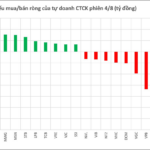

The VN-Index continued to accelerate and reached a near 57-point high compared to the reference mark during the August 5 session. However, after many stocks hit new highs and recorded strong gains, unexpected profit-taking pressure across the board caused the benchmark to fluctuate.

Nonetheless, a surge of cash flow into the market helped the VN-Index rebound, closing the August 5 session at 1,547.15 points, a gain of nearly 19 points. The matching value on the HoSE floor reached VND 69,600 billion, the highest ever.

Sharing his thoughts on the movement of the VN-Index, Mr. Nguyen Duc Khang, Head of Analysis at Pinetree Securities Joint Stock Company , said that the market is very vibrant, which is clearly reflected in the high point scores (continuously setting new historical peaks) and record liquidity.

The VN30 performed better than the VN-Index, indicating that cash flow is focusing more on large-cap stocks. In the rally that has lasted since the end of June, the VN-Index has not experienced any significant corrections.

Cash flow always comes back and quickly helps the VN-Index recover what was lost earlier. Hot money remains in the market even after the July 29 session, when the VN-Index fell more than 4% in one day; hot stocks still maintained their momentum during and after that session, including names like SHB, SHS, GEX, VIX, and VSC. In addition to hot stocks, large-cap stocks also performed well in this session (TCB, HPG, MBB…).

With cash flow moving into stocks that are considered “heavy” in the market due to their high circulation volume (HPG, MBB), the market’s “heat” is quite high, and cash flow participation is robust.

In the medium term, Mr. Khang believes that the market still has a lot of potential and momentum for growth.

On the other hand, while many market opinions mention numbers like 1,800 or even 2,500 points, the Pinetree expert believes that it is difficult to determine the exact numbers. “As investors participating in the market, we should focus on interpreting market signals and continuously adjust our interpretations rather than guessing a peak number,” Mr. Khang pointed out.

Even in the afternoon session of August 5, FOMO was quite prevalent, leading to a hot market and strong fluctuations. This peak region with high liquidity will be an area of contention between buyers and sellers.

According to the expert’s forecast, the closer it gets to the weekend, the greater the risk of market fluctuations will be, with the nearest support region at 1,484-1,500, which is also the bottom region of the July-end decline. Mr. Khang assessed: “The market is in a rally that has lasted for more than a month, and a correction is necessary to create accumulation and a foundation to conquer new peaks.”

Investors should be cautious to avoid “market fever”

Regarding the investment strategy at this time, the expert suggested that investors should avoid FOMO – chasing when the market rises. In August, although the index may increase, choosing the wrong stocks can cause an account to not only fail to increase but also decrease.

Cash flow is very hot, but it is focusing on a few stocks and industries. It is risky to be impatient, selling stocks that have not yet increased to chase after stocks that are rising quickly.

Some stocks that have risen sharply are now in the overbought zone and do not have much potential; on the contrary, new purchases at this time will potentially involve high risks of stock price adjustments. It is normal for stocks that have risen sharply by 50-70% or even doubled to correct by 5-10% from their peak.

At this peak of the market, after a month-long rally, the expert recommends a strategy of focusing on disbursement at support points, the lower boundary of the VN-Index, instead of opening purchase points at peak-breaking/breakout sessions like the morning session of August 5.

It is also worth noting that determining the market peak is very difficult. In addition, for investors with profitable positions, profit-holding skills are also very important in this phase. “We can hold stocks to see how far the market can take profits, but always remember to tighten the profit-holding mark of stocks to avoid sudden market downturns that take away all previous gains,” the Pinetree expert advised.

Two Scenarios for VN-Index in August: A Bullish Outlook

As we move into August, VFS anticipates that several positive factors will continue to support the market.

The Stock Market is Smashing Records: Investors Rush to Open New Accounts

As of July 2025, Vietnam’s stock market witnessed a significant surge in trading accounts, according to the Vietnam Securities Depository and Clearing Corporation (VSDC). With almost 10.5 million accounts, the market experienced a substantial increase of 226.3 thousand accounts since June and an impressive year-to-date growth of nearly 1.2 million accounts.