The Rapid Rise of Digital Assets in Vietnam

While it emerged after stock investment channels and lacks a formal market, digital assets are spreading at an astonishing pace in Vietnam, especially in recent years.

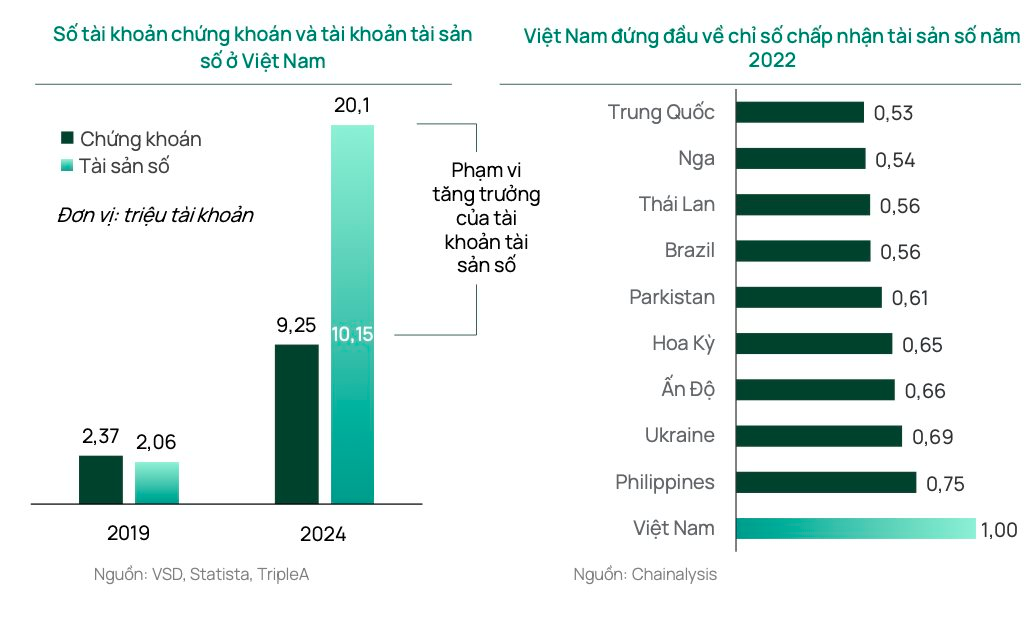

According to Statista’s 2024 statistics, the estimated number of digital account users in Vietnam reached 10.15 million, excluding the NFT (Non-Fungible Token) market. Another estimate by Triple A in 2023 suggests this figure could be as high as 20.1 million accounts.

In contrast, the Vietnam Securities Depository Center (VSD) reported approximately 9.25 million domestic securities accounts in Vietnam as of August 2024. It wasn’t until the end of May that the number of domestic investors’ securities accounts first crossed the 10 million mark after 25 years of development.

Back in 2019, the number of digital asset accounts in Vietnam (according to Statista) stood at just 2.06 million, lower than the number of domestic securities accounts (2.37 million). Notably, the period from 2020 onwards has witnessed an unprecedented wave of new investors, causing a surge in domestic securities accounts. However, the growth rate of digital asset accounts is even more remarkable.

A 2021 McKinsey report highlights that Vietnam’s economy has grown significantly over the past few decades, leading to a substantial increase in household assets and a demand for more diverse investment products. Digital assets, in particular, have attracted strong interest from individual investors seeking to diversify their portfolios and willing to take on higher risks to maximize their assets.

Since 2021, Vietnam has consistently ranked among the top 5 in Chainalysis’s Global Crypto Adoption Index, even topping the list for two consecutive years in 2021 and 2022. This index measures factors such as the number of users, the presence of exchange platforms, and the regulatory environment, adjusted for PPP-adjusted GDP per capita, reflecting the population’s engagement with the digital asset market. This not only demonstrates a high level of acceptance but also signifies a noticeable shift in individual investors’ capital allocation trends.

Notably, this evolution is occurring even without legal recognition of digital assets as a legitimate investment channel in Vietnam. The lack of a clear legal framework hinders financial institutions from providing essential services such as exchanges, custody, payment processing, and infrastructure for digital assets. Access to digital asset services in Vietnam remains limited, as most service providers are unofficial and often lack a physical presence in the country, offering their services primarily online, which poses challenges for domestic investors.

