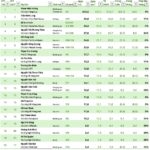

According to the Ministry of Agriculture and Environment, the total export value of agro-forestry-aquatic products in the first six months of 2025 is estimated at $33.5 billion, a 14.3% increase compared to the same period in 2024. Of this, the export value of agricultural products is estimated at $18.3 billion, a 16.8% increase; livestock products at $264 million, a 10.1% increase; aquatic products at $5 billion, a 14.5% increase; and forestry products at $8.7 billion, an 8.8% increase.

The export value of nine out of eleven groups of products continued to grow, including coffee, rubber, pepper, cashew nuts, livestock, aquatic products, wood, and wooden products. However, two product groups experienced a decrease in export value: rice ($2.6 billion, a 9.8% decrease) and fruits and vegetables ($2.7 billion, a 17.1% decrease).

Assessing the situation for the second half of 2025, the Ministry of Agriculture and Environment stated that due to challenges posed by tax policies in the United States and conflicts in the Middle East leading to increased freight costs, it would be difficult for the agro-forestry-aquatic sector to maintain its growth.

NEED TO CURB THE DECLINE OF FRUITS, VEGETABLES, AND RICE EXPORTS

To achieve the target of $65 billion for the whole of 2025, the Ministry of Agriculture and Environment has adjusted the export target for the last six months to $31.6 billion, a 4.8% decrease compared to the same period in 2024. At the same time, they emphasized: “In the second half of 2025, decisive actions are needed to continue promoting exports in traditional markets and supplementing suitable product lines, as well as adding some groups of goods that can increase export value in potential markets.”

Regarding rice exports, the target set for 2025 is $5.7 billion. However, by June 2025, only $2.6 billion was achieved. Faced with this challenge, the Ministry of Agriculture and Environment stated that the rice industry needs to maintain its market share in traditional markets such as the Philippines, Indonesia, and Malaysia, while also expanding exports to potential markets such as the EU, South Korea, Japan, and Singapore, especially for processed products such as noodles, vermicelli, and pho.

“Finding solutions to reduce logistics costs and diversify input materials are also key factors in enhancing the competitiveness of Vietnamese rice in new markets such as Ghana, Ivory Coast, and the UAE.”

Similarly, the fruit and vegetable industry aims to export $7.6 billion worth of products in 2025, a 6.8% increase compared to 2024. However, with the actual developments up to June 2025, the forecast for the whole year is expected to reach only $6.6 billion, due to a significant drop in key products such as durian, dragon fruit, bananas, and jackfruit in the Chinese market.

In the US market, despite accounting for a small proportion (1.9%), the fruit and vegetable industry still has growth potential as consumers increasingly prioritize healthy food choices. Vietnam has a competitive advantage with fresh fruits like coconuts, mangoes, grapefruit, and passion fruit; at the same time, there is potential to increase exports of processed products from mangoes and coconuts – two items that are currently experiencing good growth.

Moreover, businesses need to proactively renegotiate supply chains and share additional costs arising from tariff impacts, while also redirecting some products to other markets if they face difficulties exporting to the US.

The Chinese market, the largest consumer of Vietnamese fruits and vegetables, still holds potential due to the policy of reducing import taxes on fresh fruits within the framework of the ASEAN-China Free Trade Agreement (ACFTA). In particular, fresh coconut is assessed to have strong growth potential. The industry needs to promote the removal of barriers to durian exports, improve compliance with quarantine and food safety regulations, and stay updated on customs clearance information to proactively handle situations that may arise during peak seasons.

Additionally, the ASEAN, Japanese, South Korean, and EU markets continue to be identified as potential areas, especially for fresh fruits with export advantages such as mangoes, dragon fruit, jackfruit, watermelon, lychees, mangosteen, longan, passion fruit, and durian. Standardizing quality, packaging bases, and meeting the requirements of importing countries are crucial to maintaining and expanding the market share of fruits and vegetables.

WOOD AND AQUATIC PRODUCTS WILL FACE SIGNIFICANT PRESSURE

In 2025, the wood industry set an export target of $18.5 billion, a 7% increase compared to 2024. However, due to pressure from US tax policies – the market accounts for 67% of the industry’s total export turnover – and US customers seeking alternative sources, the competitiveness of Vietnam’s wood industry is facing significant challenges.

