|

BSR’s Business Targets in Q2 2025

Source: VietstockFinance

|

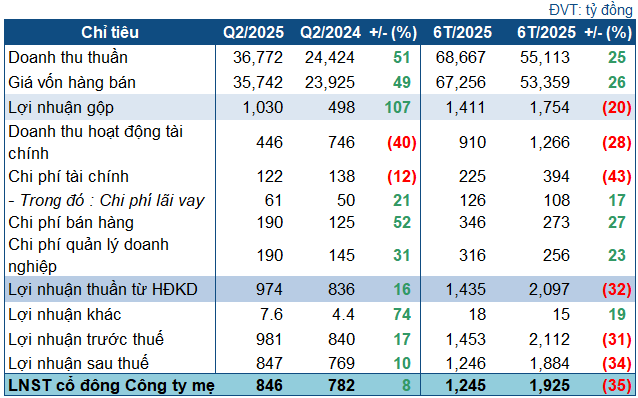

In Q2 2025, BSR recorded impressive results with consolidated revenue reaching nearly VND 36.8 trillion, a 51% increase compared to the same period last year. After deducting the cost of goods sold, the company’s gross profit amounted to over VND 1 trillion, doubling that of the previous year’s second quarter.

While gross profit increased significantly, financial revenue witnessed a sharp decline of 40%, amounting to VND 446 billion. This decrease was attributed to the absence of profit recognition from the discontinuation of a consolidated subsidiary, as was the case in the previous year. On the other hand, both selling and management expenses surged, reaching VND 190 billion. Consequently, BSR’s net profit stood at VND 846 billion, reflecting an 8% improvement over the same period last year.

BSR attributed these positive results to the upward trend in crude oil prices during Q2 2025, in contrast to the downward trend observed in the previous year. Additionally, the significant increase in consumption during this period, compared to Q2 2024 when the company underwent a comprehensive maintenance plan, also contributed to the improved gross profit and overall performance.

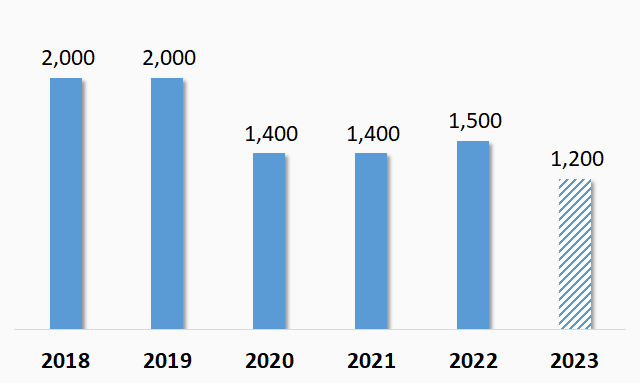

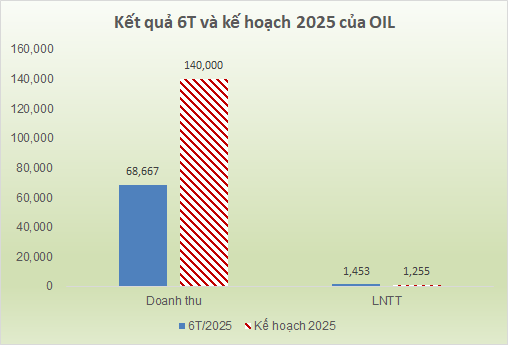

For the first six months of the year, BSR achieved consolidated revenue of nearly VND 68.7 trillion, a 25% increase year-over-year, while net profit decreased by 35% to over VND 1.2 trillion. Nevertheless, the company has successfully accomplished 49% of its annual revenue target and exceeded its profit goal by nearly 16% for the year, demonstrating a strong performance thus far.

Source: VietstockFinance

|

As of the end of Q2, BSR’s total assets amounted to over VND 84 trillion, a 5% decrease from the beginning of the year. Short-term assets accounted for nearly VND 68.4 trillion, a slight reduction of 4%. The company maintained a strong cash and deposit balance of approximately VND 42 trillion, while inventory decreased by 25% to over VND 11.8 trillion. Meanwhile, construction in progress increased by 21%, totaling over VND 1.57 trillion, mainly attributed to the expenses incurred for the Dung Quat Refinery Upgrade and Expansion Project.

In terms of capital structure, short-term debt constituted the majority of the company’s payables, amounting to nearly VND 26.8 trillion, a 16% decrease compared to the beginning of the year. Out of this, more than VND 11.3 trillion was bank loans, reflecting a 28% reduction. With its substantial cash reserves, BSR’s ability to service its debt is unquestionable.

– 08:28 08/06/2025

Market Beat July 31st: Holding the 1,500-Point Mark Triumphantly

The VN-Index faced significant challenges during the morning session, with constant struggles and adjustments, suggesting a deep decline at the closing bell. However, a remarkable turnaround took place in the afternoon session, as the market staged a strong recovery, recouping much of the lost ground. The index ultimately closed at 1,502.52, limiting the damage to a modest 5.11-point loss.

Launching BSR’s Diesel Oil into the Laotian Market

In late July and early August, amidst a wave of patriotic fervor leading up to the fourth congress of the Party Committee of the Vietnam National Oil and Gas Group for the term 2025–2030, Binh Son Refining and Petrochemical Joint Stock Company (BSR) successfully exported its first batches of diesel oil to the Lao People’s Democratic Republic. This strategic move marks a significant step towards BSR’s goal of market diversification and expansion, promising enhanced operational efficiency and profitability.

How Much Has the CEO Invested in the Sonasea Van Don Harbour City Project?

With a significant boost in gross margins, CTCP Group C.E.O Joint Stock Company (HNX: CEO) witnessed a remarkable surge in its Q2 and H1 2025 net profits, rising by 37% and 24% year-over-year, respectively.

The Market Beat – 02/01: VN-Index Starts the Year on a Positive Note Despite Lackluster Liquidity

The market witnessed a rebound in the afternoon session, with the VN-Index recovering from 1,264 to 1,269.71. Meanwhile, the HNX-Index also gained 0.26 points to reach 227.69, while the UPCoM-Index dipped slightly by 0.01 points to 95.05. Overall, the liquidity of the three exchanges was relatively low, slightly exceeding 12 trillion VND.