The stock market on Monday, August 4th, was filled with excitement as numerous groups of stocks surged, pushing the main index back to its historic peak. The VN-Index closed nearly 33 points higher at 1,528 points.

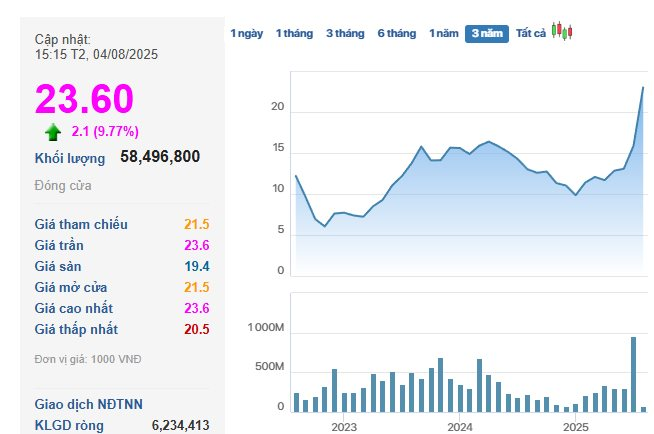

Amidst the market wave, the duo of SHB and SHS stocks rode the trend, soaring to their maximum daily limit. SHB rose 6.9% to 18,600 VND per share, while SHS climbed 9.8% to 23,600 VND per share.

SHB stock performance

Recently, on his personal Facebook page, Mr. Do Quang Vinh – Vice Chairman of SHB’s Board of Directors and Chairman of SHS’s Board of Directors – shared a post titled “Hello My August 8️⃣ 💜💜💜💜💜💜💜.”

In the comments section, Miss Do My Linh, who is also Mr. Vinh’s sister-in-law, humorously commented, “8💜 means 8 more sessions to go, right, brother?”

Source: Mr. Do Quang Vinh’s Facebook

In reality, SHB and SHS stocks have witnessed a strong upward trend in the past few months. They have become the center of attention in the stock market, boasting exceptionally high liquidity and skyrocketing prices. SHB’s current price marks an all-time high, and SHS is just shy of 3% away from its historical peak set in November 2021.

Since the beginning of 2025, SHB and SHS have surged 109% and 118%, respectively. Accompanying the price ascent, liquidity in these two stocks has been remarkably vibrant, with certain sessions witnessing SHB’s trading volume surpassing 100 million units and even breaching the 200 million mark.

The robust growth in their business performance is likely the primary factor fueling the recent rally in SHB and SHS stocks.

At Saigon-Hanoi Commercial Joint Stock Bank (SHB), the bank aims for a pre-tax profit of VND 14,500 billion this year, representing a 25% increase. They also target total assets of VND 832,000 billion, an 11% rise, and nearly VND 46,000 billion in charter capital. Their plans include a 16% credit growth target and maintaining bad debt ratio below 2%. The bank is on its way to reaching the milestone of VND 1 quadrillion in total assets by 2026.

In the first two quarters of the year, SHB’s pre-tax profit reached VND 8,913 billion, a 30% increase compared to the same period in 2024, equivalent to 61% of the 2025 plan. The cost-to-income ratio (CIR) was impressively maintained at 16.4%, one of the lowest in the industry. Operational efficiency continued to improve, as evidenced by the ROE surpassing 18%.

As of June 30, 2025, SHB’s total assets stood at nearly VND 825 trillion, including customer lending balances exceeding VND 594.5 trillion, a 14.4% increase from the beginning of the year and a significant 28.9% surge compared to the same period last year.

SHB has approved the implementation of a plan to increase charter capital from 2024 dividend payment in shares to existing shareholders. Previously, the bank’s plan for capital increase had received approval from the State Bank of Vietnam.

According to the plan, the bank will issue a maximum of nearly 528.5 million shares to pay dividends, equivalent to a 13% issuance ratio of the total circulating shares (for every 100 shares owned, shareholders will receive 13 new shares). These newly issued shares will not be subject to transfer restrictions.

The capital source for issuing dividend payment shares comes from post-tax profit after making provisions for funds in 2024. Following the successful issuance, the bank’s charter capital is expected to increase by nearly VND 5,285 billion, from VND 40,657 billion to VND 45,942 billion.

