, and BIDV Claim Over One-Third of the Banking Sector’s Profit on the Stock Exchange”

As of the morning of July 31st, all 27 banks listed on the stock exchange had released their financial reports for the second quarter of 2025. Impressively, these banks collectively raked in a total profit of 89,341 billion VND in Q2 2025, marking an 18% increase compared to the same period in 2024.

Profits Soar and Bad Debt Declines: ABBank’s Impressive First Half of the Year

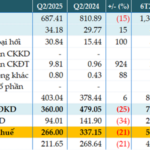

The recently released Q2 2025 consolidated financial statements reveal that An Binh Joint Stock Commercial Bank (ABBank) posted a remarkable performance with a pre-tax profit of VND 1,257 billion, tripling its figure from the previous year. This outstanding result brings the bank’s half-year pre-tax profit to VND 1,672 billion, achieving 92% of its annual target.

Unlocking the Mystery: CASA’s 26.78% Achievement and MSB’s Profit Plunge

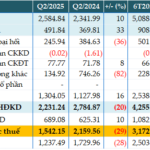

The consolidated financial statements of the Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) revealed a profit before tax of nearly VND 3,173 billion for the first half of 2025, a 14% decrease compared to the same period last year.