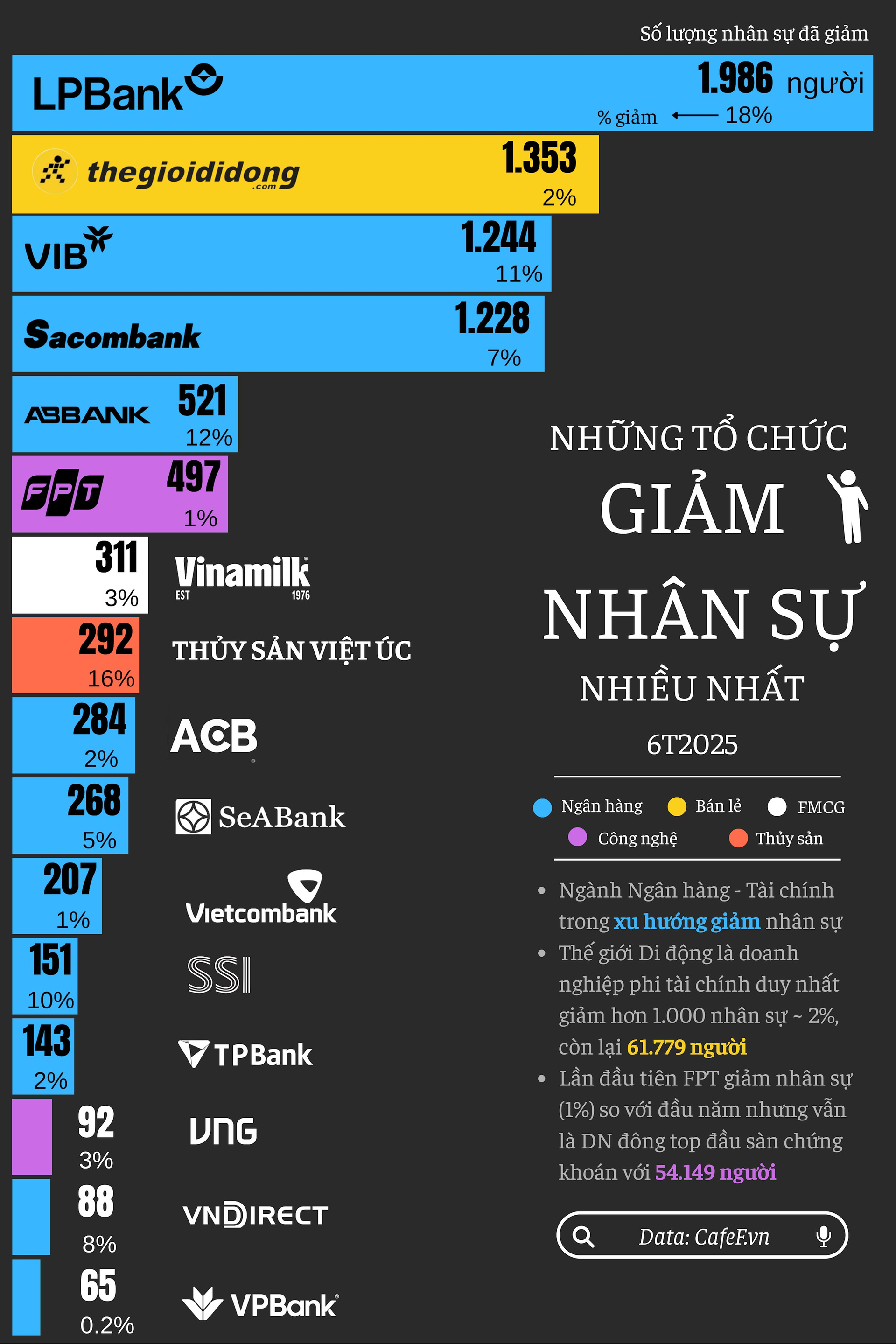

The latest consolidated financial reports from Q2 2025 of listed companies in the stock market reveal a widespread downward trend in headcount across the Financial and Banking sector.

