The Bui Thanh Nhon Family to Hold 42% of Shares

On August 5th, Novaland Group (stock code: NVL) announced two proposals to be voted on at the upcoming extraordinary general meeting of shareholders. The first proposal involves the issuance of over 168 million private placement shares to exchange for a total debt value of more than VND 2,645 billion.

Following the approval of the general meeting, Novaland will submit the private placement proposal to the State Securities Commission for their review and approval to carry out the necessary procedures in accordance with the law. The expected timeline for the issuance is between the fourth quarter of 2025 and the first quarter of 2026.

NVL to issue over 168 million private placement shares to exchange for debt.

This issuance aims to restructure Novaland’s debts and improve its financial situation. The company’s chartered capital is expected to reach over VND 21,181 billion after the issuance.

Specifically, the number of shares to be issued for debt exchange is 168,014,696, with an issuance price of over VND 15,746 per share. Thus, a debt value of VND 15,746 will be exchanged for one newly issued ordinary share. The exchange price is determined based on the average closing price of NVL shares on the Ho Chi Minh Stock Exchange (HoSE) over the last 30 trading days, from June 19th to July 30th. The ratio of the number of shares issued to the total number of outstanding shares is over 8.6%.

The identification of the three creditors for the debt exchange, namely NovaGroup, Diamond Properties, and Ms. Hoang Thu Chau, is based on the list of creditors related to Note V.19 – Payables from the sale of pledged shares of guarantors as of December 31, 2024, presented in NVL’s audited separate financial statements for 2024. These creditors have also reached an agreement in principle with Novaland on the debt exchange.

This debt represents amounts payable by Novaland to parties who had pledged their shares for secured loans to enable the company to meet its payment obligations. During Novaland’s most challenging period, these shareholders committed to supporting the company by ensuring its ability to repay maturing debts and maintain continuous operations.

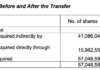

As of December 31, 2024, the debt balances of NovaGroup, Diamond Properties, and Ms. Hoang Thu Chau were approximately VND 2,527 billion, nearly VND 112 billion, and nearly VND 7 billion, respectively. Accordingly, the number of shares expected to be exchanged by Novaland for these debts is approximately 160 million for NovaGroup, nearly 71 million for Diamond Properties, and 424,000 for Ms. Chau. Consequently, the total ownership ratio of the large shareholder group (NovaGroup and Diamond Properties) and the family of Mr. Bui Thanh Nhon, Chairman of the Board of Directors of NVL, is expected to reach 42.4% of the chartered capital.

The privately placed shares for debt exchange will be restricted from transfer for one year from the end of the issuance. After the exchange, the debts will be canceled, and the creditors will become shareholders, holding ordinary shares of the company. For Novaland, the exchanged debts will be accounted for as an increase in equity. The exchanged debts will be canceled, and Novaland will no longer have any obligations regarding these debts.

Additional Borrowing of VND 5,000 Billion

At the upcoming extraordinary general meeting, Novaland will also propose a plan to enter into a convertible loan agreement with a maximum limit of VND 5,000 billion, with a term of five years from the disbursement date and repayment upon maturity.

Mr. Bui Thanh Nhon’s family, Chairman of Novaland’s Board of Directors, will hold 42.4% of the chartered capital.

Regarding the conversion right, the lender has the right to request the conversion of part or all of the principal amount of the loan into ordinary shares of the company. The conversion period is after 12 months from the final disbursement date up to 30 days before the maturity date or early repayment of the loan. The conversion price is determined based on market prices, balancing the interests of all parties.

Accordingly, Novaland will negotiate with the lender to ensure that the conversion price is not lower than the minimum level allowed by the Board of Directors, which is at least 115% multiplied by the closing price of NVL shares on the fifth working day before and including the final disbursement date.

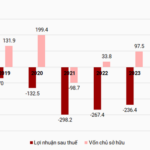

Novaland’s leadership shared that with pressures from various factors, especially the challenging cash flow situation, the company incurred losses of hundreds of billions of dong in the first half of 2025. As a result, Novaland is still unable to fully repay the debts outstanding since 2022.

“The Group is continuously seeking new restructuring plans for these debts to develop solutions from the end of 2026 to the beginning of 2027. With flexible approaches, Novaland is committed to improving its financial position and safeguarding the interests of all stakeholders,” said a Novaland representative.

“NVL Proposes Two Motions: A Loan Agreement and Private Placement for Debt Restructuring.”

NVL has unveiled two pivotal proposals that are set to transform its financial landscape. The first proposal, titled “Convertible Loan Scheme,” outlines a strategic approach to leveraging convertible loans as a mechanism for balancing debt and equity. The second proposal, “Private Placement of Shares for Debt Swap,” presents a thoughtful strategy for issuing new shares to existing debt holders. These proposals showcase NVL’s proactive approach to financial management and its commitment to exploring innovative solutions.

