Vinacafe Bien Hoa JSC (HoSE: VCF) has recently announced that it no longer meets the requirements of a public company.

According to the list of securities holders compiled by the Vietnam Securities Depository and Settlement Corporation on July 28, 2025, Vinacafe Bien Hoa has a total of 538 shareholders, including one shareholder holding 98.79% of the voting shares, and the remaining 537 shareholders holding 1.21% of the voting shares.

Vinacafe Bien Hoa is no longer considered a public company as it fails to meet the requirement of having “at least 10% of the voting shares held by at least 100 investors who are not major shareholders.”

“Vinacafe Bien Hoa JSC commits to continue fulfilling all obligations related to being a public company until receiving notification from SSC on the termination of its public company status in accordance with current legal regulations,” the company stated.

According to Clause 1, Article 120 of Decree No. 155/2020/ND-CP dated December 31, 2020, of the Government, detailing the implementation of a number of articles of the Securities Law (Decree No. 155/2020/ND-CP), the shares of a public company will be forcibly delisted when the listing organization cancels its public company status following a notification from SSC.

Therefore, it is likely that VCF shares will be delisted from the HoSE once SSC announces the termination of Vinacafe Bien Hoa’s public company status.

Wake-Up 247, a Vinacafe Bien Hoa product

It is known that the shareholder holding 98.79% of VCF’s voting shares is Masan Beverage Private Enterprise, a subsidiary of Masan Consumer Corporation (Masan Consumer, code: MCH).

Vinacafé Bien Hoa, formerly known as Coronel Coffee Factory and later renamed Bien Hoa Coffee Factory, was established in 1969 and equitized in 2004. The company’s main business is the production and processing of Vinacafé-branded products such as ground coffee, instant coffee, milk coffee, and nutritional cereals.

Masan began the process of acquiring VCF in 2010 by purchasing shares from large funds such as VinaCapital, VF1, Vietcombank Fund, and Vietnam Holding, acquiring approximately 20% of its charter capital.

On January 28, 2011, VCF officially traded on the HoSE. In September 2011, Masan, through Masan Consumer, publicly offered to buy 13.32 million VCF shares, equivalent to 50.11% of capital, at a price of VND 80,000 per share, with a total transaction value of over VND 1,069 billion.

For many years, VCF has been known as the stock with the highest market price on the HoSE. In late July 2025, VCF hit a historical peak of VND 326,400 per share.

Closing the session on August 1, VCF decreased by 4.11% to VND 313,000 per share. However, the liquidity of this stock is very low, with an average of just over 1,200 shares traded per session, reflecting the concentrated shareholder structure.

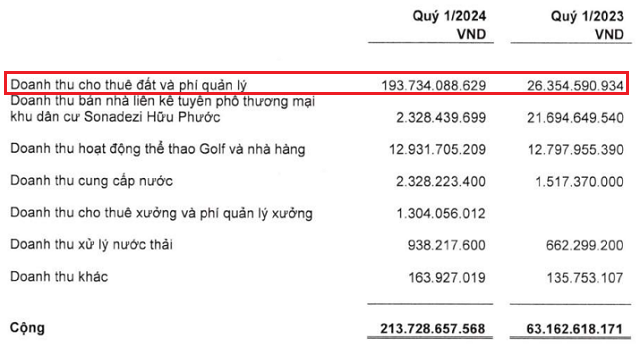

In terms of business results, for the first six months of the year, Vinacafé Bien Hoa recorded VND 1,309 billion in revenue, the highest in six years, and a net profit of over VND 249 billion.

For 2025, VCF set a revenue target of VND 2,700-2,950 billion and a net profit of VND 470-516 billion. Thus, the company has achieved 48% of its revenue target and 53% of its profit target.

The Stock Market Sell-Off: VN-Index Plunges Below 1500, Foreign Investors Dump 1.2 Billion

Market liquidity remained high this morning, with a slight increase in matched transactions on the HoSE, up nearly 3%. However, today’s performance contrasts with yesterday’s morning session. A broad-based decline in stock prices indicates a resurgence of selling pressure, particularly from foreign investors, who offloaded a net amount of VND 1,372 billion, with over VND 1,200 billion on the HoSE alone.

The Business Titan Spends Over VND 2,800 Billion on Novaland’s Subsidiary

Novaland has sold a significant 13.108% stake in its subsidiary, Cong Ty TNHH Dia Oc No Va My Dinh, to Dalat Lan Anh for an impressive VND 2,817.6 billion. This transaction showcases Novaland’s strategic move to strengthen its position in the competitive real estate market.

The Great Unloading: Corporate Leaders Race to Sell Shares, HIG Bids Farewell to the Stock Exchange

“In a recent development, four top executives at Petrosetco have signaled their intent to offload nearly 1 million PET shares between August 6 and September 4, through matching and negotiated transactions. This move comes as Hà Đức Hiếu, a member of the Board of Management at Dat Xanh Group, also registers to sell 6.355 million DXG shares to reduce his equity holdings.”