Leading the pack is LPBank, which reduced its headcount by 1,986, followed by The Gioi Di Dong with a decrease of 1,353 employees, VIB with 1,244 fewer staff, and Sacombank, which let go of 1,244 people.

Thus, out of the four companies that downsized by over a thousand people, three are banks. Moreover, six out of the top ten companies with the most significant staff reductions are from the banking and finance industry.

The human resource data is derived from the consolidated financial statements, encompassing the numbers from both the parent company/bank and their subsidiaries. During this period, Seabank’s system reduced by 268 people due to the transfer of 100% of PTF Financial Company’s capital contribution to AEON Financial Service. The parent bank only decreased by one person compared to the beginning of the year.

The Gioi Di Dong, a non-financial enterprise, is the only other company besides banks to reduce its headcount by over a thousand. However, this figure accounts for just 2% of the retail giant’s total staff strength as of June 30, 2025. The company still boasts a workforce of 61,779 people, the largest on the stock exchange.

In contrast, LPBank, VIB, ABBank, and SSI have downsized by over 10%.

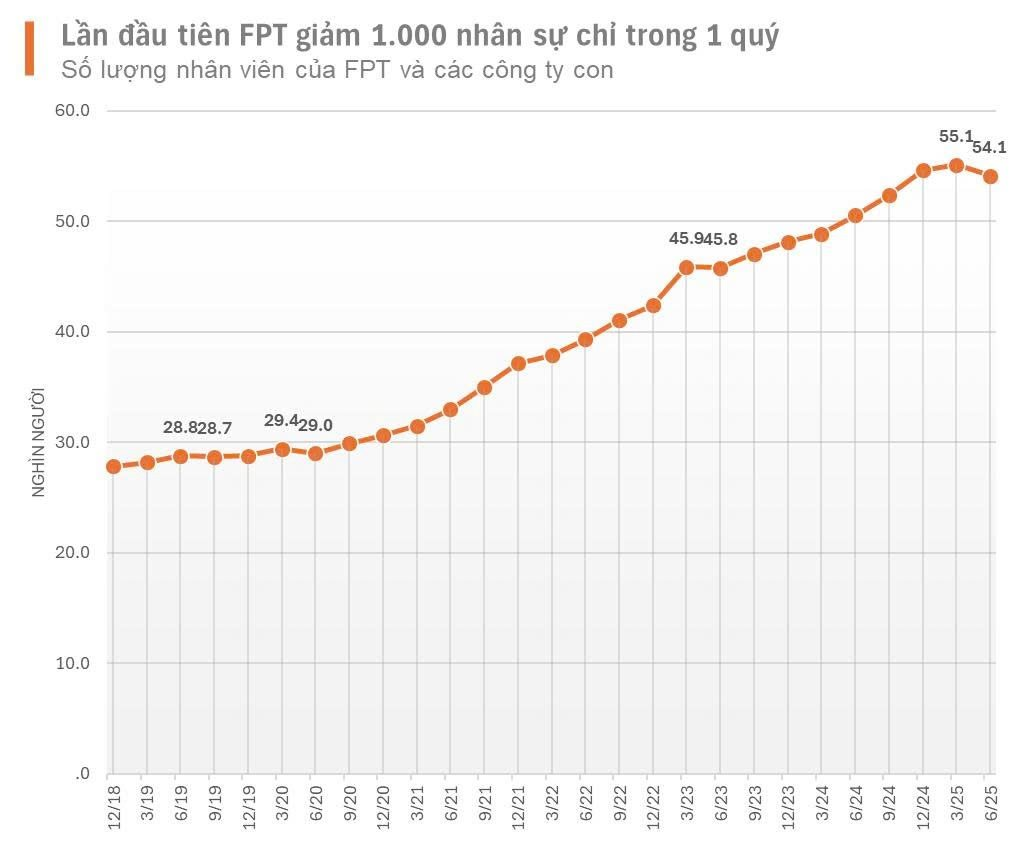

FPT Corporation (FPT) has, for the first time, witnessed a reduction in its headcount compared to the beginning of the year, with 497 fewer employees, equivalent to a 1% decrease. Notably, Q2 2025 also marks the first time FPT has reduced its workforce by a thousand in a single quarter.