To cope with this situation, the wood industry needs to leverage its strengths in diverse designs, reasonable costs, large production capacity, flexibility in OEM/ODM, and compliance with legal timber standards. Maintaining suitable product lines and increasing the import of roundwood and sawn timber from the US will not only help reduce the trade deficit but also ensure legality and avoid risks related to origin fraud. On the other hand, it is necessary to continue promoting exports to China with products such as wood chips, peeled veneer, and construction timber; expanding market share in Europe, Japan, Australia, Canada, and the Middle East is also crucial.

“Due to pressure from US tax policies – the market accounts for 67% of the total export turnover of the wood industry and wood products – and US customers seeking alternative sources, the competitiveness of Vietnam’s wood industry is facing significant challenges.”

For the aquatic industry, the export target for 2025 is $10.5 billion, a 4.3% increase compared to 2024. However, like the wood industry, the aquatic industry is also affected by the US tax policies, as the US accounts for 12.8% of its export turnover, while consumption demand there tends to decline, especially for shrimp and salmon. To maintain market share, Vietnam needs to promote the export of tra fish and enhance monitoring and traceability capabilities to meet the requirements of the Marine Mammal Protection Act (MMPA).

Amid the current challenges, the Ministry of Agriculture and Environment stated that there are still products with the potential to maintain and boost export turnover growth, such as coffee, pepper, and cashew nuts…

With the main crop harvested from December to April of the following year, the coffee industry recorded an estimated export turnover of $5.5 billion in the first six months of 2025, equivalent to the plan for the whole year. It is forecast that the turnover for the whole year could reach up to $7.5 billion, a 36.9% increase compared to 2024. Vietnamese coffee is mostly exported to the EU.

In addition to expanding exports to the EU, it is necessary to open up market share in Northeast Asia (China, Japan, South Korea), India, the Philippines, and Thailand to diversify markets and reduce dependence on the US.

PRODUCTS WITH POTENTIAL TO BOOST EXPORT TURNOVER

The pepper industry aims to export $1.35 billion worth of products in 2025, a 2.5% increase compared to the previous year. In the first half of 2025, thanks to an average export price increase of nearly 60%, Vietnam’s pepper export turnover increased by 40.5% over the same period last year, reaching over $800 million, despite a 12% decrease in export volume.

With the strong growth in the first half of the year, coffee exports for the whole year are expected to increase. To maintain this high growth rate, it is necessary to expand markets in the EU, the Middle East, and Asia.

The cashew industry targets $4.5 billion in exports in 2025, a 2.7% increase. Since the cashew industry in Vietnam still holds the key to processing technology, even if the US imposes high taxes, the competitive pressure will not be too significant. Moreover, the export turnover of this product in the first six months of the year increased by over 19%.

The Ministry of Agriculture and Environment stated that to maintain growth in the cashew industry, the EU is a large potential market due to the trend of consuming processed nuts, despite its strict requirements for sustainable production and no deforestation. Investing in deep processing, traceability, and building a national brand will be the key to increasing the value of the cashew industry in the future.

The full content of this article was published in the Vietnam Economic Magazine, Issue 27-2025, released on July 7, 2025. Dear readers are invited to read the full article at the following link: https://postenp.phaha.vn/tap-chi-kinh-te-viet-nam/detail/1493

The Prime Minister Assigns Tasks to PVN

Prime Minister requests Petrovietnam to strive for a growth rate of approximately 1.5 times the overall economic growth of the country.

Proposed Title: A Luxury Proposition: The Vietnamese High-Roller’s Monthly Indulgence

The Ministry of Finance has proposed a unique proposition for Vietnamese citizens wishing to try their luck at local casinos. Under this proposal, locals will be required to purchase an entry ticket priced at 2.5 million VND, granting them access for a continuous 24-hour period. Alternatively, for frequent visitors, a monthly pass is offered at a cost of 50 million VND per person. This innovative approach aims to regulate and monetize the country’s casino industry while offering an exciting and exclusive experience to enthusiasts.