ASEAN Securities’ (ASEANSC) latest report assesses that in the context of global trade being affected by US President D.Trump’s tariff policies, Vietnam’s internal growth drivers will remain a priority, including public investment disbursement.

Public investment disbursement is an important catalyst for economic growth

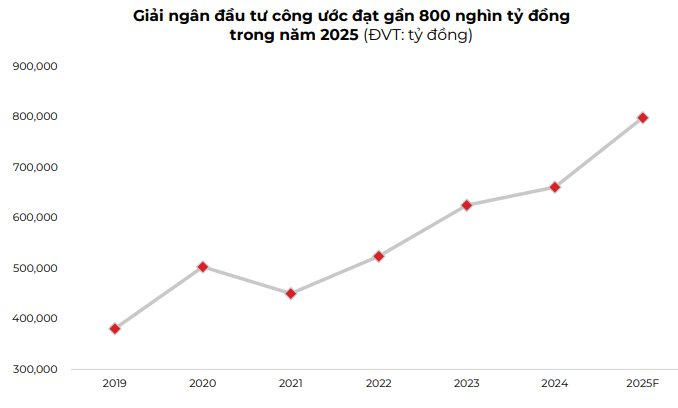

Cumulative public investment disbursement in the first six months of 2025 reached over VND 291,000 billion, up 19.5% year-on-year. This impressive growth rate compared to 6T2024 (+5.8% YoY) comes amid monetary loosening to support economic growth and achieve targets.

However, the completion rate was only 31.7%, maintaining a downward trend in recent years.

ASEANSC Research expects the disbursement pace in the second half to increase compared to the first half of 2025 as the reorganization of administrative units has been completed and stabilized. Public investment disbursement is expected to reach about VND 800,000 billion this year, up 21% from 2024, while achieving 87% of the plan.

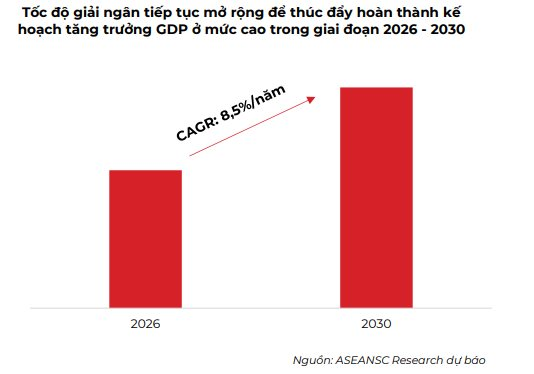

With expectations for continued GDP growth and potentially reaching double digits in the 2026 – 2030 period, analysts believe that public investment will remain an important catalyst for economic growth.

It is estimated that public investment disbursement could achieve a CAGR of 8.5%/year in the 2026-2030 period, with the disbursement pace possibly accelerating in the 2029 – 2030 period to reach 11% YoY (excluding inflation).

Which stocks will benefit?

ASEANSC Research believes that businesses involved in the construction of infrastructure projects (Operation Stage) and the supply of construction materials (Input Stage) will benefit significantly in terms of profit growth prospects. This is due to the increased value of contracts from public investment projects, especially in the accelerated disbursement phase in the second half of 2025 to ensure GDP growth meets plans.

In the field of Infrastructure Construction, the ASEANSC team highly values enterprises with leading positions and long-standing experience in implementing public investment projects, along with their current backlog value. Accordingly, VCG and HHV are the stocks expected to benefit.

For Vinaconex (VCG), ASEANSC Research forecasts a 30% year-on-year increase in core net profit for 2025F, attributed to construction contracts for Long Thanh Airport and the North-South Expressway, as well as real estate transfers for Cho Mo and Green Diamond projects this year.

Additionally, ASEANSC Research predicts a 32% year-on-year increase in net profit for 2025F of Dau Tu Ha Tang Giao Thong Deo Ca (HHV), surpassing the initial plan. The main contributors to this year’s growth are the BOT Toll and Construction and Installation segments. Moreover, the medium and long-term prospects are bolstered by the North-South high-speed railway project.

In the field of Construction Materials, ASEANSC recognizes enterprises with leading market shares that specialize in supplying critical raw materials such as steel, construction stones, and asphalt for key infrastructure projects. Accordingly, HPG, KSB, and PLC are highlighted.

HPG’s net profit for Hoa Phat Group (HPG) is expected to grow positively in 2025, potentially reaching a 32% increase due to improved consumption volume in line with the recovery of the residential real estate market and accelerated public investment disbursement. Regarding product mix, HRC output is projected to witness the most significant growth, benefiting from the contribution of the Dung Quat project, along with the impact of anti-dumping duties on imported HRC from China, leading to improved gross profit margins starting in Q2/2025.

For Khoang San Va Xay Dung Binh Duong (KSB), the ASEANSC team anticipates that KSB’s net profit for 2025F will hit a bottom this year. Specifically, KSB’s net profit is estimated at VND 132 billion, up 150% year-on-year, benefiting from the low base in 2024 and increased consumption of construction materials in infrastructure projects amid accelerated public investment disbursement in the second half of 2025, with significant contributions from quarries like Tan My and Tam Lap 3.

