Impressive Profit Growth for Vietnamese Companies in the First Half of 2025

Figure 1: Top 15 Companies by Profit Growth in the First Half of 2025

The first half of 2025 witnessed impressive profit growth for many Vietnamese enterprises, with some companies achieving profit increases of up to thousands of percent. Leading the pack was the Vietnam Exhibition Fair Center (VEFAC, VEF) with a staggering growth rate of 8,341%, resulting in a pre-tax profit of VND 19,081 billion. This extraordinary performance was attributed to VEF’s recognition of revenue from the transfer of a portion of the Vinhomes Global Gate project, amounting to VND 44,560 billion.

Following closely in second place was the National Commercial Joint Stock Bank (NCB), the only bank on the list, with a growth rate of 6,343%. Aside from VEF, another notable presence in the real estate sector was Saigontel, which achieved a growth rate of 2,026% compared to the very low base of VND 21.84 billion in the first half of 2024.

The electricity industry dominated the list with four representatives, including three hydropower companies: Buon Don Hydropower (1,477%), Huong Son Hydropower (1,092%), and Vinh Son – Song Hinh Hydropower (441%). The remaining electricity company was Dien Gia Lai, which saw a remarkable 400% increase in profits.

The securities sector claimed three spots in the top profit growth rankings for the first half of 2025: LPBank Securities Joint Stock Company (1,807%), VIX Securities Joint Stock Company (480%), and Haiphong Securities Joint Stock Company (Haseco) (452%).

In the wood industry, Truong Thanh stood out with a pre-tax profit of VND 25 billion, reflecting a remarkable growth rate of 3,714% compared to the previous year.

