Scaling Assets and Quality for Sustainable Growth

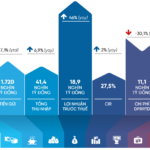

TPBank demonstrates its effective operations with a remarkable pre-tax profit of over VND 4,100 billion, a 12% increase compared to the previous year. Total assets nearly reach the threshold of VND 428,600 billion (equivalent to USD 17 billion), completing 95% of the full-year plan and an over 18% increase compared to the same period. This reflects a harmonious expansion in both scale and quality.

Credit activities yield impressive results, with outstanding loans reaching nearly VND 293,500 billion, equivalent to 93% of the annual plan and a more than 31% increase compared to the previous period. The 11.7% credit growth is directed towards strategic sectors such as retail, real estate, and consumer finance, which offer high-profit margins and stable profitability.

Notably, TPBank maintains excellent capital management efficiency, demonstrated by superior safety ratios: the loan-to-deposit ratio (LDR) stands at 77%, and the capital adequacy ratio (CAR) is above 12%—well above the State Bank of Vietnam’s requirements. The Bank also tightly controls non-performing loans. These indicators reflect a reasonable balance between growth and safety, providing a solid foundation for sustainable development.

Diversifying Income Streams with a Distinctive and Efficient Digital Ecosystem

TPBank continues to assert its pioneering position in digital transformation, achieving impressive capital mobilization of nearly VND 377,500 billion, a 19% increase compared to the previous year. The ratio of non-term deposits (CASA) has also increased to nearly 23%, clearly demonstrating the effectiveness of the digital banking strategy and the growing trust of customers.

According to experts, TPBank stands out in digital banking due to its modern technology platform and efficient reach to young customers, along with a clear brand positioning in the retail segment.

The diversification strategy has yielded positive results, with total operating income in the first half of 2025 surpassing VND 9,100 billion. Notably, service income accounts for 21% of this, amounting to nearly VND 1,900 billion, an impressive increase of more than 14% compared to the same period. This testifies to the strategic direction, helping TPBank reduce its dependence on credit income, enhance resilience, and improve operational efficiency.

Solid Reputation among Top Banks

With its strong competitive capabilities and solid market position, TPBank is honored to be listed in the Top 10 prestigious joint-stock commercial banks in 2025 by Vietnam Report, alongside prominent names such as Techcombank, ACB, HDBank, VPBank, Sacombank, SHB, LPBank, and VIB. This ranking is based on three main criteria: financial capacity, media reputation, and surveys of related parties.

Deputy CEO Khuc Van Hoa receiving the award from VNR500

Vietnam Report also forecasts five significant growth opportunities for the banking industry in the future: promoting the development of digital financial products, enhancing investment in digital transformation, Vietnam’s economic growth prospects, and amendments to relevant laws. These are areas in which TPBank has been investing heavily.

TPB stock currently has an attractive valuation, with a P/B ratio of almost 1 and a more than 35% increase from its April low, attracting strong interest from foreign investors. The Bank also maintains an attractive dividend policy, offering a 10% cash dividend and a 5% stock dividend from undistributed profits.

With outstanding business results, a pioneering digital ecosystem, and recognition from reputable organizations, TPBank solidifies its position as one of the leading private banks in Vietnam regarding efficiency, reputation, and sustainable development potential.

The Banking Giant Slashes Its Physical Presence: Shuttering 66 Branches in an Unprecedented Move

The recent wave of layoffs in the second quarter of 2025 has been a challenging time for many. With a focus on streamlining and cost-cutting measures, organizations across industries have had to part ways with valuable talent. As we move forward, it’s essential to reflect on the impact of these decisions and the potential consequences they may have on the future landscape of various sectors.

The CRM Machine and the Omnichannel Springboard: Santander to SHB’s Journey

In the quest for comprehensive digitalization, it is imperative to transform and seamlessly connect every service touchpoint. Automated transaction machines, or Cash Recycle Machines (CRMs), are pivotal in this journey. CRMs not only empower customers with self-service capabilities but also serve as a vital link in the construction of an omnichannel experience for the bank of the future.

“Techcombank – Revolving Leadership, Optimizing the Power of the Ecosystem”

As of August 1st, 2025, the Techcombank – One Mount – Masterise Group ecosystem underwent a strategic shift with a leadership transition. This move underscores the ecosystem’s commitment to harnessing the synergy of finance and technology, solidifying its pledge to accompany the nation’s digital transformation journey by leveraging the pillar of talent.

“Vietnam’s FDI Appeal Remains Unshaken by Tariff Turbulence”

Although the US administration has tweaked some tax policies amidst escalating trade tensions with China, foreign direct investment (FDI) into Vietnam, particularly in high-tech and ancillary industries, has not witnessed significant changes. Experts attribute this stability to Vietnam’s enduring competitive edge in the global supply chain, which transcends the transient effects of international tax policies.

“Financial Institutions Embrace the Digital Asset Revolution”

The legalization of digital assets marks a pivotal moment in Vietnam’s legal history. As the regulatory framework evolves, investment appetite from financial institutions is already evident, with many proactively laying the groundwork and poised to enter the market when the proverbial green light shines.