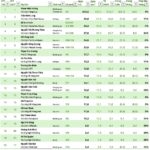

As of August 4, 2025, statistics show that 1,064 listed companies, representing 98.7% of the total market capitalization, have published their financial statements or preliminary estimates of their business results for the second quarter of 2025. These companies have maintained a growth trajectory, with a 30.2% increase in post-tax profits compared to the same period in 2024.

PROFIT GROWTH OUTPACES MARKET EXPECTATIONS

The Non-Financial group continued to lead the growth for the fourth consecutive quarter, with a remarkable 41.7% increase in the second quarter of 2025. On the other hand, the Financial group witnessed robust growth, particularly in the Financial Services sector, due to improved liquidity in the stock market during the same period.

In contrast, the Banking group’s post-tax profit growth of 17.5% in the second quarter was modest compared to the overall market. For the first six months of 2025, the Banking group’s post-tax profit growth reached 16.4%, the lowest compared to other industry groups.

However, a closer look reveals a significant performance divergence within the Banking group. Specifically, the top three banks, VCB, BID, and CTG, reported modest growth in net interest income, with NIM narrowing due to stagnant credit growth. Notably, CTG stood out with an impressive 80.2% surge in post-tax profits, attributable to non-interest income and provision reversals.

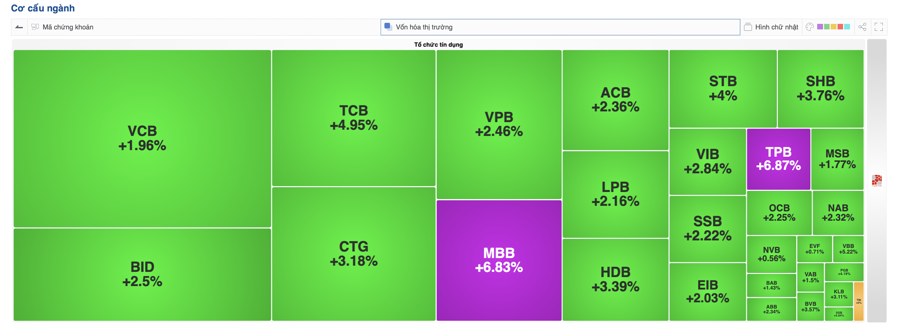

This performance divergence was also evident among private banks. VPB, VIB, STB, and SHB demonstrated strong profit growth compared to the previous year, primarily driven by robust credit growth. On the other hand, TCB remained almost unchanged (+1.2%), while MBB and LPB experienced slight declines (-1.6% and -1.1%, respectively).

The stocks with impressive profit performance in the second quarter and the first six months of the year also witnessed significant price appreciation. For instance, CTG’s six-month profit growth of 46.5% corresponded to a 23.4% increase in its stock price over three months and a 43.4% rise over one year.

MBB’s stock has climbed nearly 17% in the last three months and 29.4% in the past year, in line with the bank’s 18% profit growth in the first half. VPB has been a standout performer, surging over 39% in one month and 60% in three months, primarily due to its impressive 35.6% profit growth in the second quarter and over 30% in the first half.

In the past two sessions, banking stocks have surged, propelling the index to a new all-time high of 1,570 as of August 5. Today, MBB and TPB reached the ceiling price, following SHB’s impressive performance yesterday. Several large-cap stocks, including TCB, CTG, BID, and VPB, have also broken out.

CREDIT GROWTH EXPECTED TO REACH 18%

The rally in banking stocks is also fueled by expectations of favorable developments for the sector in the coming months. Most recently, on August 4, Vice Governor of the State Bank of Vietnam, Pham Thanh Ha, emphasized that the State Bank requires credit institutions to immediately implement tasks related to stabilizing and reducing interest rates as directed by the Government, the Prime Minister, and the State Bank.

While the immediate effect of lowering interest rates may lead to a short-term profit-sharing situation for banks, the long-term impact is expected to be positive, as more capital will be injected into the market, supporting economic growth. Credit growth is anticipated to surpass last year’s level.

On July 31, 2025, the State Bank of Vietnam announced adjustments to increase the 2025 credit growth target for credit institutions, ensuring transparency and fairness. Commercial banks’ credit growth adjustments are calculated as follows: December 31, 2024, credit balance x 2023 ranking points x 0.5%. Mr. Nguyen The Minh, Director of Retail Analysis at Yuanta Securities, attributed this additional credit room to the high capital demand to sustain and boost economic growth, especially with the 2025 GDP target set at 8-8.5% and inflation under control.

Yuanta Securities forecasts the entire system’s credit growth to reach 17-18% in 2025.

Commenting on the outlook for bank stocks, Mr. Dang Tran Phuc, Chairman of the Board of Directors of AzFin Vietnam Joint Stock Company, stated that as of July 29, 2025, the P/E ratio of the VN-Index was approximately 14.5, and the P/B ratio was 1.91, close to the median of the past 15 years. Given the positive macroeconomic backdrop and the promising business prospects for the second half of 2025 and 2026, these valuation levels remain attractive for value investors with a 2-3 year investment horizon.

“We haven’t seen any sector with extremely high valuations. On the contrary, some sectors, such as banking, steel, and industrial real estate, still offer attractive valuations,” said Mr. Phuc.

Similarly, Mr. Nguyen Viet Cuong, Vice Chairman of the Board of Directors of Kafi Securities Joint Stock Company, suggested that in the context of a new economic growth cycle driven by profound reforms and deep integration, investment strategies should be reshaped toward a medium and long-term perspective with careful stock selection. For cautious investors, he recommended prioritizing sectors that drive the economy, such as banking, which benefits from credit growth.

Gold Prices Maintain Uptrend Amid Fed Rate Cut Expectations

The price of gold surged on Friday after a disappointing jobs report from the U.S. Labor Department. The report, which fell short of expectations, revealed a sluggish jobs market with a mere 132,000 non-farm jobs added in July. This prompted a rush to safe-haven assets, with gold leading the charge.

Mr. Tran Hoang Son (VPBankS): VN-Index Poised for New Uptrend After Correction

“It is quite normal for the VN-Index to experience a correction after a strong rally, and this pullback is likely a result of short-term profit-taking,” said Tran Hoang Son, Market Strategy Director at VPBank Securities (VPBankS), during the Vietnam and the Indices show on August 4th. He added, “The index is fully capable of entering a new uptrend.”

The Power of Profits: How a 30.2% Rise in Earnings for Over 1000 Businesses is Impacting Stock Performance

The stock market is a vibrant and dynamic arena, where you’ll always find stocks that exhibit a disconnect between their stellar financial performance and their stagnant stock prices. These stocks often fly under the radar, belonging to the mid-cap or small-cap category, unnoticed by most investors.

The Wealth of Vietnam’s Top 20 Stock Market Billionaires: Vietjet Chair Adds Another $29 Million, VPBank Chair’s Family Sees Largest Increase

As of Wednesday, August 6, 2025, Mr. Pham Nhat Vuong, Chairman of Vingroup, remains the wealthiest individual on the Vietnamese stock market. With a staggering net worth of 233,500 billion VND, Mr. Vuong’s wealth continues to be a testament to his success and influence in the country’s economy.