Mrs. Pham Thi Thuy, the wife of Mr. Tran Viet Thang, Vice Chairman of Lam Dong Hydraulic Construction Investment Joint Stock Company (LHC), has recently registered to purchase 50,000 LHC shares to increase her ownership. Prior to this transaction, Mrs. Thuy held 99,700 shares, equivalent to 0.69% of the capital. Meanwhile, Mr. Thang is a major shareholder at LHC with an 8.94% stake.

Mrs. Thuy’s move comes as LHC’s share price has surged to historic highs. Since the beginning of July, LHC has gained over 26% in market price and is currently trading at VND 91,000 per share. The corresponding market capitalization exceeds VND 1,300 billion.

Notably, before the insider’s purchase, LHC announced its second-quarter financial report, showing impressive results.

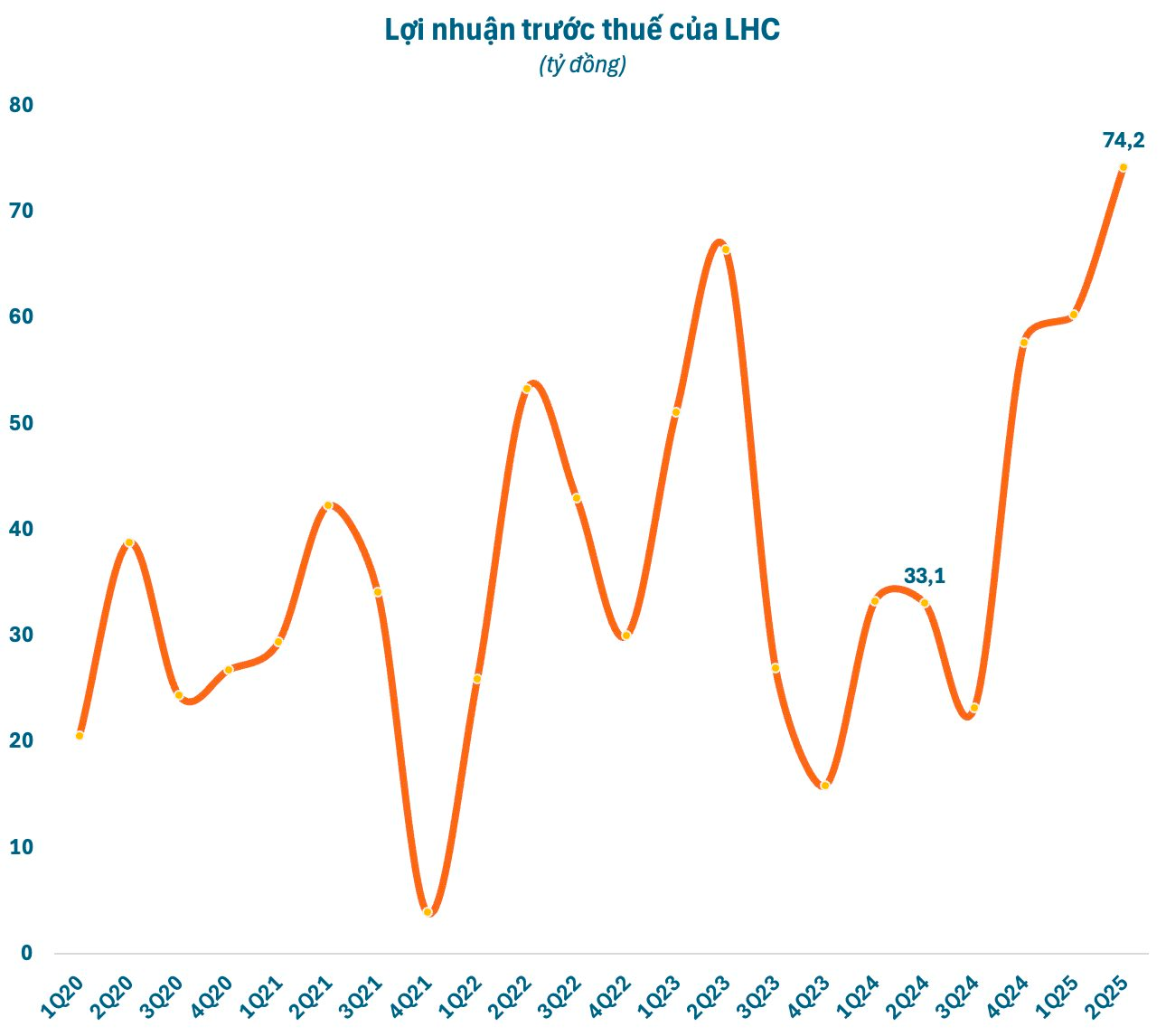

For the second quarter, LHC recorded a gross revenue of VND 427 billion, a more than 29% increase compared to the same period in 2024. After deducting expenses and taxes, LHC’s pre-tax profit reached over VND 74 billion, up 120% from the previous year and setting a record high since its operation. Net profit was VND 60.5 billion, 2.3 times higher than the same period last year, with a net profit of nearly VND 41 billion.