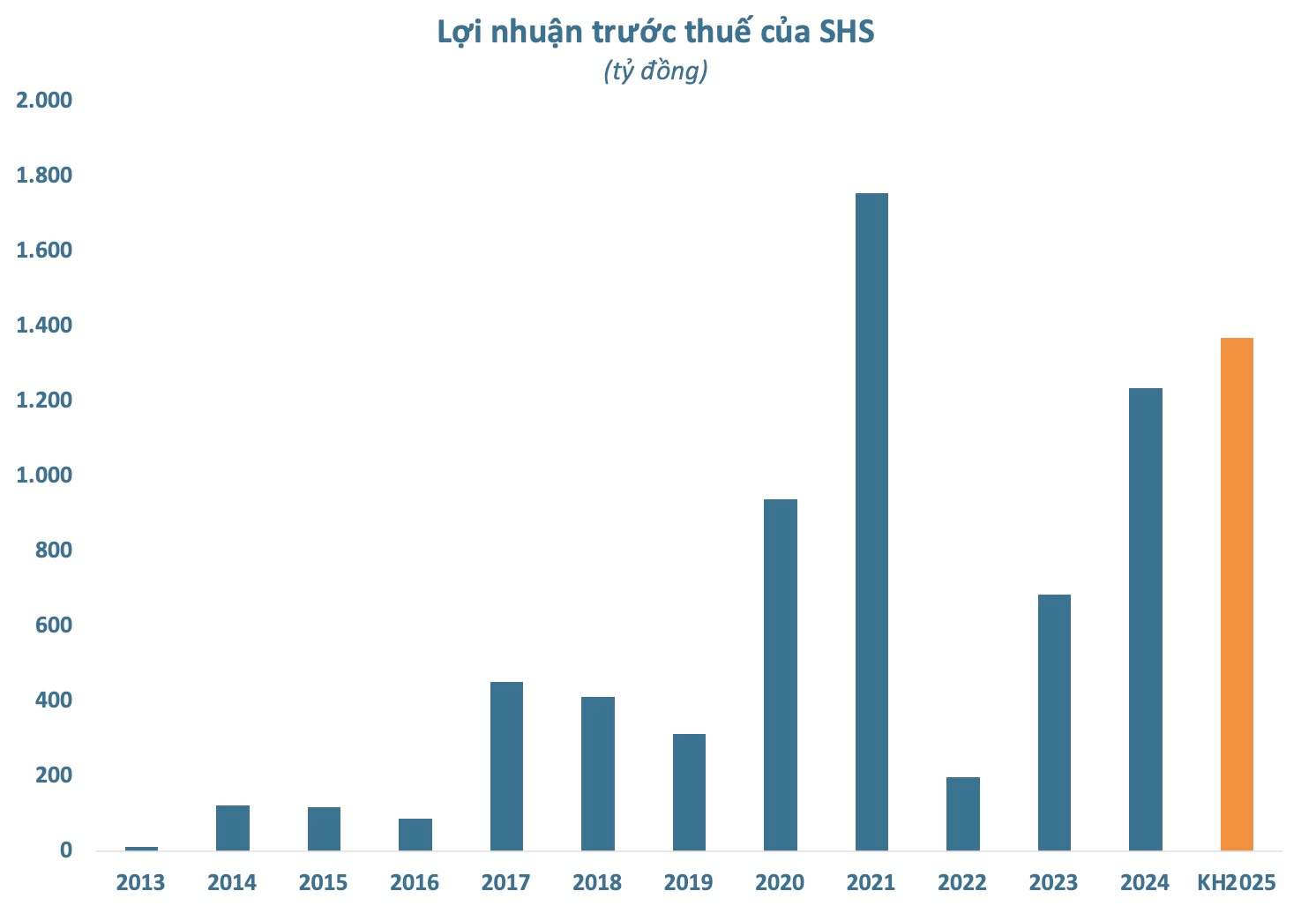

At Saigon-Hanoi Securities Joint Stock Company (SHS) – where Mr. Do Quang Vinh serves as Chairman of the Board of Directors, the securities company recorded operating revenue of VND 694 billion in Q2/2025, a 16% increase compared to Q2/2024. After deducting taxes and fees, the company’s post-tax profit was VND 383 billion, an 8% rise compared to the same period last year.

In the first six months of the year, operating revenue and pre-tax profit were VND 1,255 billion and VND 789 billion, respectively, completing 58% of the annual profit plan.

As of the end of Q2/2025, SHS’s FVTPL portfolio recorded VND 5,378 billion in stocks, including VND 288 billion in VPB stocks, VND 178 billion in TCB stocks, VND 427 billion in GEX stocks, VND 253 billion in FPT stocks, VND 98 billion in HPG stocks, and VND 4,135 billion in other stocks.

Additionally, as of the end of Q2/2025, SHS owned VND 3,053 billion in bonds and VND 733.3 billion in money market instruments. On the other side of the balance sheet, SHS’s total liabilities increased by 118% from the beginning of the year to VND 6,143 billion.

In 2025, SHS plans to pay a 20% dividend in cash and shares, including a 10% cash dividend, equivalent to over VND 813 billion; a 5% stock dividend for 2023 dividend payment; and a 5% stock dividend to increase charter capital from owner’s equity. If successful in these issuances, SHS’s charter capital will increase from over VND 8,132 billion to over VND 17,076 billion.

In April, the securities company finalized the list of shareholders to implement a 10% cash dividend payment for 2024, amounting to over VND 830 billion.

The Two Stock Symbols Unexpectedly Sold Off by Proprietary Trading Firms in Monday’s Session

The HoSE witnessed a significant development as proprietary securities firms offloaded stocks en masse, resulting in a staggering net sell value of VND 296 billion.

The Youngest Chairman on the Vietnamese Stock Exchange: A Tale of Success and Ambition

Introducing the youngest chairman on the Vietnamese stock exchange. While wealth is not the sole measure of success, this individual’s achievements are undoubtedly impressive. With a sharp mind and a knack for leadership, they have risen through the ranks to become a prominent figure in the financial world. Their story serves as an inspiration to all, proving that age is just a number when it comes to pursuing your dreams.

The Stock Market is Smashing Records: Investors Rush to Open New Accounts

As of July 2025, Vietnam’s stock market witnessed a significant surge in trading accounts, according to the Vietnam Securities Depository and Clearing Corporation (VSDC). With almost 10.5 million accounts, the market experienced a substantial increase of 226.3 thousand accounts since June and an impressive year-to-date growth of nearly 1.2 million accounts.