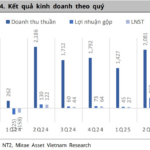

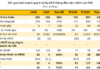

CEO Group JSC (CEO Group, code CEO on HNX) announced its Q2/2025 consolidated financial report with net revenue of VND 421 billion, an increase of nearly 8% compared to the same period. The largest contribution to revenue came from service provision while revenue from real estate business decreased by 6%, to VND 233 billion.

Due to a 12% decrease in cost of goods sold to over VND 256 billion, gross profit reached VND 164.5 billion, up 64% over the same period last year.

In this quarter, financial revenue also increased sharply by 67% to nearly VND 21 billion. Meanwhile, all kinds of expenses were reduced. Only other expenses increased sharply to over VND 27 billion, compared to a refund of over VND 1 billion in the same period last year.

As a result, CEO Group reported a post-tax profit of VND 39 billion, up 118% over the same period.

A corner of the Sonasea Van Don Harbor City Resort project

In the first 6 months of the year, CEO Group brought in VND 747 billion in revenue, up 10%. Increased revenue along with cost reduction helped post-tax profit reach VND 95 billion, up 79% over the same period.

In 2025, CEO Group sets a target of consolidated total revenue of VND 1,543 billion and consolidated after-tax profit of VND 182 billion – up 10% YoY. Thus, the company has completed 48% of the revenue plan and 52% of the profit plan after the first 6 months of the year.

As of the end of Q2/2025, CEO Group’s total assets amounted to over VND 8,700 billion, down 3% from the beginning of the year. Of which, bank deposits accounted for more than VND 1,700 billion, down 13% from the beginning of the year.

Short-term receivables accounted for VND 1,392 billion, inventory was at VND 1,374 billion. Construction in progress was VND 1,164 billion, of which, basic construction in progress of the Sonasea Van Don Harbor City Resort project increased by 6%, to over VND 982 billion.

In terms of capital sources, the company’s total liabilities were at VND 2,320 billion, a decrease of more than VND 300 billion from the beginning of the year. Of which, financial borrowings accounted for nearly VND 500 billion; short-term prepayments from customers were VND 540 billion; and long-term unearned revenue was over VND 150 billion.

In Q2, CEO Group established CEO Industrial Park JSC with a charter capital of VND 450 billion, of which CEO Group will contribute VND 445.5 billion for a 99% ownership stake. However, as of June 12, the Group has only contributed VND 50.5 billion to the subsidiary.

In another development, on July 15, the leadership of Hai Phong City approved the investment registration certificate for the Tien Lang Airport Industrial Park – Zone B project for CEO Industrial Park JSC.

“Van Phu Reports 6-Month Profit Growth of 56% in First Half of 2025”

“The positive macroeconomic climate has had a significant impact on the real estate market’s recovery, and this is reflected in the impressive financial performance of Van Phu – Invest Real Estate JSC (HOSE: VPI). The company has announced a remarkable 56% year-over-year increase in its after-tax profit for the first half of 2025, amounting to VND 148.8 billion.”

The Summer Heatwave’s Silver Lining: A Surprise 910% Profit Spike for the “Money-Printing Machine”

In the first half of the year, this company witnessed an astounding 910% surge in business, surpassing its annual profit plan by 30%.