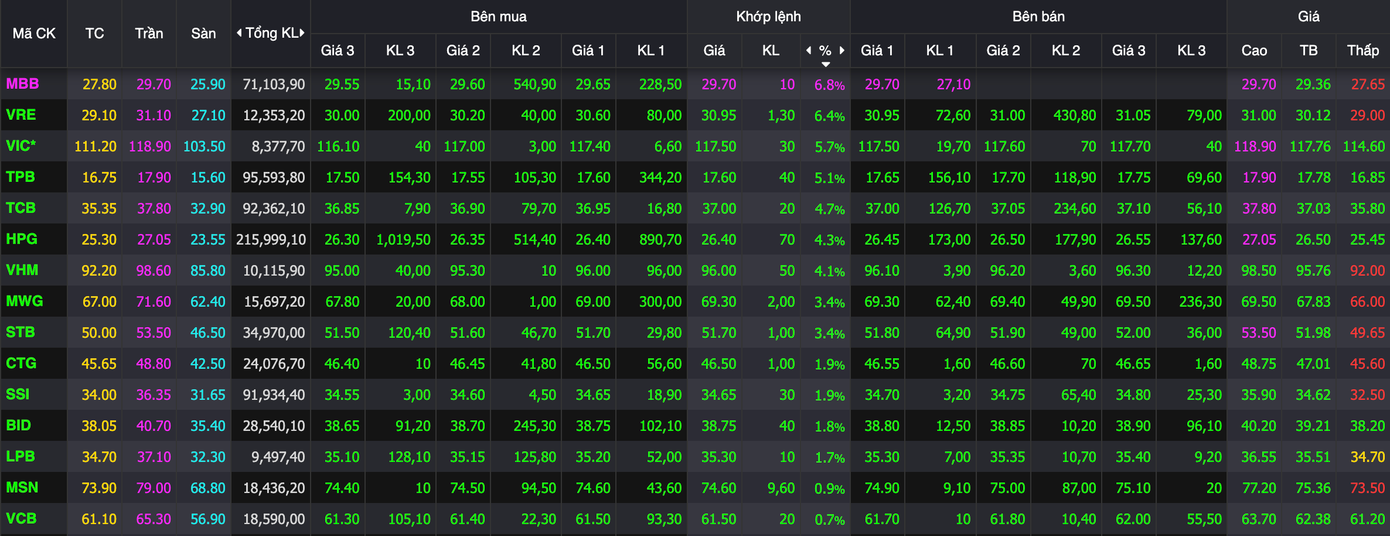

The market momentum continued to be driven by large-cap stocks. A series of stocks that had maintained their ceiling prices, such as MBB, VIC, TPB, TCB, HPG, and STB, experienced a rollercoaster of emotions during the afternoon session, with many failing to hold their ground and only MBB finishing at the ceiling price.

Many stocks hit the ceiling price during the session but later cooled off.

MBB’s rise followed the announcement of its dividend payout. The bank recently notified investors that August 14th is the record date to receive 2024 dividends in shares and cash. The ex-dividend date is August 13th.

MB plans to issue more than 1.95 billion shares as dividends, with a ratio of 32%, meaning that for every 100 common shares held, shareholders will receive 32 new shares. On the same date, the bank will also finalize the cash dividend ratio of 3%, meaning that for each share held, shareholders will receive VND 300; payment is expected on August 21st.

The banking group also witnessed a sea of green, and although they couldn’t maintain their ceiling prices, TCB and STB stood out with gains of 4-5%. Notably, TCB’s liquidity surged to over VND 3,400 billion. Much of the optimism surrounding TCB stems from the news about its “darling” Techcom Securities (TCBS), which announced an expected IPO price of VND 46,800 per share.

Meanwhile, VIC made the most significant contribution to the main index, adding nearly six points. VIC climbed 5.7% to VND 117,500 per share. Vingroup’s stock rose sharply despite foreign investors’ net sell-off of over VND 2,890 billion.

HPG also attracted substantial capital inflows, resulting in the highest liquidity on the exchange, exceeding VND 5,722 billion.

At the close, the VN-Index rose 18.96 points (1.24%) to 1,547.15. The HNX-Index fell 2.22 points (0.83%) to 266.12, while the UPCoM-Index gained 0.34 points (0.32%) to 107.5.

Liquidity surged to more than double the previous session, with the value of shares traded on HoSE reaching nearly VND 74,930 billion. Combined liquidity across the three exchanges exceeded VND 83,000 billion.

Foreign investors net sold VND 1,982 billion, focusing on VIC, SHB, VPB, VHM, FPT, VIX, and VNM.

The Stock Ticker That Demands Attention

The VIC stock was the market leader today, with an impressive performance that saw it contribute over 6 points to the VN-Index’s gain. It closed at its daily limit of VND 111,200 per share. This positive momentum also spilled over to other stocks in the same ecosystem, which witnessed a simultaneous surge in prices, creating a ripple effect of optimism across the market on August 4th.

Technical Analysis for August 5th: An Air of Optimism

The VN-Index and HNX-Index surged in tandem, accompanied by a spike in trading volume during the morning session, indicating a vibrant resurgence in investor activity.

Market Pulse for August 4th: VIC Records Nearly 10,000 Billion VND in Trading Deals

The trading session ended on a positive note, with the VN-Index surging 32.98 points (+2.21%), reaching 1,528.19. The HNX-Index also witnessed a significant boost, climbing 3.41 points (+1.29%) to close at 268.34. The market breadth tilted heavily in favor of advancers, with 498 gainers overwhelming 257 decliners. This bullish sentiment was echoed in the VN30 basket, where 29 stocks advanced, dwarfing the solitary decliner.

Market Pulse for July 21: Foreign Investors Turn Net Buyers, VN-Index Hovers Near 1,500 Points

The market closed with the VN-Index down 12.23 points (-0.82%), settling at 1,485.05. The HNX-Index also witnessed a decline of 1.98 points (-0.8%), ending the day at 245.79. The market breadth inclined towards the bears with 435 declining stocks against 331 advancing stocks. Within the VN30 basket, 17 stocks lost ground, 12 advanced, and 1 remained unchanged, reflecting a similar bearish sentiment.