Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 1.62 billion shares, equivalent to a value of more than 40.5 trillion dong; HNX-Index reached over 178 million shares, equivalent to a value of more than 3.7 trillion dong.

VN-Index opened the afternoon session on a positive note as buyers gradually returned, helping the index recover and surpass the reference level despite selling pressure. In terms of impact, VPB, CTG, BID, and SHB were the most positive influences on the VN-Index, contributing 8.6 points. On the other hand, VIC, VHM, SSB, and EIB continued to face selling pressure, resulting in a loss of more than 4.4 points from the overall index.

| Top 10 stocks with the highest impact on the VN-Index on July 30, 2025 |

Similarly, the HNX-Index also witnessed a positive performance, influenced by the gains in SHS (+9.6%), MBS (+7.99%), BAB (+4.55%), and CEO (+4.42%)…

|

Source: VietstockFinance

|

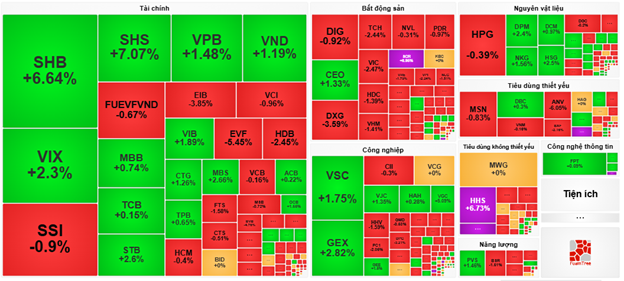

The financial sector was the best-performing group in the market, rising 2.06%, led by VPB (+6.99%), SHB (+6.98%), VIX (+6.89%), and CTG (+5.48%). The recovery was followed by the materials and industrial sectors, which increased by 0.65% and 0.59%, respectively. On the other hand, the media and communications services sector recorded the largest decline in the market, falling by -1.65%, mainly due to VGI (-2.11%), FOX (-0.27%), CTR (-2%), and VNZ (-0.08%).

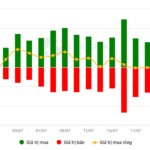

In terms of foreign trading, they returned to net buying on the HOSE exchange, focusing on SHB (170.15 billion), VIX (122.17 billion), VNM (114.72 billion), and CTG (102.04 billion). On the HNX exchange, foreign investors net bought over 108 billion dong, mainly in SHS (72.4 billion), PVS (34.18 billion), MBS (10.27 billion), and VGS (2.81 billion).

| Foreign investors’ buying and selling activities |

Morning Session: Profit-taking pressure returns, VN-Index turns negative

Strong selling pressure resurfaced towards the end of the morning session. The VN-Index closed the morning session below the reference level at 1,490.29 points, down 0.21%. The HNX-Index also narrowed its gain to 0.67%, reaching 257.08 points. The number of declining stocks increased, with 422 stocks decreasing and 258 stocks increasing.

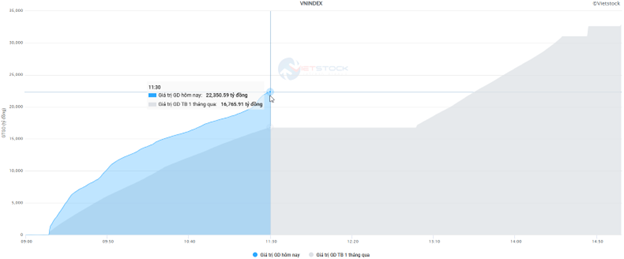

Investor sentiment remained cautious after the unexpected reversal in the previous session. The trading volume on the HOSE in the morning reached over 918 million units, equivalent to a value of 22 trillion dong, a decrease of more than 38% compared to the high of the previous session. The HNX recorded a volume of over 98 million units, equivalent to 2 trillion dong.

Source: VietstockFinance

|

In terms of impact, VIC was the biggest drag on the VN-Index, taking away 2.5 points from the index. On the other hand, SHB was the most notable positive contributor, adding 1 point to the index.

Red dominated most industry groups. Media and communications services, and real estate were the two groups that recorded the sharpest declines, with representative stocks such as VGI (-3.17%), CTR (-1.89%), SGT (-1.18%), YEG (-2.69%), VNB (-1.47%); VIC (-2.47%), VHM (-1.41%), VRE (-1.79%), DXG (-3.59%), TCH (-2.44%), and SIP (-2.28%).

Source: VietstockFinance

|

On the upside, the financial group temporarily led with a gain of 0.25%, mainly contributed by CTG (+1.26%), VPB (+1.48%), STB (+2.6%), VIB (+1.89%), VND (+1.19%), VIX (+2.3%), and SHB (+6.64%). The information technology group also saw notable bright spots, including VEC (+5.88%), DLG, and HPT, which hit the ceiling price.

The positive aspect was that foreign investors turned to net buying, with a value of 1.1 trillion dong on all three exchanges. The buying focused on FUEVFVND with a value of 619.57 billion dong, far surpassing the rest. Meanwhile, SSI led the net selling list with a value of 156.94 billion dong.

| Top 10 stocks with the highest foreign net buying and selling in the morning session of July 30, 2025 |

10:30 am: Financial and industrial groups provide support, VN-Index rebounds more than 11 points

As of 10:30 am, the market regained its positive momentum, with the VN-Index rising more than 11 points to trade at 1,504 points. The HNX-Index increased by more than 3.9 points to 259 points. The financial and industrial groups continued to contribute positively to the upward momentum.