Another prominent technology company, VNG, has decreased its staff strength by 92 people, equivalent to a 3% reduction.

Vinamilk, Vietnam’s largest dairy company, has reduced its workforce by 311 people, equivalent to a 3% decrease compared to the beginning of the year. In the first half of 2025, Vinamilk reported a slight decrease in revenue compared to the same period last year, while its after-tax profit dropped by nearly 17%, attributed to unfavorable business conditions and rising raw material costs.

Viet Uc Seafood, owned by the “Shrimp King” Luong Thanh Van, experienced a challenging first half, with revenue declines and a loss of VND 41 billion. The company downsized by 292 people (a 16% reduction) and now has 1,558 employees.

The Q2 2025 labor market report, titled “Current Reality of Workers’ Psychology and the Disconnection Between Labor Supply and Demand in the Market” by Vieclam24h, reveals that in the first half of 2025, a wave of layoffs continued to spread globally and in Vietnam, severely impacting various industries, especially Production, Retail, Finance, and Technology.

The global retail industry recorded more than 64,000 job cuts, with 7,235 people losing their jobs in April alone, a 77% increase compared to the same period in 2024. This is attributed to the impact of e-commerce, automation, and AI.

The global technology industry, including Vietnam, laid off 72,000 employees in just the first six months of the year. While this number is 28% lower than last year, the impact is still significant.

In the banking sector, Vietnam recorded more than 2,500 job losses from eight major banks in 2024, and this trend has continued into this year.

In the manufacturing sector, several industrial parks have reported large-scale layoffs in the textile, footwear, and electronics assembly industries, although there is currently no comprehensive nationwide statistic.

It is worth noting that this report is based on a survey of nearly 3,000 workers (nearly 2,000 employees and almost 1,000 enterprises) conducted in May and June 2025.

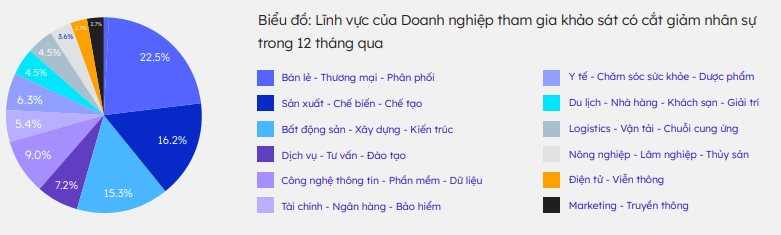

The reality of job cuts continues, with over a quarter of businesses (26.4%) downsizing in the last 12 months, and nearly 70% of those reducing their workforce by less than 10%.

The companies that downsized in the last year are mainly from labor-intensive or economically sensitive sectors, including Retail (22.5%), Manufacturing (16.2%), Real Estate (15.3%), Information Technology – Software – Data (9%), and Services – Consulting – Training (7.2%). Some specialized industries like Finance and Healthcare also witnessed significant job cuts.

The report also highlights that while layoffs have increased, with over 72.7% of affected individuals actively seeking new employment, only 24.7% found suitable positions quickly. This indicates the challenges faced in re-entering the job market.

On the other hand, businesses are struggling with a severe talent shortage. A whopping 77.4% of companies find recruitment more difficult than in previous years, especially when hiring official and middle-level employees – positions considered the “backbone” of operations.

There is a disconnect between supply and demand, a paradox reflected in the gap between the expectations, skills, and psychology of job seekers and employers, which goes beyond mere numbers.

The Future Job Market: Uncovering In-Demand Careers of 2025.

According to Top CV’s insights, Business/Sales will be the top priority for recruitment in 2025. Alongside this, IT – Software remains in high demand for talent, despite a slight dip in job postings.