Source: CafeF

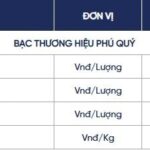

According to Phu Quy Group, a renowned Vietnamese precious metals company, the buying and selling prices of 999 silver are VND 1,405,000/tael and VND 1,448,000/tael, respectively, in Hanoi. In the past week, silver prices have dropped by 2.6%.

Meanwhile, the buying and selling prices of 1kg 999 silver bars are VND 37,466,573/bar and VND 38,613,237/bar, respectively, as of 9:09 am on August 4th.

Globally, silver prices have reached USD 36.8/ounce.

Source: CafeF

Silver prices dipped after surging at the end of last week. July data revealed that the US economy added only 73,000 jobs, significantly lower than the expected 100,000, while May and June’s employment figures were sharply revised downward. In response, the market raised the odds of a rate cut in September to 75%, up from 45% pre-announcement.

The report was released shortly after stronger-than-expected PCE inflation data on Thursday (July 31), underscoring persistent price pressures and further complicating the Fed’s policy outlook.

Christopher Lewis, a senior market analyst, warned of technical risks: “If silver falls below the $36/ounce level, it would be a negative signal. As US job market weakens, industrial demand for silver – a metal widely used in manufacturing – is also at risk of declining.”

Meanwhile, geopolitical tensions escalated as President Donald Trump reaffirmed a baseline global tariff of 10% and imposed new countervailing duties of up to 41% on nations without trade deals with the US. He also announced a 40% tariff on goods suspected of being rerouted through third countries to bypass existing tariffs.

The Glittering Future of Gold Prices: Can the Rally Continue?

However, Swiss bank UBS maintains its $2,900/oz target for the price of gold over the next few years until the end of 2025.