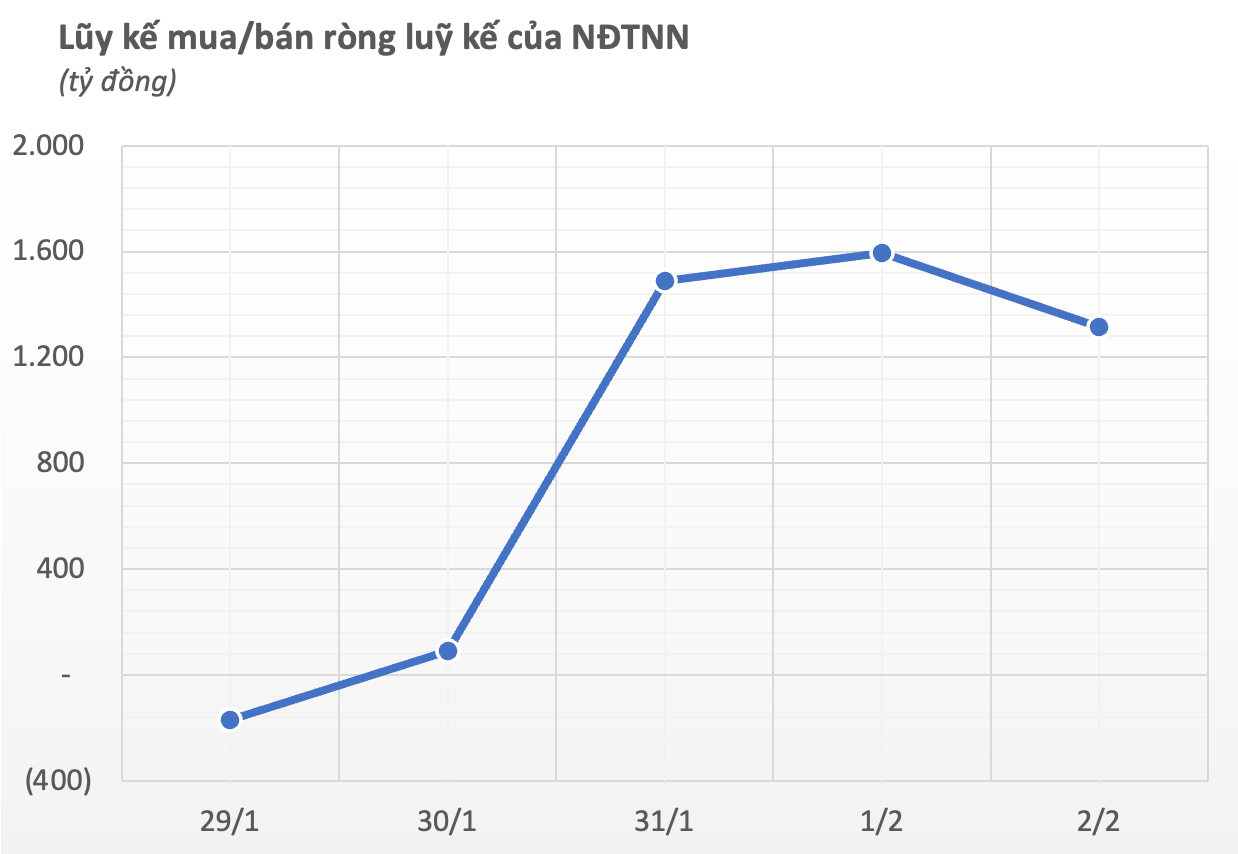

“Foreigners net-sell $10 billion, mostly in matched deals.”

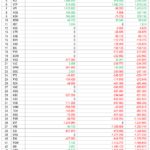

Today, foreign investors net-sold $4.3 million, with gross selling of $43.5 million and gross buying of $39.2 million. On the matching side, they net-sold $11.6 million.

The Sun City’s Fate Post-Novaland

Sun City Real Estate Investment and Development Ltd. has been given the green light to develop a landmark project in An Khanh Ward, Thu Duc City. The project, boasting a staggering investment of over VND 10.5 trillion, encompasses a high-rise complex of residential, commercial, service, and office spaces. This venture stands out as a rare gem among the few projects in Ho Chi Minh City to secure investment approval this year.

What Stocks Will Be Removed From the FTSE ETF and VNM ETF in the Q4 Review?

According to the latest report by SSI Research, the foreign ETF portfolio will undergo significant changes in the Q4 2024 reconstitution. The upcoming adjustments include the addition of promising new stocks and the rebalancing of existing holdings, setting the stage for a strategic shift in the portfolio’s composition.