After consecutive gains, Vietnam’s stock market witnessed a slight dip. However, optimistic signals persisted as the VN-Index hovered around the 1,500-point mark.

During the trading session on the morning of August 4, 2025, just 15 minutes after the market opened, the VN-Index surged to 1,508 points and swiftly climbed to its intraday high, propelled by substantial investment inflows into large-cap stocks.

In this context, the wealth of the stock market’s “big players” has become a topic of interest. One notable name on this list is Nguyen Duc Anh (born in 1995), Chairman of the Board of Directors of DSC Securities.

Chairman at 26, Amassing a Fortune of Over VND 2,516 Billion by 30

In January 2021, at the young age of 26, Nguyen Duc Anh was appointed Chairman of the Board of Directors of DSC Securities (code: DSC), following the completion of his Master’s degree in Economics at UMASS Boston University.

It is known that Nguyen Duc Anh is the son of Mr. Nguyen Quoc Hoan, Chairman of Thanh An Group, and the nephew of Mr. Nguyen Anh Tuan, Chairman of Thanh Cong Group (TC Group). TC Group is a prominent enterprise in Vietnam’s automotive industry and has diverse business interests in services, finance, and banking.

Nguyen Duc Anh became Chairman of the Board of Directors of DSC Securities at the age of 26

Chairman Nguyen Duc Anh currently holds nearly 73 million DSC shares, representing a 35.64% ownership stake. Additionally, he serves as Chairman and CEO of NTP Investment Joint Stock Company, holding 70 million DSC shares, equivalent to a 34.17% ownership stake.

Thus, considering his direct and indirect holdings, Chairman Nguyen Duc Anh possesses approximately 143 million DSC shares. As of the closing price of VND 17,600 per share on August 4, 2025, Nguyen Duc Anh’s fortune stands at over VND 2,516 billion.

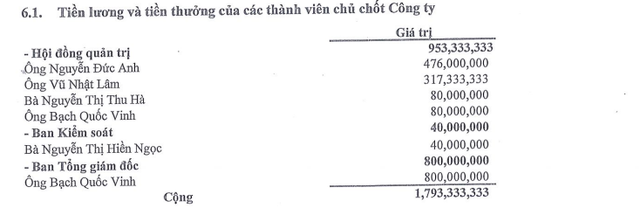

Chairman’s Quarterly Salary and Bonus: VND 476 Million

In mid-April 2025, DSC Securities Joint Stock Company (code: DSC) published its first-quarter 2025 financial report, revealing a 2% year-on-year decline in operating revenue to VND 131 billion. Operating expenses for the period decreased by 29% to VND 25 billion. Consequently, DSC posted a post-tax profit of VND 54 billion, representing a 9% decrease compared to the previous year.

As of March 31, 2025, DSC’s total assets amounted to VND 5,352 billion, reflecting a 7.6% decrease over the quarter.

Accompanying this financial report was the disclosure of remuneration for key personnel. Notably, Chairman Nguyen Duc Anh’s salary and bonus for the quarter amounted to VND 476 million.

Salary and bonus of key personnel disclosed in DSC’s Q1 2025 financial report (Source: DSC)

DSC Securities (stock code: DSC) was officially listed and traded on the Ho Chi Minh City Stock Exchange (HoSE) on October 24, 2024, according to DSC Securities. Prior to this, DSC was listed on UPCoM.

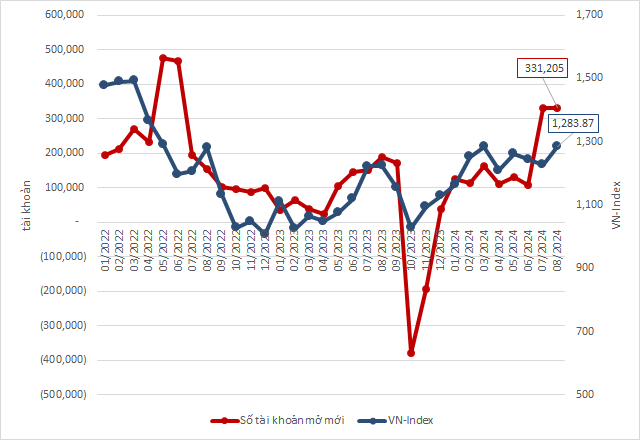

The Stock Market is Smashing Records: Investors Rush to Open New Accounts

As of July 2025, Vietnam’s stock market witnessed a significant surge in trading accounts, according to the Vietnam Securities Depository and Clearing Corporation (VSDC). With almost 10.5 million accounts, the market experienced a substantial increase of 226.3 thousand accounts since June and an impressive year-to-date growth of nearly 1.2 million accounts.

The Stock Market Boom: Vietnam’s Liquidity Breaks Records, Surpassing 80 Trillion VND in a Week

As of the market close on August 5th, 2025, the total trading value across all three exchanges (HOSE, HNX, and UPCoM) reached a staggering 85.8 trillion VND, shattering the previous record of 80 trillion VND set just one week prior.