Digiworld (DGW) reported a significant 30% year-over-year increase in net profit for Q2 2025, despite it typically being a slower period. This growth was driven by strong performance across most product categories, with a net profit of VND 222 billion for the first half of the year, up 22% from the same period in 2024.

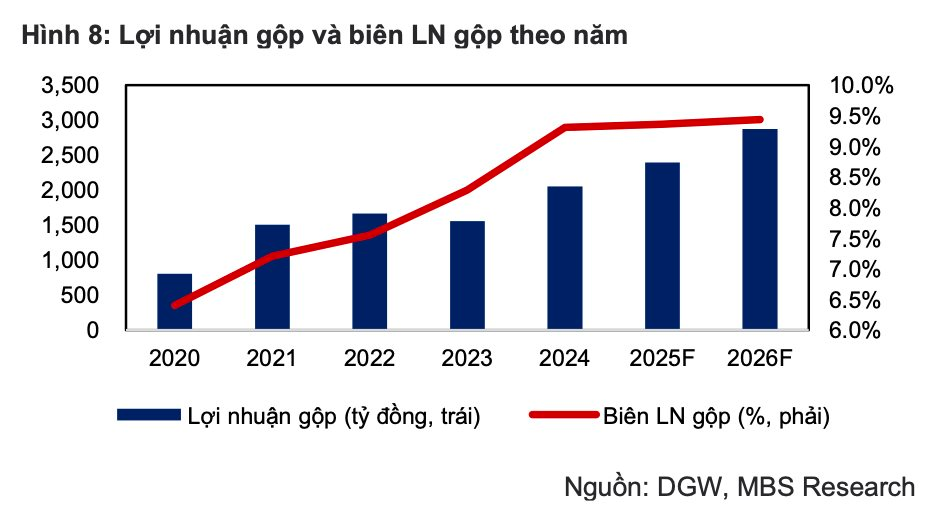

According to a recent analysis by MBS, Digiworld’s unique MES model, which encompasses market research, distribution, sales, marketing, and post-purchase customer support, is expected to drive a double-digit net profit growth of 25% in 2025-26. This growth will be supported by the recovery of overall consumer trends and their aggressive product portfolio expansion strategy, with gross margins expected to slightly increase to around 9.5%.

This MES model enhances Digiworld’s reputation and facilitates the expansion of distribution channels, especially exclusive distribution channels. With their strong business model and brand value, Digiworld is expected to achieve impressive growth in FMCGs and home appliances, with a projected compound growth rate of 38% in 25-26.

In the ICT-CE distribution market, Digiworld maintains a strong position with a vast network of over 6,000 retail customers and a healthy financial standing. As consumer demand recovers and the adoption of AI solutions gains momentum, MBS anticipates a boost in the replacement cycle for AI products, leading to increased sales of laptops and tablets, with an expected compound growth rate of 16% in 2025-26.

In the office equipment sector, the growing demand for data center expansion, enhanced home security, and the expansion of IoT product portfolios are expected to drive a compound growth rate of 32% in 2025-26, according to MBS estimates.

The Vietnamese government is taking stringent action against counterfeit and low-quality goods, coupled with tighter control on transactions by (1) directly connecting e-invoices with enterprises generating revenue above VND 1 billion per year and (2) proposing to abolish the lump-sum tax as per Resolution 68. These measures are expected to create a more favorable environment for established companies like Digiworld by reducing competition from non-compliant businesses.

The Real Estate Market in the Second Half: No Land Rush, But Also No Deep Price Cuts

“That is the assessment of Dr. Nguyen Van Dinh, Vice President of the Vietnam Real Estate Association, as he forecasts the real estate market trends for the latter half of 2025.”

Sacombank Enters the Top 10 Most Reputable Commercial Banks in Vietnam for 2025

Sacombank has been recognized by Vietnam Report and VietNamNet Newspaper as one of the Top 10 most reputable commercial banks in Vietnam for 2025. This prestigious accolade further cements Sacombank’s position as a leading private joint-stock commercial bank in the country. Additionally, Sacombank has also made significant strides, climbing into the Top 5 most reputable private banks and securing a spot in the Top 50 public companies for efficiency and reputation (VIX50).

Profiting from the Rise in Oil Prices: PV OIL’s Quarterly Earnings Double

“PV OIL (UPCoM: OIL) witnessed a positive trend in the second quarter of 2025 with domestic base prices on an upward trajectory, a stark contrast to the downward trend experienced in the same quarter of 2024. This shift has resulted in a significant boost to the company’s financial performance for the current quarter compared to the previous year.”