Following the list of the Top 20 Private Real Estate Companies with the Largest Budget Contributions in Vietnam, CafeF continues to unveil the Top 20 Securities Companies with the highest budget contributions in Vietnam as part of the PRIVATE 100 and VNTAX 200 series. These lists honor businesses that made significant contributions to the state budget based on their actual contributions in the 2024 financial year.

VNTAX 200 comprises all enterprises with budget contributions of VND 200 billion or more in the financial year (including state-owned enterprises, private enterprises, FDI enterprises, and joint ventures). Meanwhile, PRIVATE 100 is exclusively for private enterprises with budget contributions of VND 100 billion or higher.

With a total contribution of hundreds of thousands of billions of dong from leading enterprises, this is the only budget contribution recognition that comprehensively reflects the contributions of enterprises across all economic sectors.

The PRIVATE 100 and VNTAX 200 lists for 2025 – based on 2024 data – include general rankings and rankings by major industry groups such as Banking, Securities, Real Estate, Consumer Goods, and Retail. They will be announced consecutively in August 2025.

As one of the important pillars of the financial market, securities companies are increasingly becoming a significant contributor to the country’s economy in terms of budget contributions.

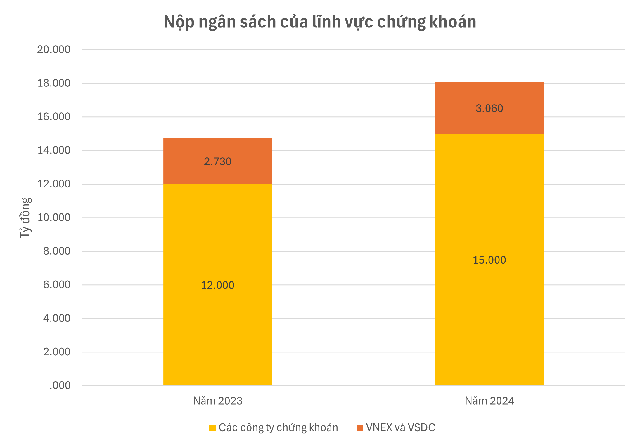

Compiled data from financial reports indicate that the total budget contributions of securities companies in 2024 amounted to approximately VND 15,000 billion, an increase of VND 3,000 billion, or 25%, compared to the previous year.

This demonstrates the efforts of securities companies in fulfilling their legal and social responsibilities and their commitment to the sustainable development of the community. It also affirms the important role of securities companies in contributing to the stability and sustainable development of the economy and society.

With transparency and honesty in budget contributions, securities companies not only build trust with the community and customers but also establish a solid reputation with shareholders. The budget contributions are channeled into the national budget to finance critical areas such as education, healthcare, infrastructure, and national defense, contributing to the country’s economic and social development.

Due to the nature of most securities transactions not incurring VAT, the budget contributions of the securities industry mainly come from corporate income tax and personal income tax (of employees and investors).

The top 10 securities companies in terms of budget contributions have contributed a total of VND 9,800 billion, an increase of VND 2,000 billion compared to the previous year.

The top three companies, all of which contributed over VND 1,000 billion, are as follows: VPS Securities Joint Stock Company leads the way with contributions exceeding VND 2,300 billion (a 30% increase compared to the previous year); followed by SSI and TCBS with contributions of over VND 1,600 billion each. Notably, the budget contributions of these three companies are the highest ever, and their combined contributions account for more than one-third of the entire industry.

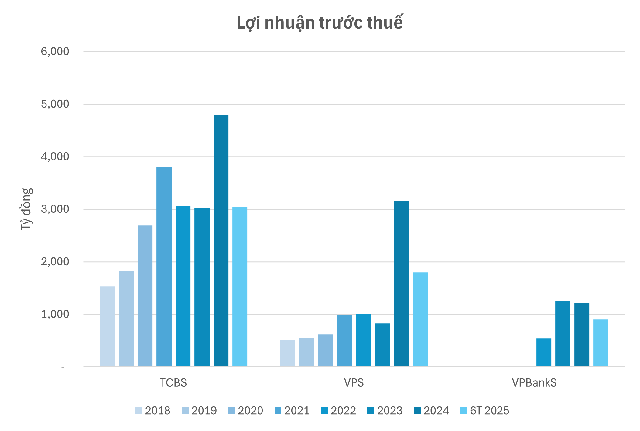

In 2024, VPS maintained its position as the securities company with the largest brokerage market share in the market and recorded a record pre-tax profit of VND 3,157 billion, nearly four times higher than in 2023.

