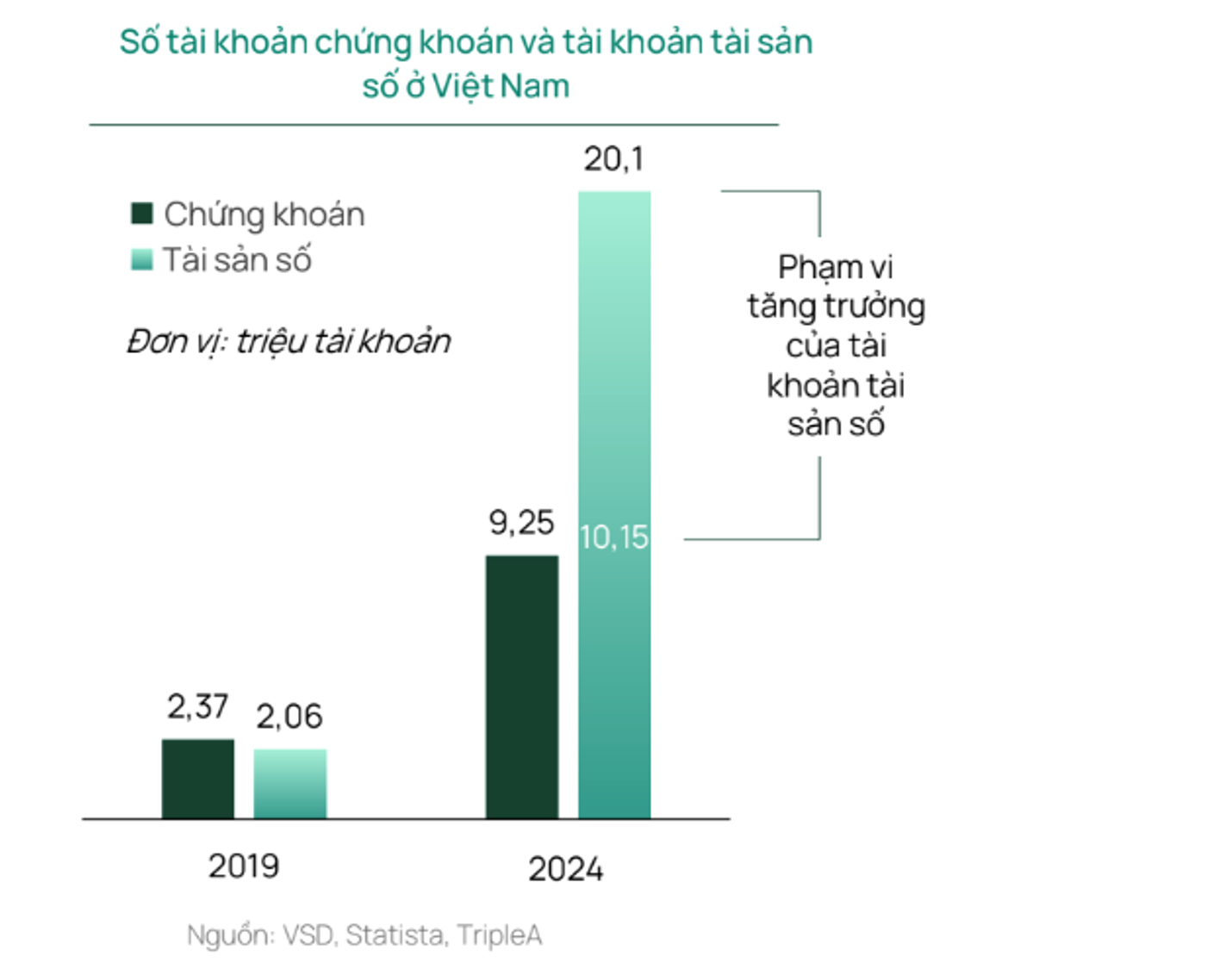

Although the digital asset channel in Vietnam does not yet have a formal market, the number of accounts has far surpassed that of the stock market.