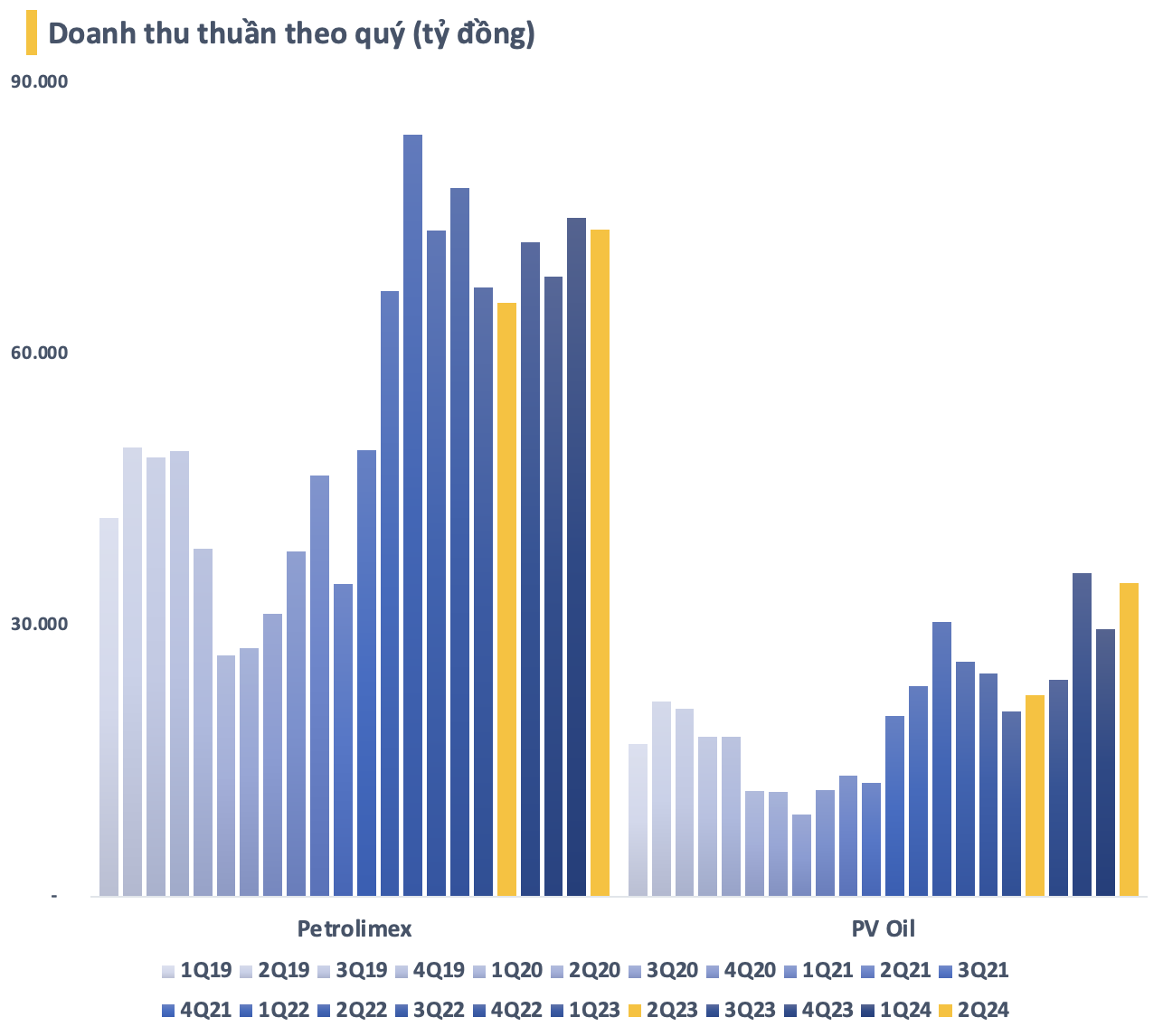

Furthermore, net profit for Tong Cong Ty Hoa Dau Petrolimex (PLC) is also forecast to grow strongly in 2025, expected to double to VND 110 billion compared to the previous year. This growth is driven by segments such as Asphalt, Lubricants, and the recovery of the Chemicals segment from losses incurred last year.

“VN-Index to End 2025 at a Modest 1,550 Points: Experts Highlight Two Attractive Options for Risk-Taking Investors”

For the intrepid investor, there are opportunities to be found in cyclical sectors and markets such as equities that benefit from cash flow, new product launches, and market upgrades. The tech sector is also a key area to consider, with long-term gains to be made from Resolution 57 on innovation, AI, semiconductors, and digital data.

Ninh Binh Province Faces Shortage of Construction Materials, Requiring Tens of Millions of Cubic Meters

The demand for sand as a construction material in Ninh Binh has soared to an astonishing 14.2 million cubic meters, far outpacing the current sand filling capacity, which stands at approximately 3.4 million cubic meters per year.