Meanwhile, Techcom Securities (TCBS) retained its top position in the securities industry in terms of profit, with a pre-tax profit of VND 4,800 billion, an increase of nearly 60% over the previous year.

In the first half of 2025, TCBS’s profit increased by 10% to over VND 3,000 billion, while VPS’s profit rose by 38% to VND 1,800 billion. TCBS has just set its IPO price at VND 46,800 per share, corresponding to a pre-IPO company valuation of USD 3.7 billion.

The remaining companies in the list, including VNDirect, HSC, Mirae Asset, Vietcap, MBS, VPBank Securities, and ACBS, contributed between VND 400 billion and VND 900 billion.

Among the top 10 securities companies in terms of budget contributions, eight are private companies, reflecting the dominance of the private sector in the securities industry.

Four securities companies are subsidiaries of banks, namely TCBS, MBS, VPBank Securities, and ACBS.

Among these, VPBank Securities can be considered the youngest newcomer, but it has shown impressive growth since being acquired and restructured by VPBank in 2022.

As of the second quarter of 2025, the company had owners’ equity of nearly VND 18,200 billion and total assets soaring to VND 50,900 billion. Its pre-tax profit for the first six months reached VND 900 billion, an increase of 80% over the same period, ranking it in the Top 5 in the industry.

In addition to securities companies, the contributions of the securities market to the national budget also include significant portions from the Vietnam Stock Exchange – VNEX (the parent company of HoSE and HNX) and the Vietnam Securities Depository – VSDC.

In 2024, VNEX contributed nearly VND 2,600 billion to the state budget, an increase of 12% compared to 2023. VSDC’s contributions also grew by a similar rate to VND 480 billion.

CafeF Lists 2025 marks the return of two prestigious recognition lists:

PRIVATE 100 – Top private enterprises with budget contributions of VND 100 billion or more

VNTAX 200 – Top enterprises with budget contributions of VND 200 billion or more in the financial year

These lists are compiled by CafeF based on publicly available sources or verifiable data, reflecting the actual budget contributions of enterprises, including taxes, fees, and other mandatory payments. By aggregating transparent, accurate, and publicly available data, we not only acknowledge the financial contributions of these enterprises but also promote their social responsibility and affirm their position in the economy.

Some notable enterprises in the 2024 list, reflecting their contributions for the 2023 financial year, include Agribank, ACB, BIM Group, HDBank, LOF, Masan Group, MoMo, OCB, PNJ, DOJI Group, Nam Long Group, TCBS, Techcombank, TPBank, Vingroup, VNG Group, VPBank, and VPS.

The King of Fruits: A Tasty Treat at an Unbelievable Price.

With prices as low as 35,000 VND per kilogram, many roadside durian vendors in Ho Chi Minh City attract customers with the promise of “guaranteed satisfaction and exchange.” However, according to the Vietnam Vegetables and Fruits Association, these durians fail to meet quality standards, and their quality is highly unpredictable.

Steel Yourself: Navigating Growth Amidst Turbulence (HPG – Part 2)

Amid positive signals in the steel market, driven by supportive policies and stable raw material costs, Hoá Phát Group Joint Stock Company (HOSE: HPG) is poised to sustain its growth trajectory. HPG’s scale, capacity, and effective expansion strategies provide a competitive edge. With a reasonable valuation, HPG presents an attractive accumulation opportunity for long-term investors.

VinaCapital: Three Key Sectors to Benefit from Vietnam’s Policy Tailwinds

Vietnam is embarking on an era of Doi Moi 2.0, a rapid transformation from policy statements to tangible outcomes. This is evidenced by the 34 laws passed in June 2025, alongside extensive administrative reforms.