Vietnam’s stock market witnessed a remarkable recovery in the first two quarters, with a significant increase in liquidity, as the country’s economy continues to grow positively, achieving a growth rate of 7.52%, closely aligning with the set target.

The quartet of resolutions by the Political Bureau, comprising Resolutions 57, 59, 66, and 68, are considered foundational pillars, providing a strong impetus for the country to embark on a new era.

In a recent ‘Phố Tài chính’ talk show, Mr. Nguyễn Việt Cường, Vice Chairman of the Board of Directors of Kafi Securities Joint Stock Company, assessed that in the coming period, the stock market will continue to be supported for growth, but the VN-Index will end the year at the 1,550-point mark.

According to the National Assembly’s initial plan, the GDP growth target for 2025 was set at 7.5%. However, given the strong economic recovery and the evident momentum from reforms, in February 2025, the National Assembly adjusted the GDP growth target for 2025 to 8%.

In the first half of 2025, the GDP growth rate reached 7.52%, the highest growth rate for the first six months during the 2011-2025 period, closely aligning with the National Assembly’s target. Specifically, in the second quarter of 2025, the GDP growth rate reached 7.96%, outperforming other countries in the Asian region. China achieved a growth rate of 5.1%, while Singapore’s growth rate was 4.3%, making Vietnam a standout performer in the region.

Major financial institutions such as UOB and Citigroup have adjusted their GDP forecasts for Vietnam upward by approximately 0.5 percentage points. Based on actual results and effective policies, GDP growth in the last two quarters is expected to reach 7.5-8%, sufficient to achieve the target set by the National Assembly at the beginning of the year.

In the second half of the year, the three main drivers of growth will be domestic consumption, public investment, and private investment. Consumption remains a key driver, with a growth rate of 10% in the first six months and a target of 12% for the whole year. The VAT reduction policy will continue to be maintained and expanded, further supporting consumption, which contributes nearly 60% to the GDP structure.

In terms of public investment, the current disbursement rate of 30% does not fully reflect the expected potential. After the rearrangement of administrative boundaries and the apparatus, the disbursement progress is being accelerated, and it is entirely possible to achieve the full-year plan, thereby boosting economic growth. At the same time, with the strong implementation of Resolution 68, a wave of investment from the private sector is taking place, along with low-interest rate policies, estimated to contribute about 10% to GDP growth this year.

While FDI accounts for a moderate proportion, it remains an important component, with disbursed capital in the first six months reaching 11.7 billion USD, an increase of over 25% compared to the same period. It is expected that in the last six months of the year, Vietnam can attract an additional 15 billion USD, fully achieving the set goal. Additionally, the restructuring process under Resolution 66 is positively supporting the realization of expenditure and growth targets in the public sector.

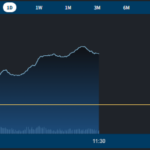

These positive signals have been reflected in the stock market. The VN-Index surpassed its historical peak in July. The market’s average P/E ratio remains attractive at about 14 times, lower than the regional average of 16 times. The number of securities accounts has surpassed 10 million, pushing the average trading value to around VND 20,000 billion/day.

The market is also supported by factors such as GDP growth prospects in the second half, public investment disbursement progress, strong FDI inflows, the operation of the KRX system creating momentum for new trading products, and expectations of market upgrade in the near future. With the current foundation, it is entirely feasible for the VN Index to close at the 1,500-1,550 point range by the end of the year.

As the economy enters a new growth cycle driven by robust reforms and deep integration, investment strategies also need to be reshaped towards a mid to long-term perspective and selective approach, aligning with risk appetite.

For cautious investors, priority should be given to leading economic sectors such as banking, benefiting from credit growth; infrastructure and public investment benefiting from strong disbursement; real estate with legal obstacles addressed through Resolution 86; and retail, recovering with the rebound in consumption and shifting to modern shopping channels.

For adventurous investors, cyclical and market-oriented sectors can be considered, such as securities benefiting from cash flow, new products, and market upgrades; and technology, benefiting in the long term from Resolution 57 on innovation, AI, semiconductors, and digital data.

The Liquidity Boom: VN-Index Hits All-Time High, Foreigners Sell Over VND 410 Billion

The market witnessed a second consecutive boom day with massive liquidity. VN-Index surged 2.41% this morning, reaching a new all-time high of 1565.03 points. Notably, the trading volume on the HoSE exchange surged by 109% compared to yesterday’s morning session, reaching VND 31,723 billion, just shy of the historical peak of VND 35,451 billion on the morning of July 29th.

10 Non-Financial Large Cap Companies Nominated for IR Awards 2025

FPT, GMD, HSG, MSN, MWG, PNJ, VHM, VIC, VNM, and VRE are the top 10 non-financial large-cap enterprises that have made it to the IR Awards 2025 semifinals. These prestigious companies will compete against each other from August 1st to 14th, 2025, showcasing their excellence and striving to be the best in their field.

A Glimpse Into the Billion-Dollar Markets of Ho Chi Minh City, Soon to Be Cleared.

TPO – With billions of dongs in investment and the aspiration to become a modern trading center, replacing the spontaneous markets, these markets in Ho Chi Minh City are now left as cold concrete blocks after more than two decades. The gates are locked tight, kiosks are covered in dust, and wild grasses grow rampant.