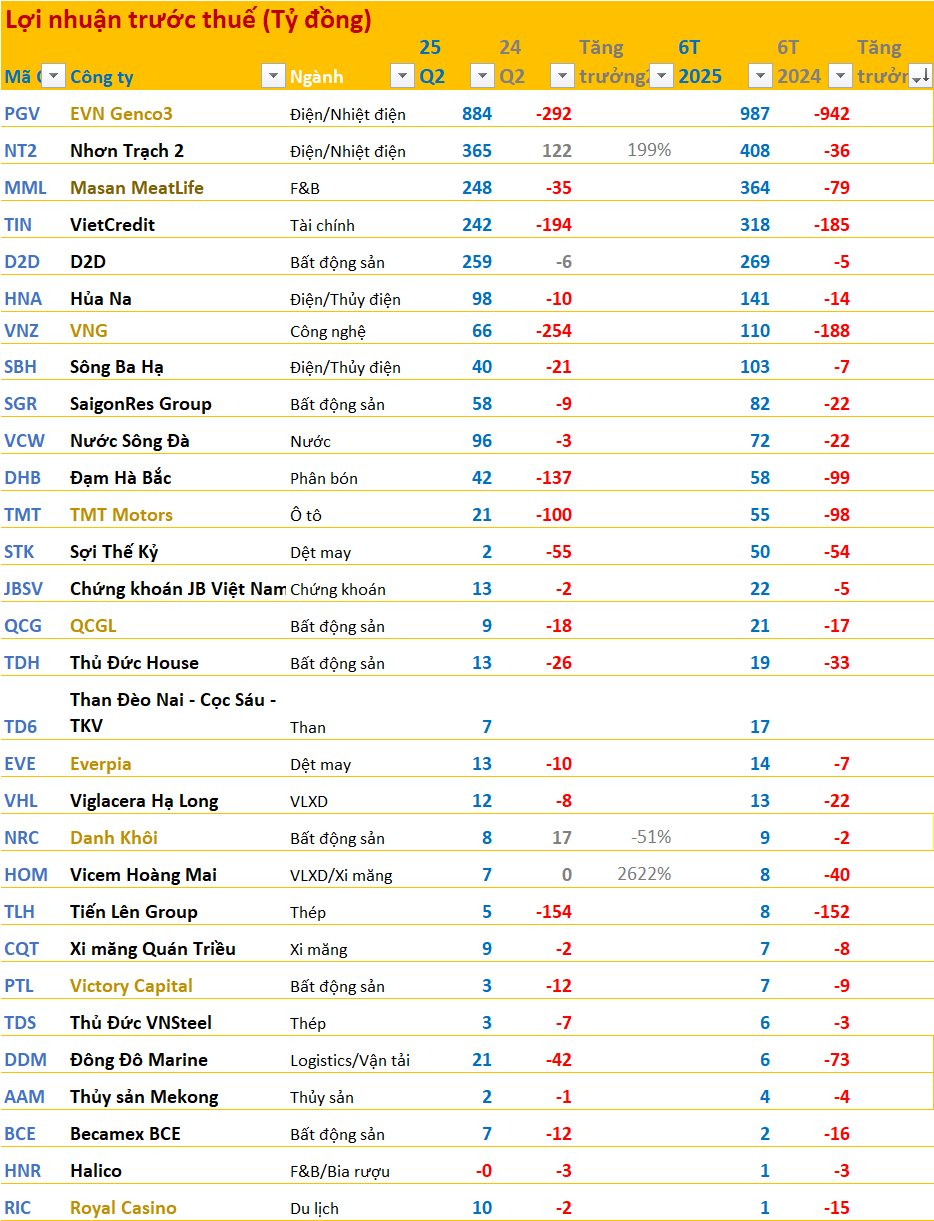

Figure 2: Turnaround in Profitability for Vietnamese Companies

Aside from impressive growth rates, many businesses turned around their performance, transitioning from losses in the first half of 2024 to profits in the first half of 2025. For instance, EVN Genco 3 recorded a remarkable shift from a loss of VND 942 billion in the first half of 2024 to a profit of VND 987 billion in the same period in 2025. Another electricity company, Nhon Trach 2, transformed a loss of VND 36 billion in 2024 into a profit of VND 408 billion.

Masan MeatLife also made a significant turnaround, moving from a loss of VND 79 billion to a profit of VND 364 billion. Additionally, the Industrial Urban Development Joint Stock Company No. 2 (D2D) witnessed a remarkable improvement, turning around a loss of VND 5 billion in the previous year to a profit of VND 269 billion.

The First Vietnamese Bank to Hit the 3-Million-Billion-Dong Mark: A Monumental Achievement

“This bank currently leads the banking system in all three financial indicators: asset scale, customer loan balance, and bank deposits. With an impressive performance, it has solidified its position as a top financial institution, outperforming its competitors and establishing itself as a powerhouse in the industry.”

Sacombank Enters the Top 10 Most Reputable Commercial Banks in Vietnam for 2025

“Sacombank has been recognized as one of the top 10 most reputable commercial banks in Vietnam for 2025 by Vietnam Report and VietNamNet Newspaper. Not only has the bank climbed to the top 5 most reputable private joint-stock commercial banks, but it has also secured a spot in the top 50 public companies for trust and performance (VIX50). This achievement is a testament to Sacombank’s financial prowess, media reputation, and positive feedback from key stakeholders in the financial and banking markets, as evaluated through independent assessment criteria.”

“Top 10 Banks With the Highest Profit in Q2 2025: A New Leader Emerges as VietinBank, Vietcombank, and BIDV Claim Over One-Third of the Banking Sector’s Profit on the Stock Exchange”

As of the morning of July 31st, all 27 banks listed on the stock exchange had released their financial reports for the second quarter of 2025. Impressively, these banks collectively raked in a total profit of 89,341 billion VND in Q2 2025, marking an 18% increase compared to the same period in 2024.

“Profit Slump Despite Strong External Income: What Caused Vietbank’s Q2 Earnings Decline?”

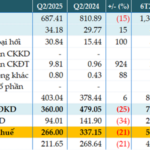

The consolidated financial statements for Q2 2025 reveal that despite a significant surge in non-interest income, Vietnam Thuong Tin Commercial Joint Stock Bank (Vietbank, UPCoM: VBB) witnessed a 21% year-over-year decline in its pre-tax profit, which stood at VND 266 billion.

Profits Soar and Bad Debt Declines: ABBank’s Impressive First Half of the Year

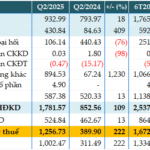

The recently released Q2 2025 consolidated financial statements reveal that An Binh Joint Stock Commercial Bank (ABBank) posted a remarkable performance with a pre-tax profit of VND 1,257 billion, tripling its figure from the previous year. This outstanding result brings the bank’s half-year pre-tax profit to VND 1,672 billion, achieving 92% of its annual target.