Profit Down 60%

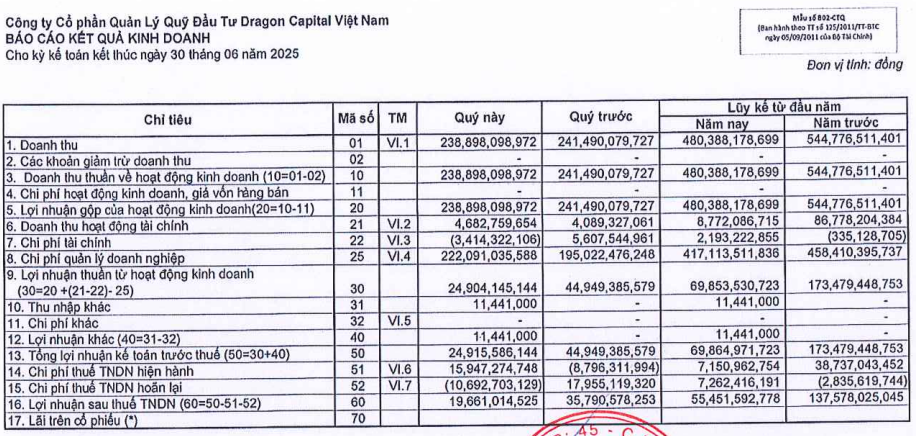

For Q2 2025, Dragon Capital reported nearly VND 234 billion in revenue and nearly VND 20 billion in post-tax profits. For the first half of 2025, the company achieved more than VND 480 billion in revenue and over VND 55 billion in post-tax profits, down 12% and 60%, respectively, compared to the same period last year.

In terms of revenue structure, investment securities consulting remained the largest contributor at 67%, equivalent to nearly VND 324 billion, down 17% from the first half of 2024. Other significant revenue generators included securities investment fund management and securities investment company, accounting for 32%, or more than VND 152 billion, a slight increase from the previous year. The remaining activities comprised investment portfolio management and voluntary pension fund management.

Source: Dragon Capital’s Q2 2025 Financial Statements

|

As of the end of Q2, Dragon Capital’s total assets exceeded VND 1,042 billion, a slight decrease from the beginning of the year. This comprised mainly short-term investments of nearly VND 452 billion, cash and cash equivalents of over VND 271 billion, business receivables of more than VND 98 billion, and fixed assets of nearly VND 166 billion.

Out of the nearly VND 452 billion in short-term financial investments, the company primarily invested in fund certificates, amounting to nearly VND 444 billion, with the remaining VND 17 billion invested in stocks. Concurrently, the company had to set aside over VND 7 billion in provisions for depreciation of short-term investments.

Business receivables of over VND 98 billion decreased by 12% compared to the beginning of the year. This comprised mainly receivables from securities investment consulting of over VND 71 billion and receivables from securities investment fund management and securities companies of nearly VND 26 billion.

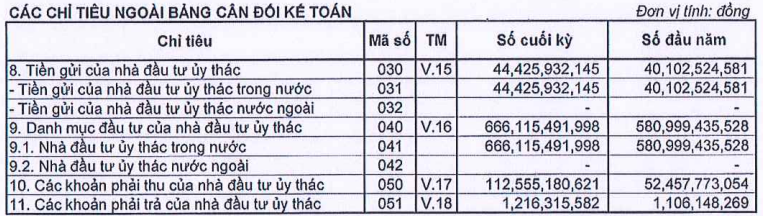

Off-balance sheet metrics showed that the size of the entrusted investment portfolio exceeded VND 666 billion, up 15% from the beginning of the year. In terms of structure, the entire entrusted amount came from domestic investors, including more than VND 360 billion from organizations and nearly VND 306 billion from individuals.

The company held over VND 44 billion in deposits from entrusted investors, an increase of 11% from the beginning of the year, comprising nearly VND 38 billion from organizations and almost VND 7 billion from individuals.

Additionally, the company had receivables of nearly VND 113 billion from entrusted investors, more than double the amount from the beginning of the year, mainly due to a significant increase in other receivables from over VND 23 billion to over VND 74 billion, and receivables from securities sales and dividends from over VND 27 billion to nearly VND 38 billion.

Source: DCVFM’s Q2 2025 Financial Statements

|

Appointment of Mr. Le Anh Tuan as CEO

On August 6, 2025, Dragon Capital announced the appointment of Mr. Le Anh Tuan as the new CEO, effective October 1, 2025. According to Dragon Capital, since joining the company in 2008, Mr. Tuan has held several key leadership positions, contributing to shaping the company’s investment philosophy and solidifying its market position.

Mr. Tuan holds an MBA from Willamette University and a Ph.D. in Economics from Pennsylvania State University in the United States. After starting his career at Merrill Private Wealth Management, he joined Dragon Capital as Chief Economist and later became Director of Research in 2010. He then served as Deputy Director of the Investment Division in 2016, Co-Portfolio Manager of the IPO/Placing Platform in 2017, and officially became Director of the Investment Division in January 2023. Mr. Tuan is also a member of the Investment Committee for all of Dragon Capital’s equity and fixed-income funds.

In the announcement of the new CEO, Mr. Dominic Scriven, Chairman of DCVFM, stated: Vietnam is entering a phase of structural reform, expanding access, and enhancing its position in the international capital market. The appointment of Dr. Tuan ensures strategic continuity and strengthens our ability to deliver sustainable value to investors.

|

Mr. Le Anh Tuan will succeed Mr. Beat Schuerch (Swiss). According to Dragon Capital, Mr. Beat will continue as a member of the Board of Directors of Dragon Capital Group and DCVFM, supporting the company during the transition phase and contributing to strategic direction.

Mr. Beat Schuerch holds a Master’s degree in Economics from the University of St. Gallen, Switzerland, and has worked in Southeast Asia since 1993, holding various management roles in manufacturing, market expansion services, consulting, and asset management. He joined Indochine Capital in 2006 as CFO in Vietnam before becoming the head of the securities division. In 2010, he started at Dragon Capital as Director of Operations and became CEO in December 2017.

“The Appointment of a New Leader: Mr. Lê Anh Tuấn Takes the Helm as CEO of a Billion-Dollar Foreign Fund”

Dragon Capital Vietnam Fund Management JSC (DCVFM) is pleased to announce the appointment of Dr. Le Anh Tuan as its new Chief Executive Officer, effective October 1st, 2025.