According to statistics, the number of digital asset accounts in Vietnam has grown from 2.06 million in 2019 to over 20 million by the end of 2024. In contrast, the number of stock accounts, as reported by the Vietnam Securities Depository (VSDC), reached over 9 million by the end of 2024 and currently stands at over 10 million after 25 years of establishment.

These impressive figures place Vietnam among the top countries globally in terms of digital asset adoption. They also demonstrate the shift towards digital asset investment among Vietnamese, even though this channel has not been officially recognized in the past years (before the passage of the Digital Technology Industry Law).

Given the high acceptance of digital assets by individual investors in Vietnam, the potential for bringing real-world assets (RWAs) onto the Blockchain through tokenization is immense. This opens up opportunities for individual investors to participate in the regulated capital market.

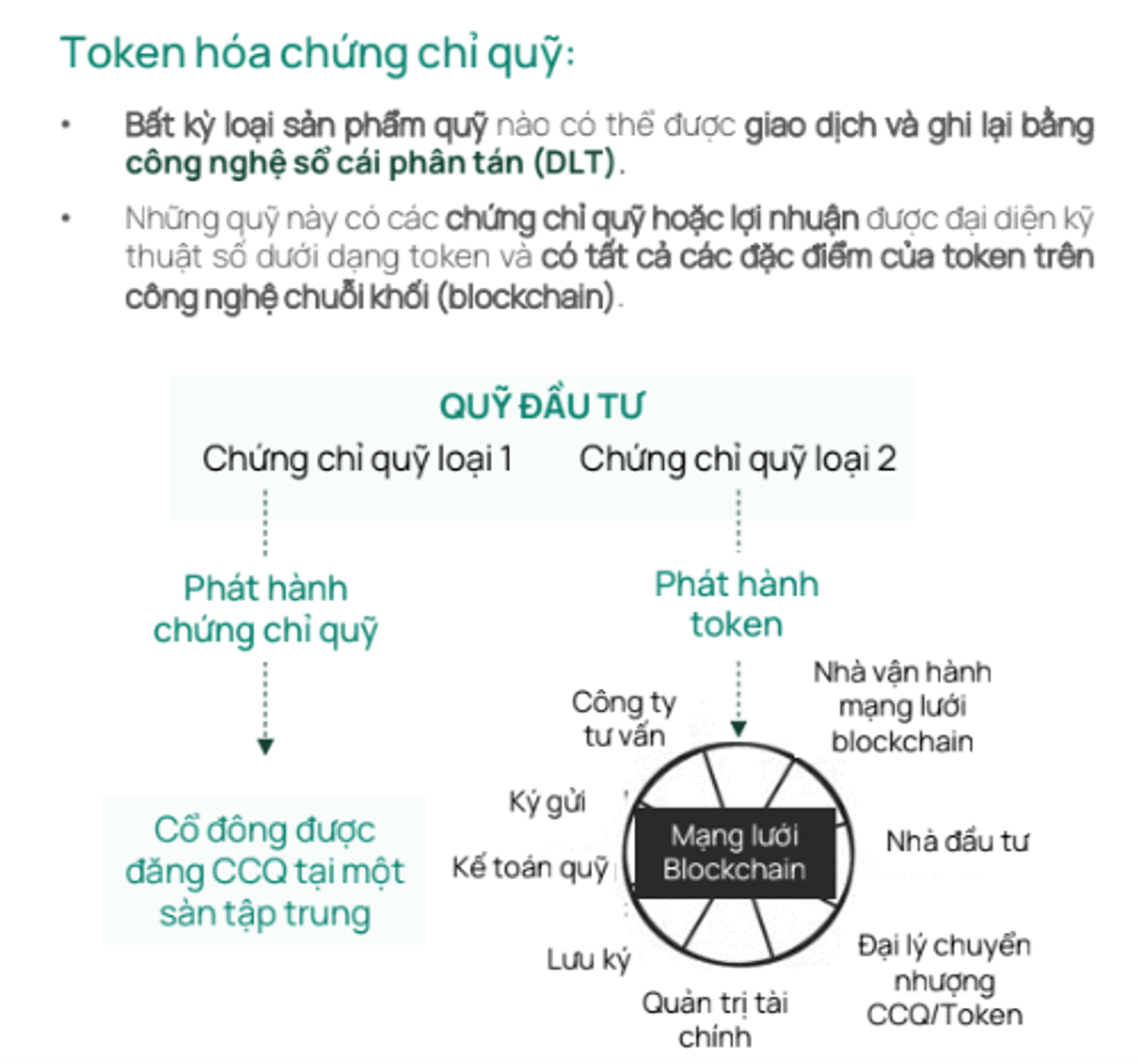

Tokenizing real-world assets means transferring these assets onto a Blockchain, transforming them into a new form of digital asset with a foundation linked to real-world finance. This tokenized asset can combine the accessibility of individual investors with regulated financial products from the traditional financial system, creating a unique blend of innovation and safety.

With the National Assembly’s official adoption of the Digital Technology Industry Law, recognizing the legality of digital assets, Dragon Capital has proposed a pilot project for tokenizing ETFs (Exchange-Traded Funds). ETFs are already familiar to many individual investors, and this approach aims to bridge the gap between traditional investment and digital asset technology, encouraging greater participation from individual investors in the capital market while promoting financial inclusion.

According to Dragon Capital, focusing on tokenizing ETFs—a well-established financial product—can bring several benefits to individual investors in Vietnam:

+ Lower Investment Threshold: Tokenization allows for partial ownership of ETFs, enabling investors to purchase tokens representing a fraction of the fund. This reduces barriers to entry, making investment more accessible with smaller capital.

+ Enhanced Liquidity: Tokenized ETFs can be traded on secondary markets, similar to cryptocurrencies, providing higher liquidity compared to traditional ETFs. This makes it easier for individual investors to enter and exit investment positions.

