Exchange Rate Fluctuations

In the free market, the VND/USD exchange rate dropped by 20 VND in the buying price and increased by 30 VND in the selling price compared to the previous session, trading at 26,420 – 26,480 VND/USD (buy – sell).

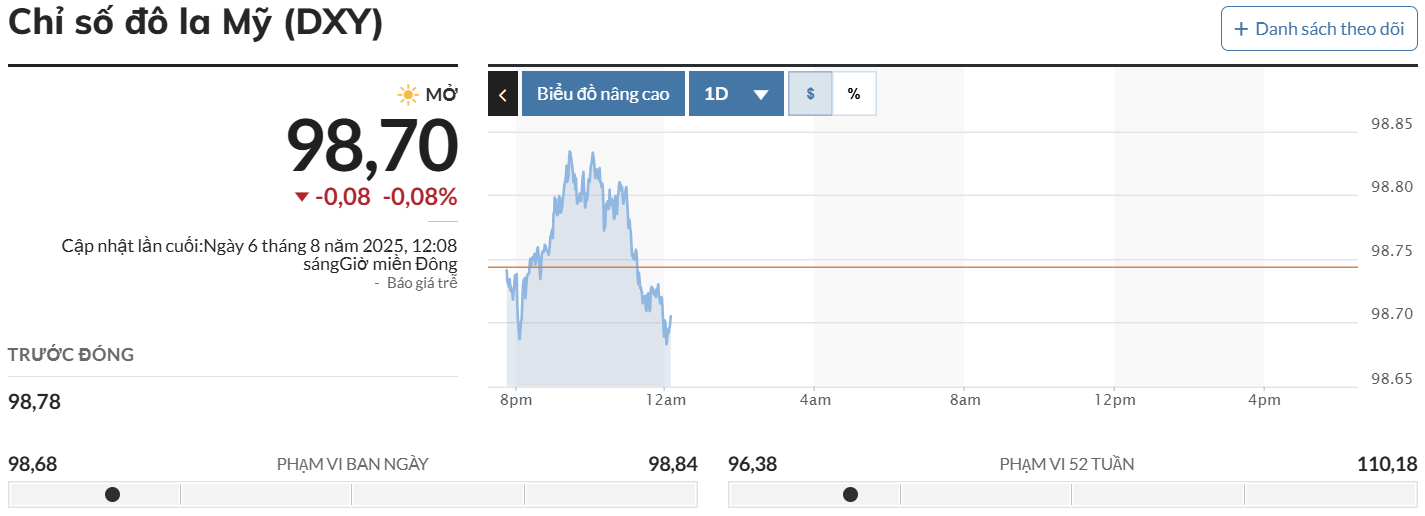

At the same time, in the global market, the USD Index (DXY) – a measure of the US dollar’s strength – stood at 98.70 points, a 0.08% decrease from the previous session.

Market Uncertainty

The DXY index remained relatively flat this week as investors assessed the Federal Reserve’s policy outlook amid mixed economic data and escalating trade tensions. Data from the Institute for Supply Management (ISM) showed that the US service sector nearly stalled in July, falling short of expectations and reflecting the negative impact of the tariffs imposed by President Donald Trump.

Meanwhile, Trump stated that he would announce the nomination for the vacant position on the Fed’s Board of Governors by the end of this week and is narrowing down the list of potential candidates to replace Chairman Jerome Powell.

Markets continue to price in a September Fed rate cut at over 90% probability, with around 60 basis points expected to be lowered this year. On the trade front, Trump threatened to impose tariffs of up to 250% on imported pharmaceuticals and may also target semiconductors.

The Vice Premier’s Directive on Electricity and Fuel Price Regulation

“The esteemed Vice Prime Minister, Ho Duc Phoc, emphasizes the critical importance of effective price management and governance as a pivotal strategy to propel economic growth. Among the key areas of focus, he highlights the management of electricity and fuel prices, underscoring their impact on the broader economy. This directive serves as a timely reminder of the government’s commitment to fostering a stable and prosperous Vietnam.”

Gold Prices Maintain Uptrend Amid Fed Rate Cut Expectations

The price of gold surged on Friday after a disappointing jobs report from the U.S. Labor Department. The report, which fell short of expectations, revealed a sluggish jobs market with a mere 132,000 non-farm jobs added in July. This prompted a rush to safe-haven assets, with gold leading the charge.

The Fed’s Move: How the Central Bank’s Actions Impact the Global Economy and Your Wallet

Since the beginning of the week, the SBV has raised the central exchange rate for four consecutive sessions, reaching a new peak since the application of this mechanism in early 2016.