Legal Recognition of Digital Assets

These barriers are gradually being removed following the National Assembly’s official adoption of the Law on Digital Technology Industry at its 9th session in mid-June last year. For the first time, the law introduced the concepts of digital and virtual assets. The law defines digital assets as:

(1) Virtual assets in the electronic environment are a type of digital asset that can be used for exchange or investment purposes. Virtual assets do not include securities, legal tender, and other financial assets as defined by civil and financial laws;

(2) Encrypted assets are a type of digital asset that uses encryption or similar digital technology to authenticate assets during creation, issuance, storage, and transfer. Encrypted assets do not include securities, legal tender, and other financial assets as defined by civil and financial laws; Other digital assets.

The content related to the management of digital assets includes: The creation, issuance, storage, and transfer of digital assets; The rights and obligations of parties involved in activities related to digital assets; Measures to ensure network security and prevent money laundering, terrorist financing, and proliferation financing; Inspection, examination, and handling of violations; Conditions for providing encrypted asset services; and Other management content.

A crucial link in promoting the development of digital assets in the future is the International Financial Center, which is being urgently implemented. At the conference on implementing the National Assembly’s Resolution on the International Financial Center in Vietnam, the Prime Minister stated that successfully establishing the center would bring strategic and comprehensive benefits and help Vietnam achieve the following goals:

Capital Flows

By expanding connections with the global financial market, attracting international financial institutions and investment capital, and optimizing and promoting domestic resources.

Services

Developing a modern, internationally-standardized financial-banking service ecosystem to meet the growing needs of businesses and investors.

Markets

Achieving a qualitative leap in the development of Vietnam’s financial market, ensuring its operation is transparent, fair, efficient, and aligned with international standards.

National Status

Enhancing Vietnam’s role, prestige, and influence on the world stage, enabling deeper participation in global value, supply, and production chains.

Economic Security

Strengthening the foundation of a self-reliant, robust, and sustainable economy, contributing to safeguarding national financial security; helping maintain political stability, social order and safety, and creating a stable environment for development, ensuring a warmer and happier life for the people.

According to the Prime Minister, the National Assembly’s issuance of Resolution 222 has provided the first and most important legal framework for establishing, operating, and developing the International Financial Center in Vietnam. The legal framework for the center has been and is being perfected based on several core principles.

