Hanoi-Sai Gon Securities Joint Stock Company (HSX: SHS) has announced its plans to issue shares to employees through an Employee Stock Ownership Plan (ESOP) in 2025.

The company intends to offer 5 million ESOP shares, equivalent to 0.56% of the total outstanding shares. These shares will be restricted from transfer for one year from the end of the offering period, which is expected to take place sometime in 2025. With a proposed offering price of VND 10,000 per share, the company aims to raise VND 50 billion to supplement its operating capital.

Illustrative image

Mr. Nguyen Chi Thanh, the CEO, will be offered the largest number of shares at 624,720 in this ESOP issuance. Following him, Mr. Do Quang Vinh, the Chairman of the Board of Directors, will be offered 200,000 shares, and Mr. Le Dang Khoa, a member of the Board of Directors, will receive 70,000 shares, among others.

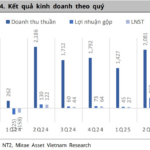

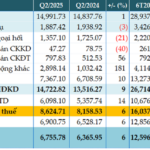

In terms of business performance, Hanoi-Sai Gon Securities’ Q2 2025 financial report showed total operating revenue of nearly VND 694 billion, a VND 95 billion increase compared to the same period last year. Profit from financial assets recognized through profit and loss (FVTPL) amounted to over VND 417 billion, a 10.9% increase from Q2 2024. Profit from lending and receivables reached nearly VND 153 billion, while securities brokerage revenue was VND 71 billion, and financial advisory revenue exceeded VND 13 billion.

During this period, total operating expenses amounted to VND 156 billion, with securities brokerage expenses slightly increasing by VND 6 billion to VND 59 billion. Expenses for securities investment consulting, securities depository, and financial advisory services remained relatively unchanged from the previous year, totaling VND 6.6 billion. Borrowing costs exceeded VND 52.5 billion.

After accounting for taxes and fees, the company reported a net profit of nearly VND 383 billion for Q2 2025, an increase of 8.2% compared to the same period last year.

For the first half of 2025, Hanoi-Sai Gon Securities recorded total operating revenue of VND 1,255.4 billion, a nearly 7.9% increase from the previous year. Profit from financial assets recognized through FVTPL reached nearly VND 582 billion. Revenue from stock brokerage exceeded VND 123 billion, while profit from margin lending and receivables totaled nearly VND 281 billion, a 7% increase year-over-year.

The company’s pre-tax profit for the first six months of 2025 stood at VND 788.7 billion. For the full year 2025, Hanoi-Sai Gon Securities targets total revenue of VND 2,519.8 billion and pre-tax profit of VND 1,600.6 billion.

As of June 30, 2025, the company has achieved 57.6% of its annual profit target. Net profit for the first half of the year exceeded VND 645 billion. Total assets as of the same date amounted to VND 17,328 billion, a 23.5% increase from the beginning of the year, and equity stood at VND 11,184.8 billion.

“Ben Thanh TSC Announces 30% Cash Dividend, to be Paid in Two Installments”

Ben Thanh Trading & Services Joint Stock Company (Ben Thanh TSC) has announced a generous cash dividend payout of VND 40.5 billion for the fiscal year 2024, amounting to a 30% dividend ratio. This payout marks the second-highest dividend in the company’s history and is a testament to its strong financial performance and commitment to returning value to shareholders. As the company embarks on a new phase of growth, with plans to reinvest profits into a long-awaited project in the heart of Ho Chi Minh City, this dividend declaration stands as a highlight in the company’s trajectory.

BIDV Posts 6% Pre-Tax Profit Increase in Q2, Total Assets Near VND 3 Quadrillion

The consolidated financial statements for the second quarter of 2025 reveal impressive results for the Joint Stock Commercial Bank for Investment and Development of Vietnam, better known as BIDV (HOSE: BID). The bank posted a remarkable pre-tax profit of nearly VND 8,625 billion, reflecting a 6% increase compared to the same period last year. As of the end of the second quarter, BIDV’s total assets stood at over VND 2.99 million billion.

Electric Vehicle Sales Surpass Real Estate, Becoming Vingroup’s Mainstay in Q2 2025

In Q2 2025, production operations witnessed a remarkable surge in revenue, skyrocketing by 115.85% to VND 17,242 billion compared to Q2 2024. This impressive performance accounted for the largest share of this period’s revenue structure, constituting a significant 37%.