Project perspective. Source: MST

|

| Huy Duong Group JSC (HDGR) recently announced its 2024 financial statements with after-tax profit of VND 46 billion, up from VND 36 billion in the previous year. During the year, the company raised VND 900 billion in bonds with an interest rate of 12.5%/year and an additional VND 200 billion in bank loans, thereby increasing total assets from VND 70 billion to over VND 1,300 billion; of which liabilities accounted for VND 1,179 billion. |

The Greenhill Village Quy Nhon Resort was handed over to Greenhill Village Co., Ltd. (Greenhill Village) as the investor in 2019 with an initial registered capital of VND 230 billion. In 2022, the project’s capital was increased to VND 2,596 billion. Also in this year, Ms. Truong My Lan acquired the project but failed. In 2024, after the bank auctioned the bad debt of the investor, the project is being urgently implemented through a huge amount of capital mobilized from bonds.

Accordingly, Huy Duong Group is the issuer of VND 900 billion in bonds to serve the Greenhill Village Quy Nhon project. Meanwhile, MST Joint Stock Company (HNX: MST) is the general contractor and business partner.

It is known that MST owns 18% of the capital in Greenhill Village Joint Stock Company (equivalent to a financial investment value of VND 198 billion) and 19% of HDGR’s capital (VND 28.5 billion).

|

Greenhill Village was established in April 2018 in the form of a Limited Liability Company. Chartered capital is VND 627 billion, contributed by 3 shareholders including Mr. Ta Hung Quoc Viet (Director) contributing 51%, Mr. Ta Tri Hung and Mrs. Nguyen Huynh Hoa each contributing 24.5%. In August 2019, the Company changed to a Joint Stock Company with a charter capital of over VND 720 billion. Of which, Mr. Viet holds 61%, Mr. Hung and Mrs. Hoa each hold 19.5%. By the end of 2020, the capital increased to nearly VND 1,102 billion, the shareholder structure was not announced. In August 2022, the Company changed its name to Greenhill Luxury Resort Joint Stock Company along with a new legal representative, Mr. Nguyen Trung Nghia – General Director. Less than a week later, the Company reverted to its old name – Greenhill Village Joint Stock Company. In mid-2023, MST and Vina2 Investment and Construction Joint Stock Company (HNX: VC2) (MST owns 36.16% of VC2) approved the direction that each side plans to buy 18% of Greenhill Village’s capital. In September 2023, VC2, together with the investor and MST, held a groundbreaking ceremony for the project. However, VC2’s financial statements from the second half of 2023 no longer recognized investment amounts in Greenhill Village. |

Bond money flow

According to a report by Saigon Ratings, published in July 2024, at the Greenhill Village project, HDGR is expected to contribute VND 1,200 billion and will mobilize the entire capital source through bonds guaranteed by a bank.

HDGR’s cash flow in the period of 2024-2028 will depend on the Greenhill Village project, which means that the ability to fulfill financial obligations is associated with the successful investment and efficiency of the project.

Saigon Ratings said that the project has basically completed the legal documents and investment procedures, including the approved investment policy, has been granted a “Certificate of Land Use Right, Ownership of Houses and Other Assets attached to Land” and is exempt from a Construction Permit. However, in the resort real estate segment, the project will be subject to higher market demand fluctuations compared to other real estate segments.

In the first half of this year, MST recorded other payables to HDGR of more than VND 1,172 billion, a significant increase from the figure at the beginning of the year of only VND 360 billion.

In addition, in the first 6 months, MST had an interest expense on investment cooperation contracts of up to VND 53.7 billion, while in the same period last year it was only VND 74 million. This figure is equivalent to the interest on HDGR’s VND 900 billion bond issuance at an interest rate of 12.5%/year. Before the time of HDGR’s issuance, in November 2024, the Board of Directors of MST approved the use of the Company’s assets to secure the bond obligations of HDGR. Thus, it is possible that MST has paid bond interest on behalf of HDGR while the project has not yet had revenue.