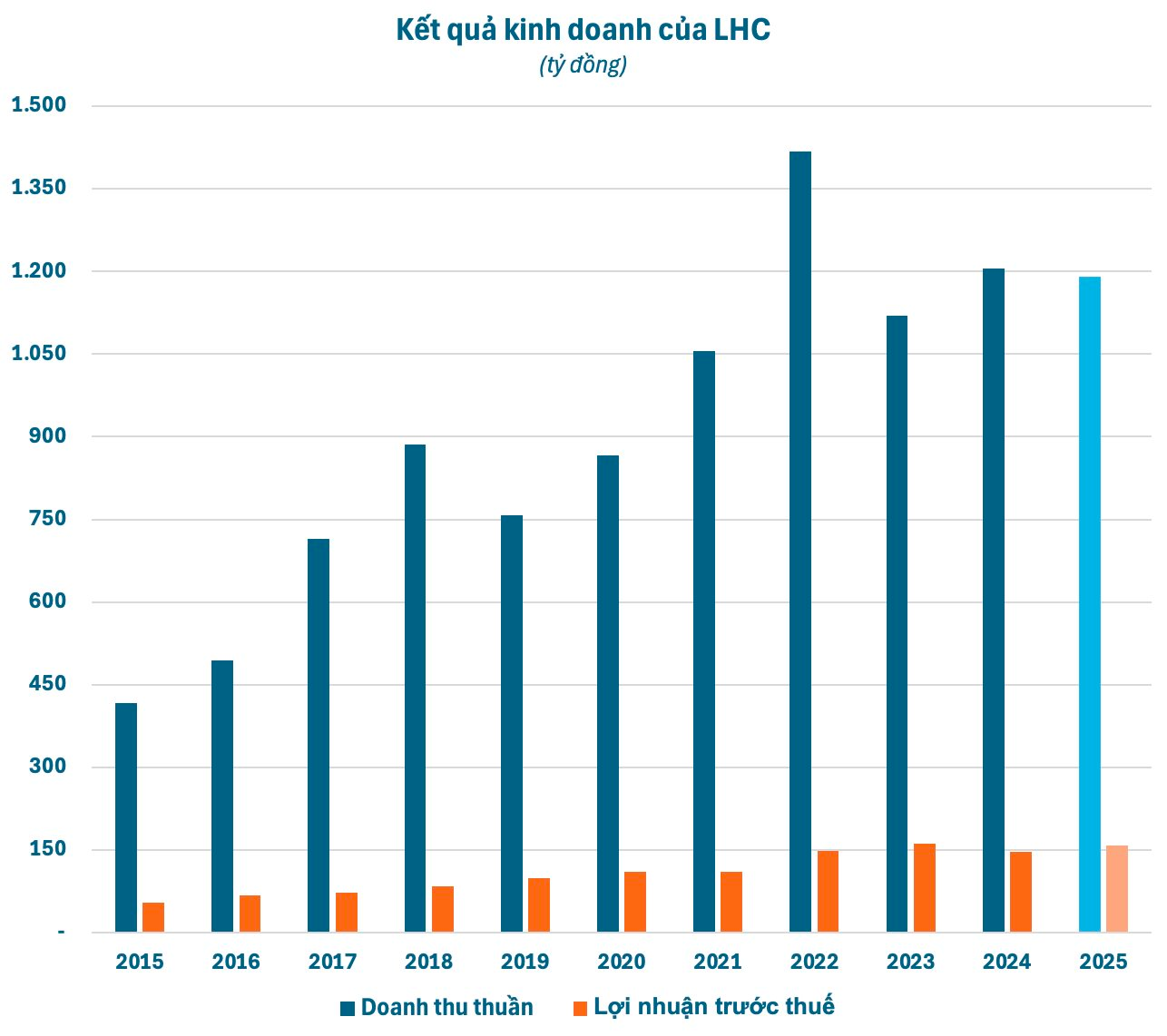

For the first six months of the year, LHC’s gross revenue reached nearly VND 742 billion, and its pre-tax profit was VND 134.5 billion, increases of 39% and 103%, respectively, compared to the first half of 2024. Net profit was VND 78 billion, corresponding to a basic earnings per share (EPS) of VND 5,421. With these results, LHC has accomplished 62% of its annual revenue plan and 85% of its profit target.

