**VietinBank’s Strategic Transformation: Enhancing Efficiency and Customer Experience**

In the first half of 2025, VietinBank underwent significant changes regarding its branch network. Specifically, as of the end of June 2025, VietinBank had 157 branches and 887 transaction offices (including 2 branches abroad).

In contrast, at the end of 2024, VietinBank operated 157 branches and 953 transaction offices. Notably, during the first six months of 2025, the bank closed 66 transaction offices. This restructuring was primarily focused in the second quarter, during which 56 transaction offices ceased operations.

At the 2025 Annual General Meeting of Shareholders, Mr. Tran Minh Binh, Chairman of the Board of Directors of VietinBank, shared that the bank is implementing a strategy to streamline its system. VietinBank is the first among the large state-owned banks to initiate a reduction in its transaction network. “VietinBank plans to cut down several hundred transaction offices and replace them with digital platforms to better serve customers and enhance their experience,” said Mr. Binh. He added, “This is a key area of investment for VietinBank, and we expect to see significant results in the coming period.”

Alongside this restructuring, VietinBank is vigorously promoting digital transformation and applying artificial intelligence (AI) in governance and customer care. Notably, even with the closure of many transaction offices, the bank’s personnel scale has not been reduced but has slightly increased over time.

As of the end of June 2025, the total number of employees in VietinBank and its subsidiaries was 24,914, an increase of 183 people compared to the end of 2024. Specifically, the number of employees in the parent bank, Vietinbank, was 22,507, a rise of 15 individuals.

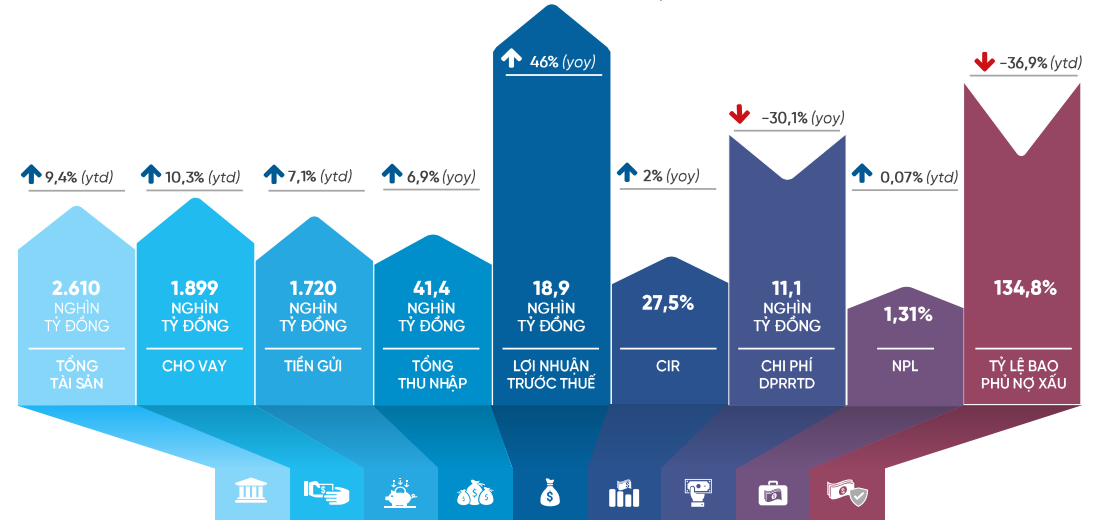

VietinBank has demonstrated impressive financial performance in the first half of the year. In the second quarter of 2025, the bank’s pre-tax profit reached VND 12,097 billion, a 79% increase compared to the same period last year, making it the highest pre-tax profit in the industry for that quarter. For the first six months, VietinBank’s profit reached VND 18,920 billion, ranking second in the system.

The bank’s total operating income in the first half reached VND 41.4 thousand billion, a 6.9% increase compared to the same period last year. The CIR ratio (operating expenses/total income) was among the lowest in the industry at 27.5%. There was also a significant decrease of 30.1% in provision expenses, amounting to VND 11,100 billion.

As of June 30, 2025, VietinBank’s bad debt ratio was 1.31%, an increase of 0.07% compared to the end of 2024 but a decrease of 0.24% compared to the end of the first quarter of 2025. According to VietinBank, bad debts are concentrated in sectors negatively affected by global and domestic economic difficulties, such as real estate, construction, consumer lending, and agriculture. The debt coverage ratio at the end of the second quarter of 2025 was 134.8%. The bank’s target for this year is to maintain a bad debt ratio below 1.8%.

VietinBank’s Financial Results

As of June 30, 2025, VietinBank’s total assets exceeded VND 2.6 million billion, a 9.4% increase compared to the beginning of the year. Customer lending increased by 10.3% to nearly VND 1.9 million billion. This growth was observed across all customer segments, with significant increases in consumer lending, real estate lending, electricity, other financial activities, and lending to the electronics and computer equipment sectors.

Customer deposits at VietinBank increased by 7.1% to over VND 1.7 million billion, with growth across all segments. The CASA ratio stood at 24.9%.

The CRM Machine and the Omnichannel Springboard: Santander to SHB’s Journey

In the quest for comprehensive digitalization, it is imperative to transform and seamlessly connect every service touchpoint. Automated transaction machines, or Cash Recycle Machines (CRMs), are pivotal in this journey. CRMs not only empower customers with self-service capabilities but also serve as a vital link in the construction of an omnichannel experience for the bank of the future.

“Techcombank – Revolving Leadership, Optimizing the Power of the Ecosystem”

As of August 1st, 2025, the Techcombank – One Mount – Masterise Group ecosystem underwent a strategic shift with a leadership transition. This move underscores the ecosystem’s commitment to harnessing the synergy of finance and technology, solidifying its pledge to accompany the nation’s digital transformation journey by leveraging the pillar of talent.

Sacombank Enters the Top 10 Most Reputable Commercial Banks in Vietnam for 2025

“Sacombank has been recognized as one of the top 10 most reputable commercial banks in Vietnam for 2025 by Vietnam Report and VietNamNet Newspaper. Not only has the bank climbed to the top 5 most reputable private joint-stock commercial banks, but it has also secured a spot in the top 50 public companies for trust and performance (VIX50). This achievement is a testament to Sacombank’s financial prowess, media reputation, and positive feedback from key stakeholders in the financial and banking markets, as evaluated through independent assessment criteria.”

“Top 10 Banks With the Highest Profit in Q2 2025: A New Leader Emerges as VietinBank, Vietcombank, and BIDV Claim Over One-Third of the Banking Sector’s Profit on the Stock Exchange”

As of the morning of July 31st, all 27 banks listed on the stock exchange had released their financial reports for the second quarter of 2025. Impressively, these banks collectively raked in a total profit of 89,341 billion VND in Q2 2025, marking an 18% increase compared to the same period in 2024.