Today’s market witnessed a shocking trading session for investors with the index experiencing drastic fluctuations. The morning session was dominated by banks, pushing the VN-Index to a new historical peak of 1,564 points. However, a massive sell-off in the afternoon wiped out these gains, with the index even dipping nine points at one point, causing widespread losses.

Support came from VIC, VHM, and a few bank stocks such as TCB, MBB, CTG, BID, and HPG, allowing the VN-Index to close with a gain of nearly 19 points, approaching the 1,547-point level. Nonetheless, the breadth was unfavorable, with 221 declining stocks versus 118 advancing ones.

Banks and real estate remained the market leaders, although there was significant differentiation within these sectors. Smaller-cap stocks corrected after a brief surge, while large-cap stocks like TCB, which rose 4.67%, CTG and BID, both up 1.8%, and MBB, which hit the ceiling price, outperformed. Similarly, the real estate sector witnessed substantial corrections in speculative stocks like NVL, SJS, and QCG, while VIC gained 5.67% and VHM rose 4.12%. These real estate and bank stocks alone contributed 16 points to the VN-Index.

In the securities sector, VIX corrected by 3.25% after a nearly 2.5-fold increase, and SHS, BSI, and smaller peers also declined, while SSI, VND, and VCI remained robust. Overall, mid- and small-cap stocks that had been pushed up recently faced profit-taking pressure. Telecommunications, energy, information technology, and consumer services also turned red.

The terrifying sell-off that emerged as soon as the VN-Index hit a new historical peak indicates that latent sell pressure remains substantial. The index closing below the historical peak of six sessions ago is a negative signal, suggesting that if the market continues to rise, another wave of selling is likely.

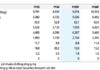

On the bright side, ample liquidity awaits dips to enter the market. Today’s trading volume on the three exchanges broke records again, reaching VND 82,600 billion, with foreign investors net selling VND 2,084.0 billion. However, in matched orders, they were net buyers to the tune of VND 678.5 billion.

Foreign investors’ net buying in matched orders focused on Basic Resources, Food & Beverage, and Health Care. The top net bought stocks by foreign investors in matched orders included HPG, MSN, BID, VIC, VCB, GMD, CTG, MWG, VRE, and HAG. On the other hand, they net sold Information Technology stocks, with the top net sold stocks in matched orders being SHB, VPB, VIX, FPT, VHM, HAX, KDH, FRT, and GEX.