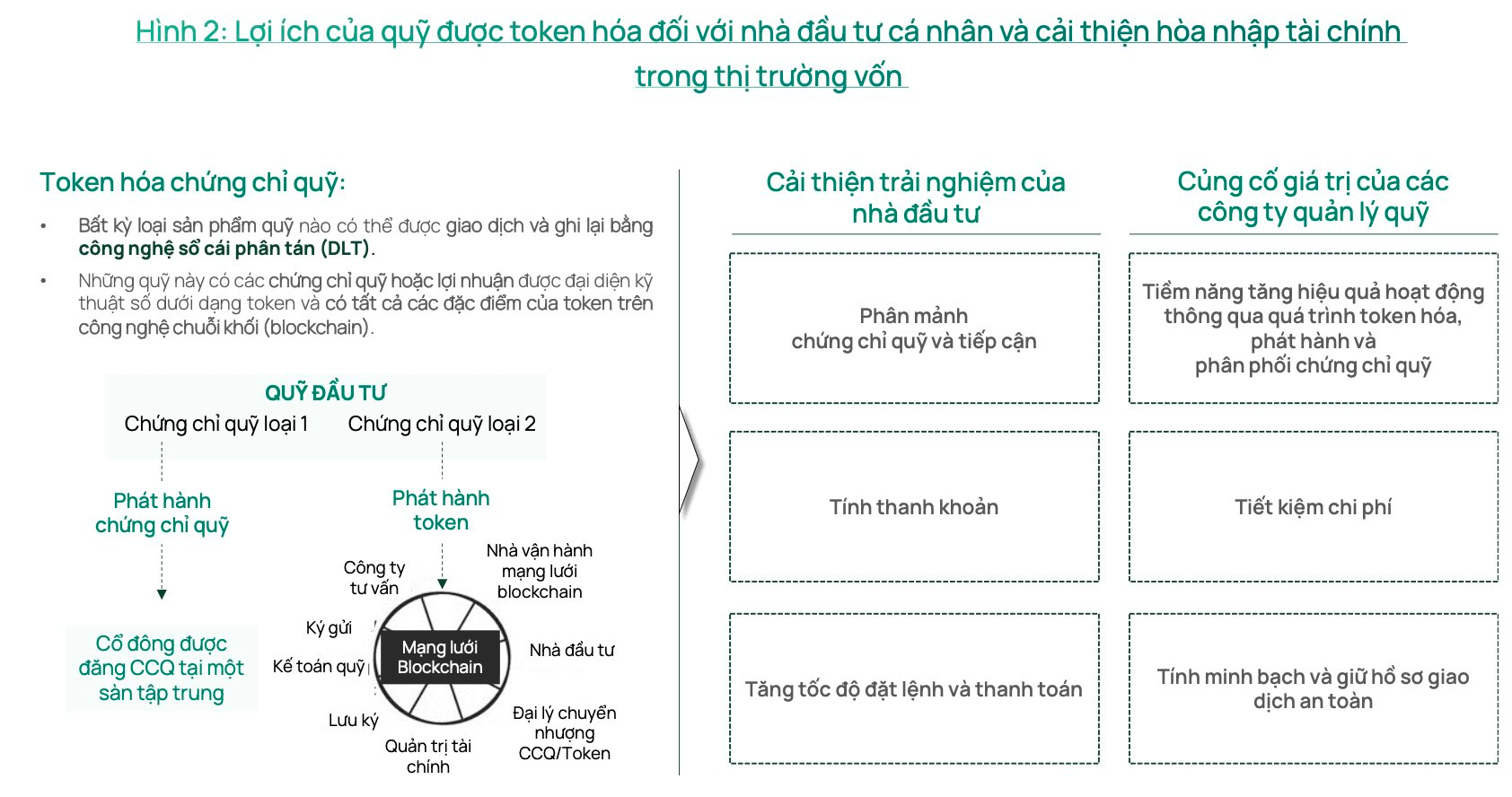

Tokenization of Real Assets, Starting with ETFs

With the high level of acceptance of digital assets in Vietnam, along with the legal framework and technical infrastructure in place, there is significant potential to bring real assets onto the blockchain through tokenization, in addition to digital currencies. This is expected to be a new class of investment products that aligns with global development trends.

In this context, Dragon Capital proposes a pilot project to tokenize ETFs (Exchange-Traded Funds) as they are already familiar to many individual investors. This approach aims to bridge the gap between traditional investing and digital asset technology, encouraging greater participation in the capital market while promoting financial inclusion.

According to Dragon Capital, focusing on tokenizing ETFs – a well-established financial product – offers several benefits to individual investors in Vietnam:

Lower Investment Thresholds

Tokenization allows ownership of a fraction of an ETF, enabling investors to purchase tokens representing a portion of the fund. This lowers the barrier to entry, making investing more accessible with smaller capital.

Enhanced Liquidity

Tokenized ETFs can be traded on secondary markets, similar to cryptocurrencies, offering higher liquidity than traditional ETFs. This makes it easier for individual investors to enter and exit investment positions.

Improved Access

The digital nature of tokenized ETFs simplifies the trading process, especially for those familiar with digital assets, encouraging participation in the investment market.

Diversification Opportunities

ETFs are known for providing diversified investment portfolios. Tokenization can further expand these opportunities, allowing individual investors to diversify their portfolios with smaller amounts of capital.

Transparency and Security

Blockchain technology ensures transparency and security for transactions. All transactions are recorded on the blockchain, providing an immutable audit trail.

Reduced Costs and Fees

Tokenization can simplify the process of buying and selling ETFs, reducing transaction costs and management fees, making it more affordable for individual investors.

Real-Time Trading

Unlike traditional ETFs, which are traded at the end of the day based on net asset value, tokenized ETFs can be traded in real-time, offering flexibility and immediate responsiveness to market fluctuations.

Overall, Dragon Capital believes that tokenized ETFs offer a new and efficient way for individual investors in Vietnam to participate in the investment market, combining the benefits of traditional ETFs with the innovative features of blockchain technology. By leveraging blockchain’s potential within a legal framework, tokenized funds can enhance transparency, security, and efficiency in financial markets.

The King of Fruits: A Tasty Treat at an Unbelievable Price.

With prices as low as 35,000 VND per kilogram, many roadside durian vendors in Ho Chi Minh City attract customers with the promise of “guaranteed satisfaction and exchange.” However, according to the Vietnam Vegetables and Fruits Association, these durians fail to meet quality standards, and their quality is highly unpredictable.

Steel Yourself: Navigating Growth Amidst Turbulence (HPG – Part 2)

Amid positive signals in the steel market, driven by supportive policies and stable raw material costs, Hoá Phát Group Joint Stock Company (HOSE: HPG) is poised to sustain its growth trajectory. HPG’s scale, capacity, and effective expansion strategies provide a competitive edge. With a reasonable valuation, HPG presents an attractive accumulation opportunity for long-term investors.