The Vietnamese stock market just experienced a volatile trading session with unprecedented fluctuations. The benchmark VN-Index reached a historic high of 1,584.98 points, surging nearly 57 points at one point early in the afternoon session. However, selling pressure at higher prices after 2 pm caused a sharp decline in a series of large-cap stocks, pushing the VN-Index into negative territory, falling more than 9 points.

Nonetheless, bottom-fishing activities were quickly activated, and just before the ATC session, the index recovered and turned positive again. At the market close, VN-Index gained 18.96 points to close at 1,547.15 points.

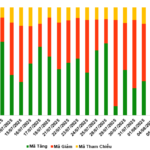

Market trading became extremely vibrant, with liquidity exploding as more than 2.77 billion shares changed hands on HoSE, equivalent to approximately VND 75,000 billion, setting a new liquidity record. Across all three exchanges, total trading value reached VND 82,500 billion, with matched orders reaching nearly VND 77,000 billion (~USD 3 billion).

Investors were taken by surprise by the market’s “rollercoaster-like” performance. The trading session offered an unforgettable emotional journey for many stock investors, from anxiety and confusion to amazement and excitement as the VN-Index plunged and then dramatically rebounded.

In terms of stock groups, 19 constituents of the VN30 basket recorded solid gains during today’s volatile session. Notably, MBB soared to its daily limit of 6.8% to a historic high. VRE climbed 6.4% to 30,950 VND per share, while VIC also rose 5.7% to 117,500 VND per share.

Aside from MBB, several bank stocks ended the session in positive territory, including TPB, TCB, STB, CTG, BID, and LPB…

The steel industry giant, HPG, unexpectedly rose 4.3% to 26,400 VND per share, briefly touching its daily limit during the session. Notably, trading liquidity at this stock set a new record with nearly 216 million units changing hands, equivalent to a value of over VND 5,700 billion.

Some securities stocks performed well, including SSI, VND, VCI, and VDS, while others witnessed adjustments, such as VIX, SHS, PSI, and APS,…

The retail group was relatively mixed, with MWG and MSN maintaining their gains. MWG climbed 3.4% to 69,300 VND per share, while MSN rose 0.9% to 74,600 VND per share. In contrast, FRT and DGW fell over 2%, while PET, after a sharp surge earlier, plunged to its daily limit, closing at 33,800 VND per share.

Foreign trading during this “rollercoaster” session was also quite tug-of-war. Overall, foreign investors net sold VND 2,259 billion on all exchanges. However, excluding the net sell of nearly VND 2,900 billion in matched orders at Vingroup – VIC, foreign investors still net bought approximately VND 600 billion.

The focus of buying activity today was on HPG, with a net buy value of nearly VND 1,100 billion. Foreign capital also net bought MWG, VCB, BID, MSN, and VRE… In contrast, SHB, VPB, VHM, and FPT faced net selling pressure from foreign investors.

Two Scenarios for VN-Index in August: A Bullish Outlook

As we move into August, VFS anticipates that several positive factors will continue to support the market.

The Youngest Chairman on the Vietnamese Stock Exchange: A Tale of Success and Ambition

Introducing the youngest chairman on the Vietnamese stock exchange. While wealth is not the sole measure of success, this individual’s achievements are undoubtedly impressive. With a sharp mind and a knack for leadership, they have risen through the ranks to become a prominent figure in the financial world. Their story serves as an inspiration to all, proving that age is just a number when it comes to pursuing your dreams.

The Stock Market Boom: Vietnam’s Liquidity Breaks Records, Surpassing 80 Trillion VND in a Week

As of the market close on August 5th, 2025, the total trading value across all three exchanges (HOSE, HNX, and UPCoM) reached a staggering 85.8 trillion VND, shattering the previous record of 80 trillion VND set just one week prior.