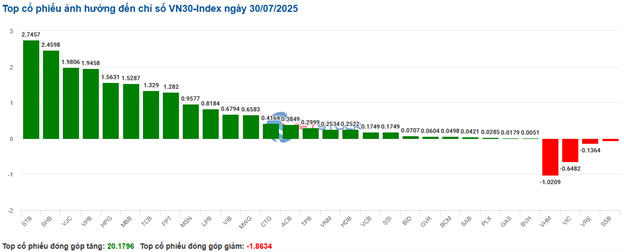

The breadth in the VN30-Index basket was overwhelmingly positive. Notably, STB, SHB, VJC, and VPB contributed 2.7 points, 2.4 points, 1.9 points, and 1.9 points to the VN30 index, respectively. On the other hand, only a few stocks, including VHM, VIC, VRE, and SSB, continued to face selling pressure, resulting in a loss of more than 1.8 points from the overall index.

Source: VietstockFinance

|

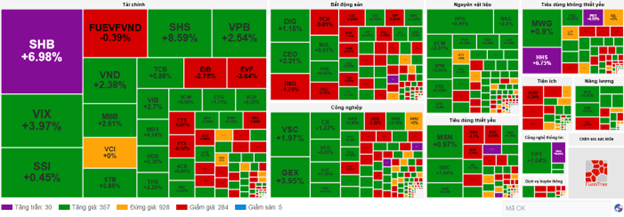

The financial group continued to attract attention as most stocks in this sector reversed their losses. Notable gainers included VIX (+4.18%), SSI (+0.45%), SHS (+8.59%), VND (+3.09%), SHB (+6.98%), VCI (+0.24%), and MBB (+2.61%)…

The industrial sector also recorded positive performance in leading stocks. Specifically, VSC rose by 1.97%, followed by CII, GEX, and VCG, which increased by 1.22%, 3.95%, and 1.01%, respectively.

In contrast, the real estate group witnessed a sea of red, with strong selling pressure and pronounced stock divergence. Specifically, selling pressure was concentrated in VIC, which fell by 0.44%, VHM by 0.98%, VRE by 0.36%, and DXG by 2.05%…

Compared to the opening, buyers returned to support the market. There were 357 advancing stocks and 284 declining stocks.

Source: VietstockFinance

|

Opening: Market shows mixed performance after sharp decline

As of 9:40 am, the VN-Index rose more than 6 points to 1,499.88 points. Similarly, the HNX-Index edged up by 1.92 points to 257.28 points.

Green and red colors were interspersed across all industry groups. Notably, the information technology sector led the market recovery, with gains in some leading stocks such as FPT rising by 0.85%, CMG by 0.88%, and ELC by 0.84%…

Additionally, the financial group also provided decent support to the indices despite some stock divergence. On the buying side, BID rose by 0.8%, CTG by 0.68%, TCB by 0.44%, and VPB by 1.06%… Conversely, some stocks on the selling side included SSB, which fell by 0.25%, EIB by 2.38%, and VCI by 0.6%…

On the other hand, the media and communications services group remained in negative territory. Selling pressure was concentrated in large-cap stocks such as VGI, which fell by 1.98%, FOX by 1.37%, and VNZ by 1.38%…

– 15:20 30/07/2025

Stock Market Insights: Can the Uptrend Persist?

The VN-Index showcases a near-Doji candle pattern, with liquidity maintained above the 20-session average, indicating investor indecision. In the short term, the index is likely to retest the historical peak around the 1,530-point level. However, investors should be cautious of potential volatility at higher price levels, as the Stochastic Oscillator indicator weakens in the overbought territory.

Market Beat: Foreigners Turn Net Buyers, VN-Index Holds Firm at 1,510 Points

The trading session concluded with the VN-Index climbing 2.77 points (+0.18%), reaching 1,512.31. Meanwhile, the HNX-Index witnessed a rise of 1.48 points (+0.6%), ending the day at 249.33. The market breadth tilted towards the bulls, as evident from the advance-decline ratio of 467:296. A similar trend was observed in the VN30 basket, with 17 gainers outpacing 13 losers.

The Market Breakthrough

The VN-Index soared to new heights, surpassing its previous record peak set in early 2022. Impressive liquidity has been sustained, with average volumes over the past 20 weeks reflecting a strong influx of capital into the market. The MACD indicator continues to widen the gap with the Signal line since the buy signal emerged in mid-May 2025, reinforcing the upward momentum in the medium term. However, the Stochastic Oscillator has begun to level off in the overbought region, suggesting a potential for technical corrections at elevated price levels in the coming weeks.

Vietstock Weekly 21-25 July 2025: Marching Towards Historic Highs

The VN-Index rallied for the fifth consecutive week, eyeing the historic peak reached in early 2022 (1,500-1,530 points). Last week’s trading volume hit a record high, indicating vigorous market participation. The MACD indicator continues to widen the gap with the signal line after giving a bullish signal in mid-May 2025, reinforcing the intermediate uptrend. Nonetheless, investors should be cautious of potential short-term fluctuations as the Stochastic Oscillator ventures deeper into overbought territory.

Market Beat July 31st: Holding the 1,500-Point Mark Triumphantly

The VN-Index faced significant challenges during the morning session, with constant struggles and adjustments, suggesting a deep decline at the closing bell. However, a remarkable turnaround took place in the afternoon session, as the market staged a strong recovery, recouping much of the lost ground. The index ultimately closed at 1,502.52, limiting the damage to a modest 5.11-point loss.