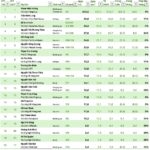

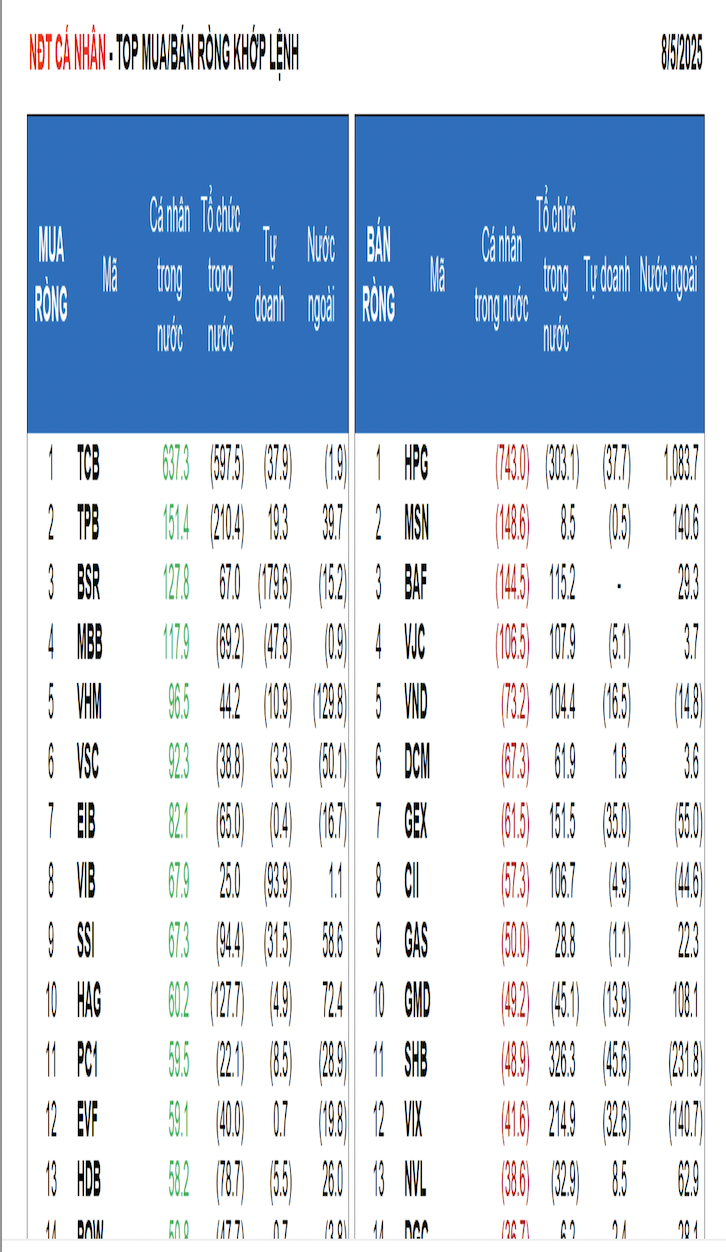

Individual investors net bought VND 2,725.3 billion, including VND 531.7 billion in matched orders. In matched orders, they net bought seven out of 18 sectors, mainly Banks. Their top net bought stocks included TCB, TPB, BSR, MBB, VHM, VSC, EIB, VIB, SSI, and HAG.

On the net selling side in matched orders, individual investors sold 11 out of 18 sectors, primarily Basic Resources, Food & Beverage, and Health Care. The top net sold stocks included HPG, MSN, BAF, VJC, VND, DCM, CII, GAS, and GMD.

Proprietary trading accounts net sold VND 1,314.0 billion, including VND 823.8 billion in matched orders. In matched orders, they net bought three out of 18 sectors, with the strongest purchases in Information Technology, Food & Beverage, and Health Care. The top net bought stocks by proprietary trading accounts in today’s session included FPT, VNM, TPB, FUEVFVND, NVL, E1VFVN30, CTS, FUEVN100, MSB, and HSG. On the net selling side, they focused on Banks. The top net sold stocks included BSR, VIB, VIC, MBB, CTG, SHB, BID, TCB, HPG, and ACB.

Domestic institutional investors net bought VND 928.0 billion, but in matched orders, they net sold VND 386.4 billion. In matched orders, domestic institutions net sold seven out of 18 sectors, with the largest value in Banks. The top net sold stocks included TCB, HPG, TPB, BID, HAG, VCB, VIC, SSI, STB, and HDB. On the net buying side, they focused on Financial Services. The top net bought stocks included SHB, VIX, VPB, GEX, BAF, VJC, CII, VND, FPT, and VNM.

Today’s matched orders contributed 6.4% to the total trading value, with a value of VND 5,485.7 billion, down 53.6% from the previous session. Notably, there was a significant matched order in VIC, with a foreign organization selling over 25.8 million shares, equivalent to VND 2,816.2 billion, to an individual and domestic institution.

The money flow allocation increased in Banks, Steel, Agriculture & Fisheries, and Food & Beverage, while it decreased in Real Estate, Securities, Construction, Chemicals, Retail, Aviation, Power Production & Distribution, and Gasoline Distribution. In matched orders, the money flow allocation increased in large-cap stocks (VN30) and decreased in mid-cap stocks (VNMID) and small-cap stocks (VNSML).

Mr. Tran Hoang Son (VPBankS): VN-Index Poised for New Uptrend After Correction

“It is quite normal for the VN-Index to experience a correction after a strong rally, and this pullback is likely a result of short-term profit-taking,” said Tran Hoang Son, Market Strategy Director at VPBank Securities (VPBankS), during the Vietnam and the Indices show on August 4th. He added, “The index is fully capable of entering a new uptrend.”

The Power of Profits: How a 30.2% Rise in Earnings for Over 1000 Businesses is Impacting Stock Performance

The stock market is a vibrant and dynamic arena, where you’ll always find stocks that exhibit a disconnect between their stellar financial performance and their stagnant stock prices. These stocks often fly under the radar, belonging to the mid-cap or small-cap category, unnoticed by most investors.

The Wealth of Vietnam’s Top 20 Stock Market Billionaires: Vietjet Chair Adds Another $29 Million, VPBank Chair’s Family Sees Largest Increase

As of Wednesday, August 6, 2025, Mr. Pham Nhat Vuong, Chairman of Vingroup, remains the wealthiest individual on the Vietnamese stock market. With a staggering net worth of 233,500 billion VND, Mr. Vuong’s wealth continues to be a testament to his success and influence in the country’s economy.

The Vietstock Daily: Back on the Upward Trend

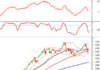

The VN-Index witnessed a robust surge and maintained its position above the middle line of the Bollinger Bands. However, a cautionary signal is flashing with the trading volume dipping below the 20-session average. Additionally, the Stochastic Oscillator is exhibiting continued weakness after issuing a sell signal and exiting the overbought territory. Investors should remain vigilant as the risk of volatility persists around the April 2022 peak levels of 1,480-1,530 points.