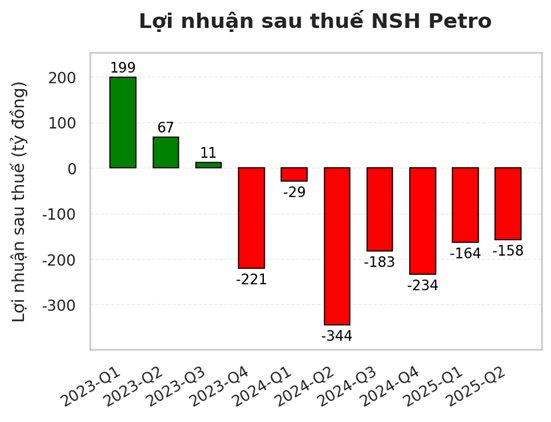

NSH Petro announces a consolidated financial report for Q2 with a post-tax loss of over 322 billion VND in the first half of the year, surpassing Novaland to become the company with the highest loss in the first six months of 2025.

Specifically, in terms of business results, NSH Petro had no revenue in Q2. However, thanks to reduced expenses, particularly a decrease of over 100 billion VND in interest expenses, the company reported a post-tax loss of more than 158 billion VND, an improvement compared to the same period last year’s loss of over 344 billion VND. This marks the seventh consecutive quarter of losses for NSH Petro.

For the first six months of the year, NSH Petro recorded a meager revenue of just over 15 billion VND, a staggering 97% decrease compared to the previous year. Despite a reduction in cost of goods sold, the company incurred a gross loss of nearly 4.7 billion VND, whereas, in the same period last year, the gross loss was nearly 51.4 billion VND. The company’s post-tax loss for the period amounted to over 322 billion VND, an improvement from a loss of nearly 374 billion VND in the previous year. As of June 30, 2025, NSH Petro’s accumulated loss stood at nearly 831 billion VND.

As of the end of Q2, NSH Petro’s total assets amounted to 10,565 billion VND, with inventory accounting for the lion’s share at 4,680 billion VND.

The company’s total liabilities exceeded 10,085 billion VND, including a total loan liability of 6,941 billion VND.

NSH Petro is recognized as one of the largest distributors of gasoline and oil in the Mekong Delta region of southwestern Vietnam. The company was established on February 14, 2012, and is headquartered in Hau Giang province, with Mr. Mai Van Huy serving as the Chairman of the Board of Directors. According to their website, the company currently operates 67 retail outlets and has a network of 550 agents across the Mekong Delta region. Additionally, they manage a system of 9 warehouses and ports with a total capacity of over 500,000 cubic meters.

In mid-2024, the SSC made a decision to impose penalties on individuals, including Mr. Mai Huu Phuc, Ms. Vo Nhu Thao, Ms. Do Thuy Tien, and Mr. Tran Minh Hoang, for manipulating the stock market with PSH stock codes. Notably, Mr. Mai Huu Phuc (born in 1988) is the son of Mr. Mai Van Huy, the Chairman of PSH. Mr. Phuc previously served as PSH’s Vice President but was dismissed from his position on May 24, 2024.

Prior to this, more than 126 million PSH shares were delisted from HoSE as of June 25, 2025, and from July 9, 2025, PSH shares began trading on the Upcom. In the market, PSH is currently priced at 1,700 VND per share, and there have been no recent transactions.

“Sunshine Group Announces SCG’s Q2 2025 Financial Report”

The second-quarter 2025 financial reports of Sunshine Group Joint Stock Company (HNX: KSF) and SCG Construction Group Joint Stock Company (HNX: SCG) have just been released.

Profitable Venture: Producer’s Triumph as Hit Show “Brother Overcomes Adversity” Triples Profits

As of the first half of 2025, Yeah1 has achieved remarkable financial growth with a staggering net revenue of over VND 673.5 billion, reflecting a 2.4x surge compared to the same period in 2024. Impressively, their net profit after corporate income tax reached nearly VND 56.6 billion, marking a 2.6x increase year-over-year.

“Missing Revenue Targets, Kinh Bac Reports 46% Surge in Q2 2025 Net Profit”

In Q2 of 2025, Kinh Bac’s net revenue decreased by 35.1% compared to the same period last year, falling to VND 578.7 billion. However, due to effective cost management, the company reported a remarkable 46.4% increase in net profit, amounting to over VND 399 billion.