According to our information, at the end of June, the People’s Committee of Binh Dinh province approved the adjustment of the detailed planning of the Greenhill Village Quy Nhon tourist resort, Nghenh Rang ward, Quy Nhon city (now Quy Nhon Nam ward, Gia Lai province).

Is MST in need of capital?

In 2024, MST achieved only 75% of its revenue plan and 23% of after-tax profit, reaching VND 1,274 billion and over VND 17 billion, respectively. In 2025, MST set a target of nearly VND 2,119 billion in revenue and over VND 68 billion in after-tax profit. MST expects a large contribution from the Greenhill Village project to bring profits and cash flow to the Company. In the first half of this year, the Company achieved VND 731 billion in revenue and VND 10.6 billion in profit, accounting for 34% and 16% of the full-year targets, respectively.

Approved by the 2025 General Meeting of Shareholders, MST restarted the plan to issue 30 million private placement shares to 9 professional investors at a price of VND 10,000/share. The proceeds of VND 300 billion will be used to repay loans at BIDV – Thai Ha Branch.

|

List of investors buying privately issued shares of MST

|

In addition, the Company will issue more than 7.6 million shares to pay dividends at a rate of 10%, from undistributed profit by the end of 2024 (nearly VND 89 billion). It is estimated that through the two share issuances, MST’s charter capital will increase from VND 760 billion to VND 1,136 billion.

Besides issuing shares, MST also plans to buy assets and borrow capital. The total value of assets purchased is expected not to exceed VND 2,000 billion, and the Company plans to borrow a maximum of VND 1,500 billion from individuals, credit institutions, and financial institutions; authorizing the Board of Directors to implement and decide on all related issues of this policy.

Thus, it can be seen that MST’s capital demand in 2025 is very large, up to VND 1,800 billion.

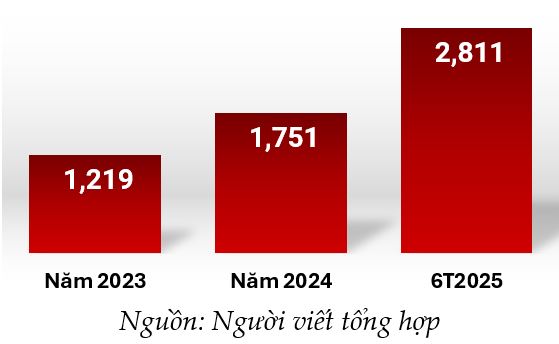

Since 2023, MST’s total assets have continuously increased, especially after the cooperation contract with HDGR at the Greenhill Village Quy Nhon project.

|

MST’s total assets increased continuously from 2023 to the present

(Unit: billion VND)

|

In 2024, the Board of Directors of MST issued resolutions to divest capital from 4 companies, including Urban and Transport Infrastructure Construction Joint Stock Company, PQ Tin Viet Joint Stock Company, Hung Yen Petroleum Joint Stock Company, and to terminate the investment contract of the An Binh Riverside Residential Area project with An Binh Long Xuyen Investment Cooperation Joint Stock Company.

Thu Minh

– 08:12 06/08/2025

The Perfect Title:

“Scoring the Bad Debt Jackpot: Greenhill Village’s Fortunes Reversed”

By successfully bidding for VietinBank Thu Thiem’s asset, which was a debt owed by Greenhill Village JSC, MST Corporation (HNX: MST) now holds the exclusive rights to the land-use rights of the Greenhill Village tourism project in Quy Nhon. This acquisition represents a significant opportunity for MST Corporation to capitalize on the project’s potential and enhance its own portfolio.

A Real Estate Company Floors General Contractor on a Project Once Cornered by Truong My Lan, with a Contract Worth Over VND 2,000 Billion

This company currently holds 18% of the investment capital in the Greenhill Village Quy Nhon project, equivalent to an original value of over VND 198 billion. A significant stake that showcases their commitment to this development and the potential it holds.