|

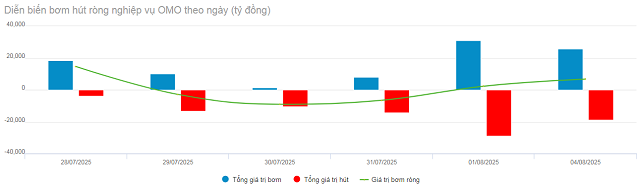

OMO Net Pumping Development last week (28/7-01/8/2025). Unit: Billion VND

Source: VietstockFinance

|

Specifically, the SBV continued to suspend the issuance of bills while consistently supporting liquidity through the 7-91 day term purchase channel at a fixed interest rate of 4%/year. In the week, the total new issuance reached VND94,411 billion, while VND89,453 billion matured, withdrew from the system and returned to the SBV.

Ending week 04/08, the operator net injected VND4,958 billion into the open market. Currently, the circulating volume on the term purchase channel reaches VND251,170 billion, with no outstanding bills.

|

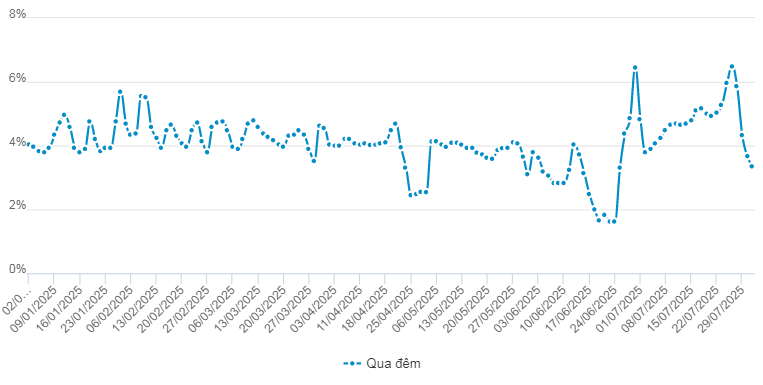

Development of overnight interbank interest rates since the beginning of 2025. Unit: %/year

Source: VietstockFinance

|

In the interbank market, the overnight interest rate dropped sharply after hitting a peak of 6.5%/year on July 25 – the highest since November 2022. By August 01, this interest rate fell 114 basis points from the previous week to 5.36%/year. The average trading volume also decreased slightly, reaching over VND549 thousand billion/day.

|

DXY movement since the beginning of 2025 up to August 05

Source: marketwatch

|

In the international market, the USD Index jumped to 98.69 points at the end of the August 01 session after the Federal Reserve (Fed) kept interest rates unchanged at its July meeting. At the same time, positive economic data bolstered expectations that the US economy is strong enough to withstand high interest rates, thereby supporting the USD.

Domestically, the exchange rate listed at Vietcombank on August 01 increased by VND70 in both buying and selling directions compared to the previous week, to the level of VND26,000-VND26,390/USD (buying – selling)

– 10:52 05/08/2025

“Vietnam’s Central Bank Meets With Commercial Banks to Discuss Interest Rates”

The State Bank of Vietnam (SBV) has instructed credit institutions to follow the directives of the Government, the Prime Minister, and the SBV itself, with a key focus on maintaining stability in deposit interest rates. Institutions are also encouraged to further reduce operating expenses, embrace digital transformation, and be prepared to share a portion of their profits to lower lending rates.

The Greenback Slides: A Sudden Shift in Fortune

“The U.S. dollar took a turn last week, experiencing a decline in the international market as the deadline for higher tariffs loomed. As the week of July 21-25, 2025, unfolded, the implications of President Donald Trump’s trade policies became increasingly apparent, with the dollar’s performance reflecting the market’s anticipation of these changes.”

The Exchange Rate Conundrum: Why It Remains a Challenge in 2025

Although there have been signs of cooling off since the beginning of the year, the USD/VND exchange rate remains one of the most unpredictable factors of 2025. What key elements could influence the foreign exchange market this year?