+ Improved Accessibility: The digital nature of tokenized ETFs simplifies the trading process, especially for those familiar with digital assets, encouraging participation in the investment market.

+ Diversification Opportunities: ETFs are known for offering diverse investment portfolios. Tokenization can further expand these opportunities, allowing individual investors to diversify their portfolios with smaller amounts of capital.

+ Transparency and Security: Blockchain technology ensures transparency and security for transactions. All transactions are recorded on the Blockchain, providing an immutable audit trail.

+ Reduced Costs and Fees: Tokenization can simplify the process of buying and selling ETFs, leading to lower transaction costs and management fees, benefiting individual investors.

+ Real-time Trading: Unlike traditional ETFs, which are traded at the end of the day based on net asset value, tokenized ETFs can be traded in real-time, offering flexibility and immediate response to market fluctuations.

Overall, Dragon Capital believes that tokenized ETFs provide a novel and efficient way for individual investors in Vietnam to participate in the investment market, combining the benefits of traditional ETFs with the innovative features of Blockchain technology.

While tokenized fund products must comply with the regulations of the traditional financial market, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, they still have the potential to reach investors who have never participated in the traditional capital market. The appeal of tokenized funds lies in their ability to bridge the gap between the innovation of digital assets and the legal framework of traditional finance.

With their accessibility and flexibility, these products can attract digitally savvy individuals seeking alternative investment opportunities outside of traditional offerings. This could lead to the participation of a larger and more diverse investor base, contributing to the depth and resilience of the financial market.

Dragon Capital views tokenized funds not as a means to circumvent regulations but as an opportunity for regulators to better protect investors, enforce taxation, and control capital more effectively. By harnessing the potential of Blockchain technology within a legal framework, tokenized funds can enhance transparency, security, and efficiency in financial markets.