I. MARKET DEVELOPMENT OF WARRANTS

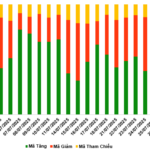

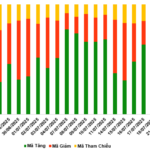

As of the trading session ending July 29, 2025, the market witnessed 21 advancing codes, 196 declining codes, and 29 reference codes.

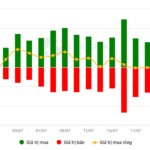

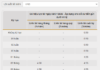

Market breadth over the last 20 sessions. Unit: Percentage

Source: VietstockFinance

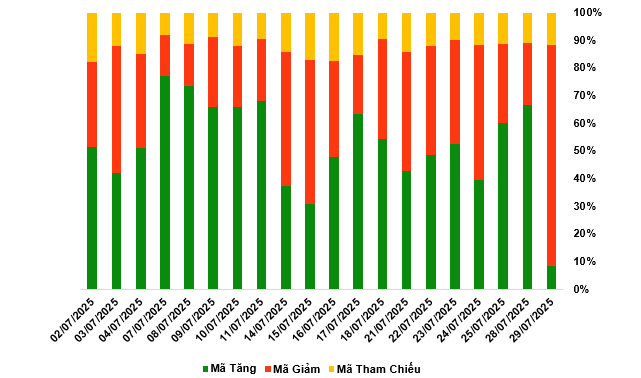

During the trading session on July 29, 2025, sellers dominated the market, causing most of the warrant codes to decline in price. Specifically, the large declining codes in the group were CVHM2502, CVPB2513, CVIC2509, and CTCB2507.

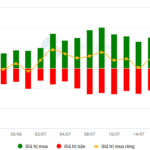

Source: VietstockFinance

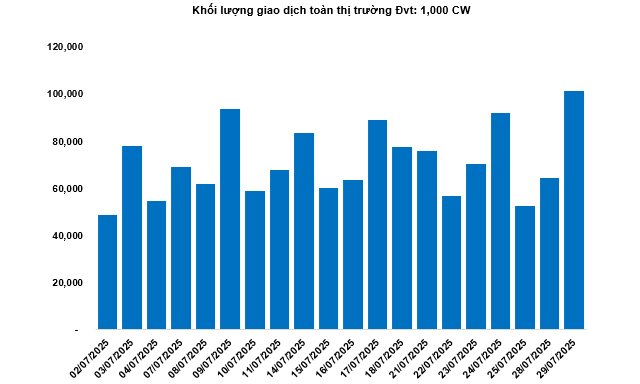

The total market trading volume in the session of July 29 reached 101.45 million CWs, up 56.81%; the trading value reached VND 197.61 billion, up 54.29% compared to the session of July 28. Of which, CHPG2406 was the code leading the market in terms of volume and value, with a total volume of 7.39 million CWs, equivalent to a value of VND 8.75 billion.

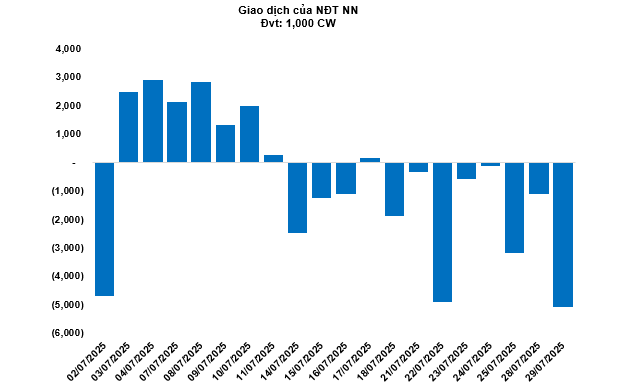

Foreigners continued to sell a net in the session of July 29, with a total net selling volume of 5.09 million CWs. In particular, CMSN2506 and CSSB2503 were the two codes that were net sold the most.

Securities companies SSI, ACBS, HCM, KIS, and VPBank are currently the organizations with the most warrant codes in the market.

Source: VietstockFinance

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

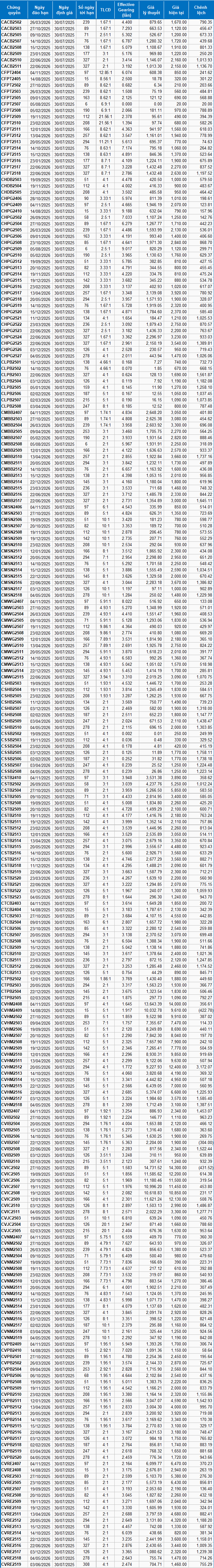

Based on the valuation method suitable for the initial period of July 30, 2025, the reasonable prices of the warrants currently traded in the market are presented as follows:

Source: VietstockFinance

Note: The opportunity cost in the valuation model is adjusted to suit the Vietnamese market. Specifically, the risk-free bill interest rate (government bills) will be replaced by the average deposit interest rate of large banks with term adjustments suitable for each type of warrant.

According to the above valuation, CVIC2502 and CVHM2409 are currently the two warrant codes with the most attractive valuations.

The higher the effective gearing ratio of the warrant codes, the greater the increase/decrease in accordance with the underlying securities. Currently, CHPG2410 and CHPG2509 are the two warrant codes with the highest effective gearing ratios in the market.

Economic Analysis and Market Strategy Department, Vietstock Consulting Department

– 18:58 29/07/2025

Stock Market Insights: Can the Uptrend Persist?

The VN-Index showcases a near-Doji candle pattern, with liquidity maintained above the 20-session average, indicating investor indecision. In the short term, the index is likely to retest the historical peak around the 1,530-point level. However, investors should be cautious of potential volatility at higher price levels, as the Stochastic Oscillator indicator weakens in the overbought territory.

Stock Market Insights: Has the Tide Turned?

The VN-Index retreated, forming a Bearish Engulfing candlestick pattern as it encountered resistance at the psychological level of 1,500 points. This retreat indicates significant profit-taking pressure. Additionally, the Stochastic Oscillator has provided a sell signal within the overbought territory. Investors should exercise caution in the near term as a fall below this level could trigger increased short-term corrective pressure.

The Warrant Market on July 29, 2025: An Enduring Sense of Optimism

The trading session ending July 28, 2025, witnessed a mixed performance across the market. With 164 advancing stocks, 55 decliners, and 27 unchanged, it was a vibrant day. Foreign investors continued their selling spree, offloading a net total of 1.1 million CW.