For 2025, LHC has set its business plan with a target of VND 1,190 billion in gross revenue and nearly VND 159 billion in pre-tax profit, equivalent to 99% and 108% of the 2024 figures, respectively. The expected dividend payout ratio for 2025 is 15-25%.

With the government’s policy to boost public investment to drive economic growth, LHC is expected to have many opportunities in the coming period. Notably, the company has made thorough preparations to seize these opportunities.

Specifically, at the end of March, LHC’s subsidiary, Lam Dong Minerals and Construction Materials Joint Stock Company (LBM), consecutively won the bid for mining rights for stone mines used as construction materials in Duc Trong district, Lam Dong province, with a total area of nearly 14 hectares. These mines are strategically located to serve public investment projects in the area and its vicinity.

At the 2025 Annual General Meeting of Shareholders, Mr. Le Dinh Hien, Chairman of LHC, shared that the company had prepared for five years and strategically positioned itself for these opportunities. As the public investment projects enter the peak period of capital disbursement in the latter half of the year, LHC and its subsidiaries are poised to capitalize on this opportunity.

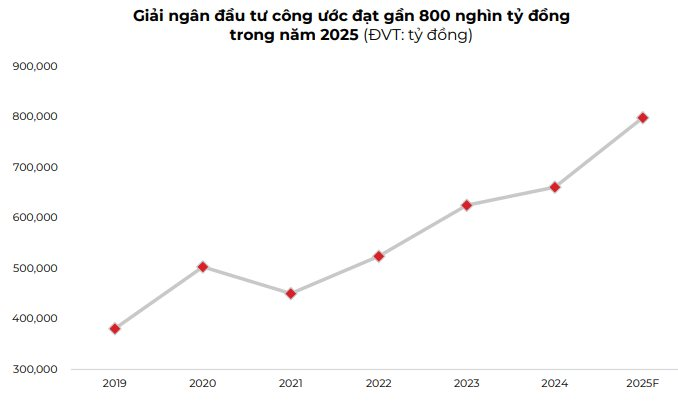

In a recent report, ASEANSC Research anticipated an increase in the pace of disbursement in the second half of the year compared to the first six months of 2025, given the completion and stabilization of administrative unit reorganization. The expected scale of public investment disbursement for this year is about VND 800,000 billion, a 21% increase from 2024, with an estimated completion rate of 87% of the plan.

However, the Chairman of LHC also emphasized the importance of risk management. “Large investors may have a prominent name, but they often have limited financial capacity,” he cautioned. Mr. Hien’s management philosophy focuses on mitigating risks and avoiding turning the company’s money, resources, and assets into liabilities, frustrations, and risks. He stressed that LHC consistently practices prudent risk management to safeguard the interests of the company and its shareholders.

The Profit Picture: Unraveling the Complexities of Bank Groups’ Earnings

The Q2 report reveals a 17% growth in profits for commercial banks compared to the previous year. This is an encouraging figure, yet it masks a significant disparity in the performance of individual banks. A closer look at the numbers reveals a wide gap in provisioning policies, which warrants further investigation and raises several concerns.

The Most Profitable Growth Companies in Q2 2025: Top Performers and Industries Unveiled

The energy sector takes center stage, with an impressive performance in the first half of 2025, followed closely by the stock market sector, which secured three spots in the top-performing categories.

The First Vietnamese Bank to Hit the 3-Million-Billion-Dong Mark: A Monumental Achievement

“This bank currently leads the banking system in all three financial indicators: asset scale, customer loan balance, and bank deposits. With an impressive performance, it has solidified its position as a top financial institution, outperforming its competitors and establishing itself as a powerhouse in the industry.”

Unlocking Capital: Vietnam’s Public Investment Disbursement Reaches an Estimated VND 388 Trillion by July End

As of July 31, 2025, the Ministry of Finance estimates that disbursement since the beginning of the year stands at VND 388,301.15 billion, representing 39.45% of the plan and 43.9% of the plan assigned by the Prime Minister. This demonstrates a significant improvement compared to the same period in 2024, when disbursement reached only 27.76% and 33.8% of the respective plans.