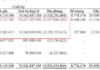

With nearly 117.3 million shares outstanding, BIC plans to spend approximately VND 176 billion on cash dividends (equivalent to VND 1,500/share). The payment date is expected to be November 6.

Source: VietstockFinance

|

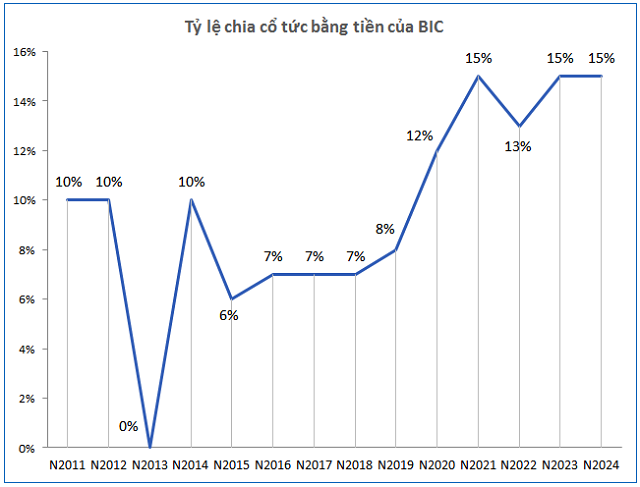

Since 2020, BIC has maintained a high cash dividend policy, especially keeping the rate at 15% for the past two years, thanks to stable business growth. The 2024 cash dividend marks a change from the initial plan – previously, the Company intended to pay dividends in stocks at the same rate.

At the same time, BIC will issue nearly 84.8 million bonus shares to existing shareholders, equivalent to a performance ratio of 72.3%. After the issuance, BIC’s charter capital is expected to increase from VND 1,173 billion to over VND 2,020 billion – marking the first time the company has raised capital in 12 years since 2014.

Source: VietstockFinance

|

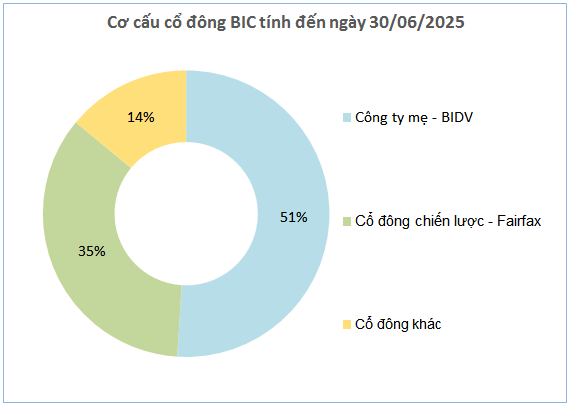

Vietnam Joint Stock Commercial Bank for Investment and Development (BIDV) is currently the largest shareholder, owning 51% of BIC’s capital. It is estimated to receive nearly VND 90 billion in dividends and more than 43 million bonus shares. Following closely is Fairfax Asia Limited with a 35% stake, expected to earn nearly VND 62 billion in dividends and almost 30 million bonus shares.

Regarding the 2025 business plan, BIC aims for a consolidated pre-tax profit of VND 710 billion, up 9% from 2024. However, the cash dividend ratio is expected to decrease to 10%.

Source: VietstockFinance

|

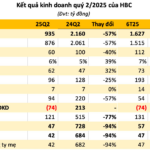

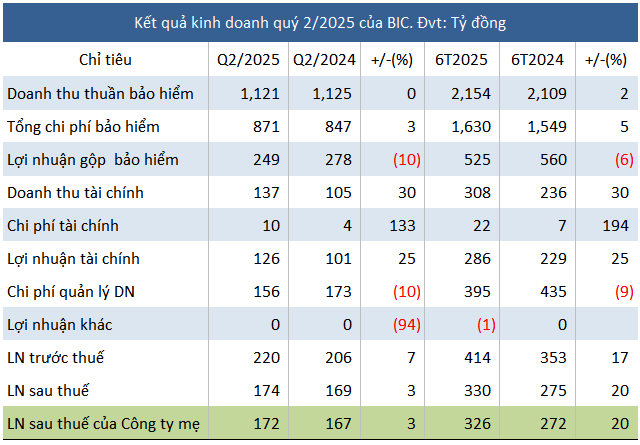

In the second quarter of 2025, BIC’s gross profit from insurance activities decreased by 10% compared to the same period last year, reaching VND 249 billion. Thanks to a 25% increase in financial income and a 10% reduction in management expenses, net profit still slightly increased by 3%, reaching VND 172 billion.

In the first six months of the year, BIC recorded a net profit of VND 326 billion, up 20% from the previous year. Of this, profit from insurance business activities decreased by 6% to VND 525 billion, but financial income increased sharply by 25% to VND 286 billion, mainly due to a 2.4-fold increase in profit from securities investment. With these results, the Company has achieved over 58% of its annual profit plan.

– 14:58 08/06/2025

Construction Firm, Hòa Bình (HBC), Turns a Profit by Liquidating Fixed Assets

Let me know if you would like me to tweak it or provide any additional ideas!

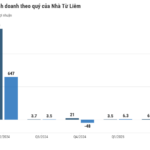

The six-month profit for Construction Hòa Bình has plummeted by 94% compared to the same period last year, with only about 13% of the annual target achieved so far.

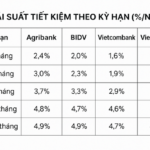

“August Savings: Maximizing Interest Rates at Agribank, Vietcombank, BIDV, and VietinBank”

The interest rates on savings accounts at state-owned banks remain low at the beginning of August, with long-term deposits attracting rates of just 4.7-4.9% per annum.