The number of domestic individual investors stood at over 10.4 million as of late July, contributing to the nearly 10.5 million total accounts. This reflects an increase of almost 226,000 accounts compared to the previous month. Meanwhile, institutional investors accounted for 18,500 accounts, a rise of 164.

In terms of foreign investors, individual accounts increased by 179 to surpass 44,100. Organizations, on the other hand, added 9 accounts, bringing their total to nearly 4,700.

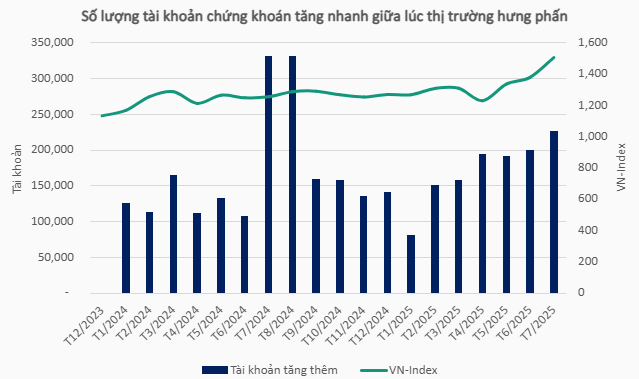

Altogether, more than 226,300 new accounts were added in July, the highest monthly increase in the last 11 months. As of the first seven months of the year, the market has witnessed an addition of nearly 1.2 million accounts.

This surge in account openings comes amidst a robust stock market performance in July, which saw the market reaching new historic highs. Market liquidity also witnessed a substantial increase, with the average trading value on HOSE surging to nearly VND35,000 billion/session, compared to VND20,100 billion/session in June.

Source: VietstockFinance

|

– 19:04 08/05/2025

What Fueled the Banking Stock Boom that Took VN-Index to New Heights?

As of August 5th, bank stocks surged for the second consecutive session, propelling the index to a record high of 1570 points. However, a closer look at the statistics reveals that the group’s profits are lagging compared to the broader market.

Mr. Tran Hoang Son (VPBankS): VN-Index Poised for New Uptrend After Correction

“It is quite normal for the VN-Index to experience a correction after a strong rally, and this pullback is likely a result of short-term profit-taking,” said Tran Hoang Son, Market Strategy Director at VPBank Securities (VPBankS), during the Vietnam and the Indices show on August 4th. He added, “The index is fully capable of entering a new uptrend.”

The Power of Profits: How a 30.2% Rise in Earnings for Over 1000 Businesses is Impacting Stock Performance

The stock market is a vibrant and dynamic arena, where you’ll always find stocks that exhibit a disconnect between their stellar financial performance and their stagnant stock prices. These stocks often fly under the radar, belonging to the mid-cap or small-cap category, unnoticed by most investors.