Source: Ministry of Construction

|

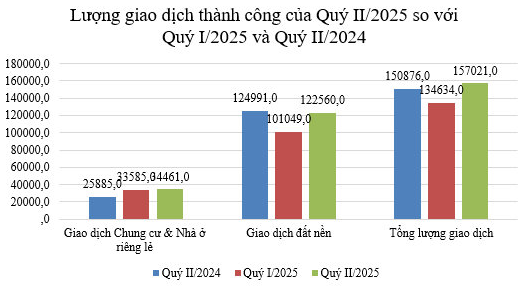

Among the successful transactions, there were 34,461 apartment and detached house sales, 2.3 times higher than the same period last year and twice as much as the previous quarter.

Meanwhile, there were 122,560 land plot transactions, a 98% increase from the same period last year and 2.2 times higher than the previous quarter.

The real estate inventory in the second quarter of 2025 included over 25,294 units/plots (including apartments, detached houses, and land plots): 3,287 apartments, 10,290 detached houses, and 11,717 land plots.

The inventory showed a slight upward trend, with detached houses and land plots doubling and apartments increasing 2.4 times compared to the first quarter.

According to the Ministry of Construction, real estate and housing prices in different localities have generally remained stable, with some project areas experiencing slight increases compared to the beginning of the year.

Specifically, apartment prices in Hanoi and Ho Chi Minh City, as well as other major cities across the country, remained stable in the second quarter compared to the previous one.

However, both cities recorded the highest prices in almost a decade.

In Hanoi, the average selling price in the market during the second quarter of 2025 reached VND 80 million/m2, an increase of 5.6% compared to the previous quarter (up 33% compared to the same period last year).

Meanwhile, the average apartment price in Ho Chi Minh City was VND 89 million/m2, with no significant changes from the previous quarter (up about 36% compared to the same period last year).

Secondary prices also increased significantly, especially in areas with developed infrastructure or completed projects.

The main reasons for this trend include land scarcity, rising input costs, slow legal processes, and high expectations from investors.

Regarding land plots, there was a localized land plot fever in some provinces (such as Bac Ninh, Phu Tho, Ninh Binh, Hung Yen, Hai Phong, and Dong Nai) at the end of the first quarter of 2025.

Land prices in these provinces surged due to information about provincial mergers and the rearrangement of new administrative units.

Most transactions during this time were speculative. In response, local management agencies issued warnings to the public and implemented control measures to regulate the real estate market in these areas.

As a result, land transfer prices have been controlled, with a slight increase of about 3-5% in the second quarter compared to the beginning of the year.

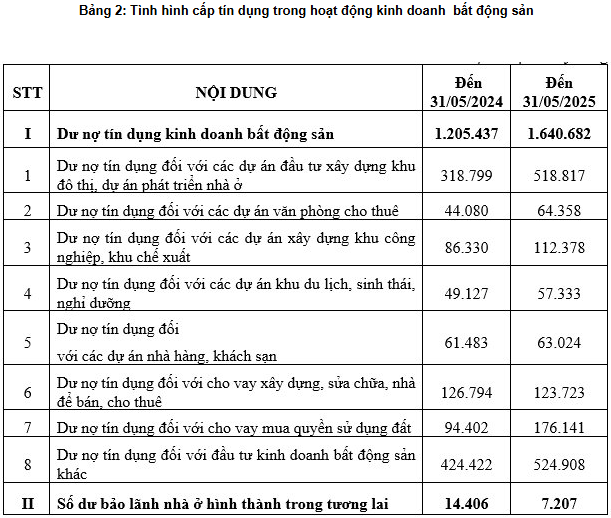

By the end of May 2025, the credit debt in the real estate business sector reached VND 1.64 quadrillion, a 36% increase compared to the previous year, according to the State Bank of Vietnam.

This figure, the highest since 2023, indicates the recovery and expected growth of various economic sectors, including real estate.

Unit: VND trillion. Source: Ministry of Construction

|

The significant increase in real estate credit debt after one year indicates a relaxation of capital flow from banks into this sector and a recovery of confidence from both banks and businesses.

Real estate credit is prioritized for segments that serve social welfare, such as social housing, worker housing, and commercial projects that meet the actual housing needs of the people.

With a targeted credit growth rate of 16% in 2025 (equivalent to about VND 2.5 quadrillion), there is a high likelihood that real estate credit will continue to increase, especially with the support of low-interest rates for home purchases and preferential credit packages for young people.

In the bond market, the Ministry of Construction compiled information showing 65 private bond issuances in the second quarter, with a total value of nearly VND 87 trillion.

Notable real estate companies that issued bonds during the quarter include Vingroup with three issuances totaling VND 6,000 billion, Vietnam Hoang Construction, Investment, and Real Estate Joint Stock Company with one issuance of VND 3,466 billion, AAC Vietnam Joint Stock Company with one issuance of VND 500 billion, Song Phuong Industrial – Real Estate and Construction Co., Ltd. with one issuance of VND 388.5 billion, and Van Phu Real Estate Development Joint Stock Company with a bond lot worth VND 150 billion.

On the other hand, FDI in the real estate sector in the first half of 2025 reached USD 5.17 billion, accounting for 24% of total registered FDI and doubling compared to the same period last year.

The Ministry of Construction considers this a positive signal for the market, especially for the industrial real estate segment, as foreign investors continue to view Vietnam as a market with high development potential.

Ha Le

– 15:15 08/05/2025

“Implementing a 20% Tax on Real Estate Capital Gains: A Recipe for Price Hikes”

The proposed 20% personal income tax on property transfer profits is unlikely to curb rising prices, and experts suggest it could even fuel further price hikes.

The Rise of the Southern Metropolis: Satellite Cities and Infrastructure Take Off

As urban decentralization gains momentum and central land resources deplete, the southern region of Ho Chi Minh City is emerging as a “golden destination” for real estate investors. Benefiting from the infrastructure boost and integrated urban planning, this once-peripheral area is now transforming into a thriving satellite city, offering both residential and investment opportunities ahead of its upcoming breakthrough in the new development cycle.

“Sunshine Group Announces SCG’s Q2 2025 Financial Report”

The second-quarter 2025 financial reports of Sunshine Group Joint Stock Company (HNX: KSF) and SCG Construction Group Joint Stock Company (HNX: SCG) have just been released.

The Grand Residence – An Iconic Landmark in Ho Chi Minh City’s International Waterfront Metropolis

On the evening of July 31, 2025, the luxurious setting of the five-star Benthanh Princess cruise ship at Ben Nha Rong – a historic landmark in Ho Chi Minh City – played host to an event titled “Maison Grand – Power Wave – Power Up.” This event signaled a pivotal moment in the development journey of the Maison Grand commercial apartment complex.