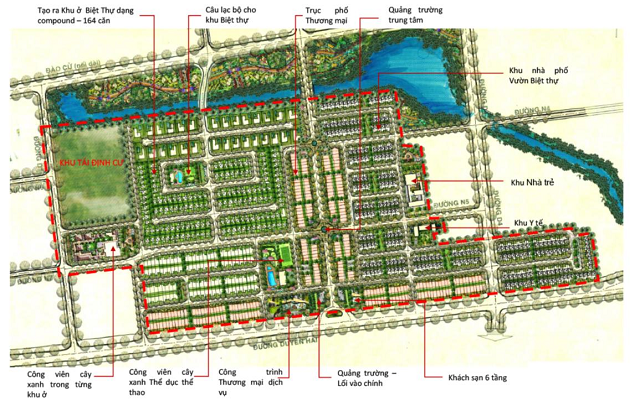

With a scale of nearly 30 hectares, this project is located in Long Hoa, Can Gio (old name), an area with great potential as it is just 1 km away from Can Gio beach and is planned to be a high-end residential area for 4,000 residents. This used to be one of Savico’s key real estate projects, recognized as long-term receivables through cooperation investment advances. The capital withdrawal from this project is part of the 2025 real estate portfolio restructuring plan to focus on the core business.

The Long Hoa project is a joint development between Savico and Ho Chi Minh City Foreign Trade and Investment Development Corporation (Fideco, HOSE: FDC) since 2002 in a 50-50 ratio without establishing a new legal entity. The project was granted land by the Ho Chi Minh City People’s Committee in 2005 after the investment policy was approved in 1999. However, after completing land filling in Q4/2009, the progress has been stagnant for many years.

According to Fideco’s 2024 annual report, the legal procedures have not been completed, causing further delays in implementation.

The initial design of the project involved a total investment of approximately VND 320 billion, expecting to generate VND 672 billion in revenue and about VND 254 billion in after-tax profit. The planning includes villa subdivisions, commercial houses, terraced houses, and resettlement areas with a construction density of nearly 22% and a maximum height of 5 floors.

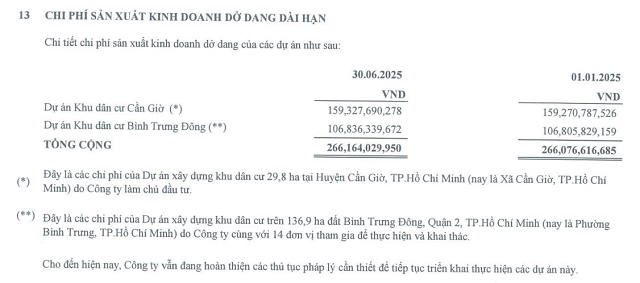

Fideco once expected to complete the residential area by the end of 2015. However, by the end of June 2025, the company still accounted for nearly VND 160 billion in long-term unfinished production and business expenses for this project.

Long Hoa – Can Gio residential area project remains unfinished after 26 years of investment approval. Source: Fideco

|

The Can Gio residential project has cost Fideco about VND 160 billion over the years. Source: Fideco’s Consolidated Q2/2025 Financial Statements

|

For Savico, the capital withdrawal will likely be recorded in the Q3 financial statements, as the company’s consolidated Q2 report still accounts for “Long-term receivables from cooperation investment contracts” of about VND 727 billion, slightly lower than the beginning of the year.

Along with the withdrawal from the Long Hoa – Can Gio project, Savico is restructuring its investment portfolio. In July, the company’s Board of Directors approved the transfer of all capital contributions to Saigon Commercial Services Co., Ltd. – an authorized Yamaha dealer in Can Tho; while also dissolving Otos JSC – the unit that once operated the online automobile platform. In the opposite direction, Savico contributed VND 720 billion to Tasco Business Joint Stock Company (Tasco RT), holding 70.6% of its charter capital.

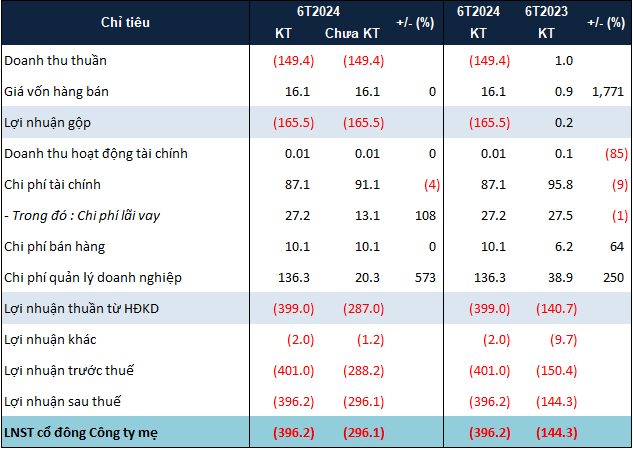

In terms of business results, Q2/2025 witnessed Savico’s net profit reaching VND 73 billion, the highest since Q4/2022 and 1.7 times higher than the same period last year, thanks to the remarkable recovery of the automobile market. Revenue was over VND 6,600 billion, up 23%; gross profit was VND 477 billion, up 20%; gross profit margin remained stable at 7.18%. In addition, the company also recorded VND 98 billion in financial activities, double that of the same period, along with nearly VND 25 billion in other income, 3.6 times higher.

For the first six months, Savico achieved VND 12,200 billion in revenue, up 29%, and VND 84 billion in net profit, up to 83%, quickly achieving the net profit target of VND 83 billion in just the first half of the year. However, the 2025 plan has been adjusted down by 17% compared to the performance in 2024.

By the end of June, total assets increased by nearly VND 1,200 billion to VND 10,100 billion. In particular, “Other short-term receivables” surged from nearly VND 1,100 billion to over VND 1,800 billion, mainly due to an increase of VND 930 billion in “Receivables from cooperation investment contracts.”

On the other hand, “Payables from cooperation investment contracts” also increased sharply to over VND 1,700 billion, leading to “Other long-term payables” of nearly VND 1,900 billion. Borrowings from the parent company, Tasco (HNX: HUT), increased significantly from VND 447 billion to VND 810 billion.

| Savico’s net profit hits the highest since Q4/2022 |

Savico injects VND 720 billion into Tasco RT, strengthening the Tasco automobile ecosystem

Savico transfers Yamaha motorcycle dealership in Can Tho, dissolves Otos member

– 10:39 04/08/2025

Stock Trading Leadership: Chairpersons’ Great Escape from “The Bag Holding”

The weekly transaction statistics for the period of 7th to 11th of October 2024 reveal a notable bias towards selling among leaders and their affiliates. What stands out is the high number of successful stock sales by Chairmen during this week.