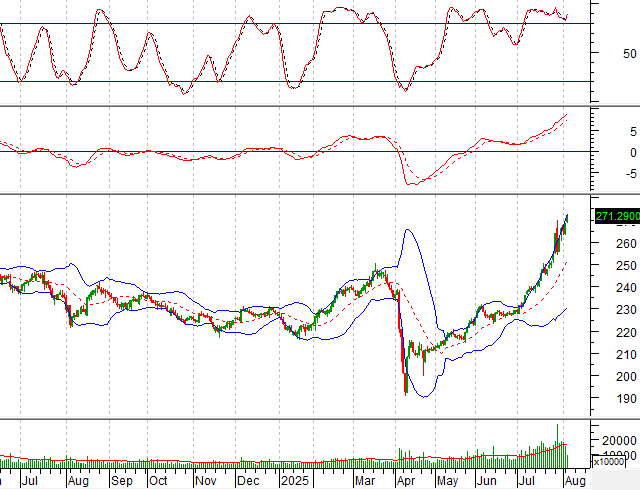

Technical Signals for VN-Index

In the trading session on the morning of August 5, 2025, the VN-Index witnessed a strong upward surge accompanied by a significant increase in trading volume, indicating the return of vigorous trading activities among large investors.

At present, the index continues to reach new 52-week highs and closely follows the upper band of the Bollinger Bands.

Additionally, the MACD line is narrowing the gap with the signal line after issuing a sell signal, while the ADX line remains above 25. This suggests that the short-term recovery trend is gaining further traction.

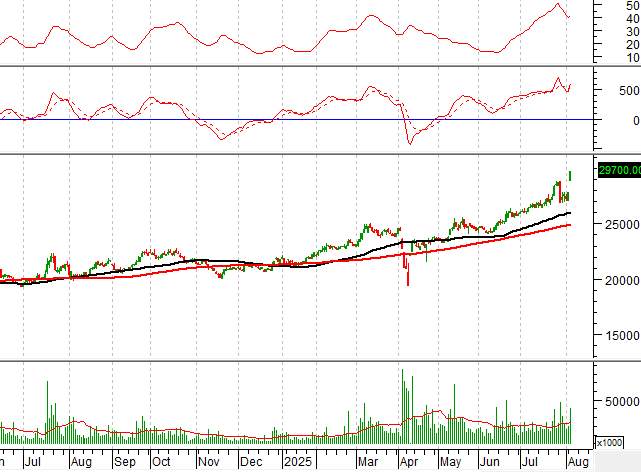

Technical Signals for HNX-Index

During the trading session on the morning of August 5, 2025, the HNX-Index opened higher with an expected trading volume surpassing the average by the session’s end, reflecting investors’ optimistic sentiment.

Moreover, the index remains close to the upper band of the Bollinger Bands, while the Stochastic Oscillator generates a buy signal again. This indicates a positive outlook for the short term.

MBB – Military Commercial Joint Stock Bank

On the morning of August 5, 2025, MBB’s share price opened with a substantial increase, forming a White Marubozu candlestick pattern, along with a trading volume exceeding the 20-session average, signifying lively trading activities among investors.

Furthermore, the MACD line has crossed above the signal line, issuing a buy signal once more, while the ADX indicator remains in the extremely strong trend region (ADX>25). This suggests that the upward price scenario is prevailing.

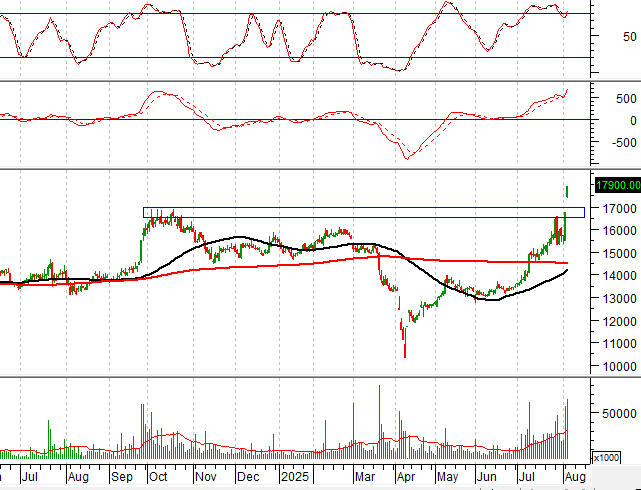

TPB – Tiên Phong Commercial Joint Stock Bank

In the trading session on the morning of August 5, 2025, TPB’s share price witnessed a robust increase, forming a Rising Window candlestick pattern, along with a continued surge in trading volume, surpassing the average of recent sessions. This indicates active trading among investors.

Currently, the price has surpassed the previous peak of October 2024 (corresponding to the 16,500-17,000 region) while the gap between the 50-day SMA and the 200-day SMA is narrowing.

If a golden cross appears in the future, the long-term upward trend will become even more robust.

Vietstock Consulting and Technical Analysis Department

– 12:08 05/08/2025

“VN-Index to End 2025 at a Modest 1,550 Points: Experts Highlight Two Attractive Options for Risk-Taking Investors”

For the intrepid investor, there are opportunities to be found in cyclical sectors and markets such as equities that benefit from cash flow, new product launches, and market upgrades. The tech sector is also a key area to consider, with long-term gains to be made from Resolution 57 on innovation, AI, semiconductors, and digital data.