**Vietnam Joint Stock Commercial Bank for Investment and Development’s (BIDV) Financial Report for Q2 2025:**

Vietnam Joint Stock Commercial Bank for Investment and Development (BIDV – Code: BID) has recently released its Q2 2025 financial report, announcing a consolidated pre-tax profit of nearly VND 8,625 billion, a 5.7% increase compared to the same period in 2024.

For the first six months of the year, BIDV’s profit reached nearly VND 16,038 billion, a 3.1% increase, ranking third in the banking system, after Vietcombank (VND 21,894 billion) and VietinBank (VND 18,920 billion).

In the first half of 2025, BIDV’s net interest income was VND 28,937 billion, a modest 2% increase compared to the same period in 2024. Meanwhile, net income from service activities decreased by 5.7% to VND 3,426 billion, and net income from foreign exchange trading decreased by over 30% to VND 2,221 billion.

The main growth driver for BIDV’s revenue was income from other business activities, which amounted to over VND 4,114 billion, a 168% increase compared to the first half of 2024. The securities trading and investment segments also performed well, contributing VND 261 billion and VND 793 billion, respectively, in the first six months.

Overall, BIDV’s operating income for the first six months of 2025 was nearly VND 39,988 billion, a 6.9% increase. After deducting operating expenses of VND 13,274 billion, the bank’s net income was VND 26,714 billion, a 5.6% increase compared to the same period in 2024.

In the first half of 2025, BIDV set aside more than VND 10,676 billion in credit risk provisions, a 9.5% increase.

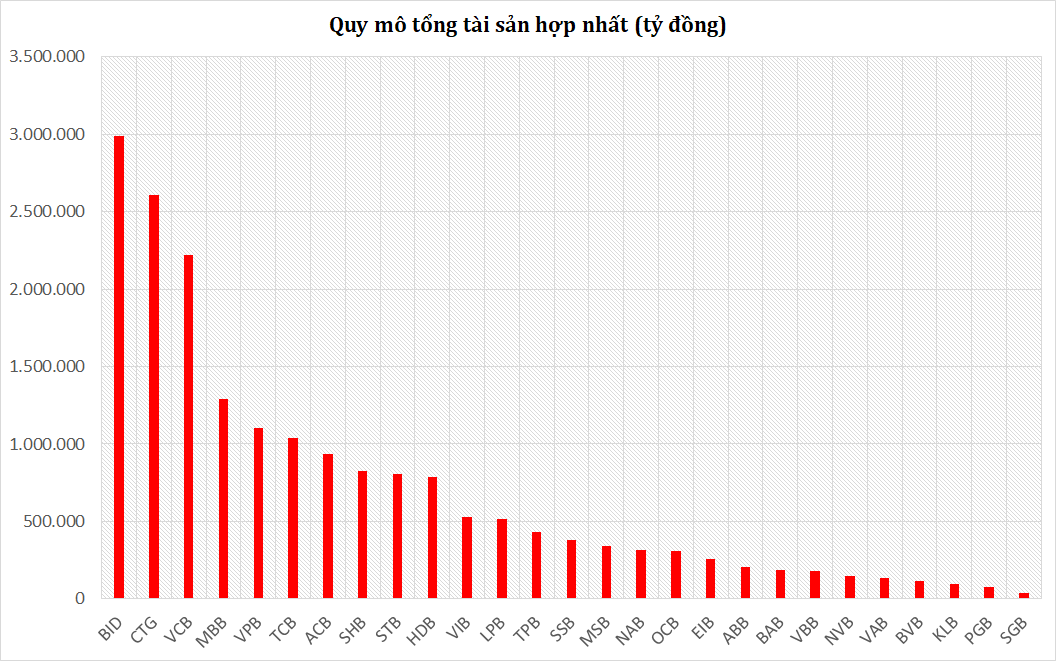

As of the end of June, BIDV maintained its leading position in the banking system in terms of asset scale, with nearly VND 2,992 quadrillion, an 8.4% increase compared to the beginning of the year. BIDV’s asset scale is nearly equal to the combined total of the three largest private banks: VPBank (VND 1,105 quadrillion), Techcombank (VND 1,038 quadrillion), and ACB (VND 933,541 billion).

With an average growth rate of more than VND 38,500 billion per month, BIDV is expected to reach a total asset scale of VND 3 quadrillion in the early days of Q3 2025.

In the first half of the year, BIDV’s customer loan balance expanded by 6% to VND 2.18 quadrillion, with bad debt balance reaching VND 43,140 billion, one and a half times higher than at the beginning of the year. The bad debt ratio increased from 1.41% at the beginning of the year to 1.98%.

Q2 2025 also marked a new record for BIDV as customer deposits surpassed the VND 2 quadrillion mark, reaching nearly VND 2,075 quadrillion, a 6.2% increase compared to the beginning of the year.

Thus, BIDV leads the banking system in three key financial indicators: asset scale, customer loan balance, and bank deposits.

The Banking Giant Slashes Its Physical Presence: Shuttering 66 Branches in an Unprecedented Move

The recent wave of layoffs in the second quarter of 2025 has been a challenging time for many. With a focus on streamlining and cost-cutting measures, organizations across industries have had to part ways with valuable talent. As we move forward, it’s essential to reflect on the impact of these decisions and the potential consequences they may have on the future landscape of various sectors.

Sacombank Enters the Top 10 Most Reputable Commercial Banks in Vietnam for 2025

“Sacombank has been recognized as one of the top 10 most reputable commercial banks in Vietnam for 2025 by Vietnam Report and VietNamNet Newspaper. Not only has the bank climbed to the top 5 most reputable private joint-stock commercial banks, but it has also secured a spot in the top 50 public companies for trust and performance (VIX50). This achievement is a testament to Sacombank’s financial prowess, media reputation, and positive feedback from key stakeholders in the financial and banking markets, as evaluated through independent assessment criteria.”

“Top 10 Banks With the Highest Profit in Q2 2025: A New Leader Emerges as VietinBank, Vietcombank, and BIDV Claim Over One-Third of the Banking Sector’s Profit on the Stock Exchange”

As of the morning of July 31st, all 27 banks listed on the stock exchange had released their financial reports for the second quarter of 2025. Impressively, these banks collectively raked in a total profit of 89,341 billion VND in Q2 2025, marking an 18% increase compared to the same period in 2024.

“Saigonbank Reports a 22% Drop in Pre-Tax Profits: A Significant Rise in Provision Costs”

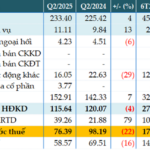

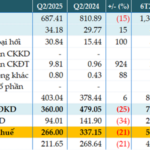

“Saigonbank’s latest quarterly report reveals a pre-tax profit of over VND 76 billion in Q2 of 2025, marking a 22% dip compared to the previous year’s figures. This decrease is attributed to a significant 79% surge in credit risk provisions, highlighting the bank’s cautious approach amidst economic uncertainties.”

“Profit Slump Despite Strong External Income: What Caused Vietbank’s Q2 Earnings Decline?”

The consolidated financial statements for Q2 2025 reveal that despite a significant surge in non-interest income, Vietnam Thuong Tin Commercial Joint Stock Bank (Vietbank, UPCoM: VBB) witnessed a 21% year-over-year decline in its pre-tax profit, which stood at VND 266 billion.