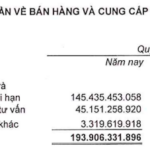

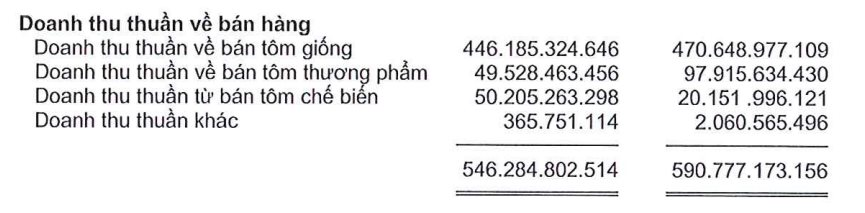

Vietnam-Australia Seafood Joint Stock Company has released its consolidated financial report for the first half of 2025, recording a net revenue of 546 billion VND, a 7.5% decrease compared to the same period in 2024. The majority of the company’s revenue comes from shrimp fry sales, amounting to over 446 billion VND, which accounts for 82% of net revenue.

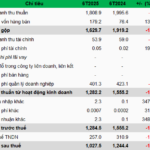

After deducting the cost of goods sold, Vietnam-Australia Seafood reported a gross profit of over 250 billion VND, a 21% decrease compared to the previous year. The company’s gross profit margin decreased from 53.86% in the first half of 2024 to 45.83% in the same period in 2025.

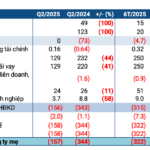

The company’s financial income for the period decreased by 41% to 3.89 billion VND, while financial expenses quadrupled compared to the same period last year, increasing from 537 million VND to over 2.2 billion VND.

A positive note is that selling expenses decreased by 6% to 148 billion VND, and management expenses also decreased by 9%, amounting to 121 billion VND.

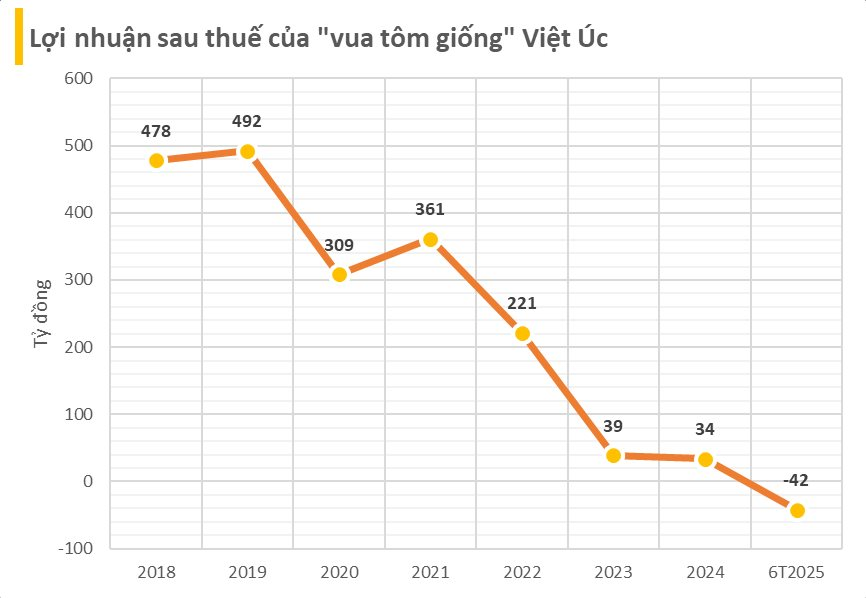

Vietnam-Australia Seafood reported a net loss of over 41 billion VND in the first six months of 2025, compared to a net profit of over 13 billion VND in the same period last year.

As of June 30, the company’s total assets stood at 2,272 billion VND, an increase of 31 billion VND from the beginning of the year. Liabilities were at 212 billion VND, a 52% increase from the beginning of the year, including nearly 93 billion VND in short-term borrowings, with no long-term debt. Owners’ equity was 2,060 billion VND.

Vietnam-Australia Seafood, formerly known as Vietnam-Australia Limited Liability Company, was established in July 2001 in Binh Thuan Province. The company is founded and chaired by Mr. Luong Thanh Van (born in 1963). Its main business is aquaculture.

In May 2015, the company officially transitioned to a joint-stock company model and became a public company in March 2019. Vietnam-Australia Seafood is known as the “shrimp fry king,” holding over 30% of the domestic market share and ranking first in Vietnam. With large-scale farms across multiple provinces, the company has a production capacity of 50 billion shrimp fry per year, meeting 25% of the domestic market demand.

In the past, Vietnam-Australia Seafood also impressed with its remarkable returns on capital. In 2020, the company achieved a basic earnings per share (EPS) of nearly 30,000 VND. Even a year earlier, the company’s EPS reached nearly 48,000 VND. This was due to the company’s small paid-up capital of just over 103 billion VND, equivalent to 10.3 million shares.

In 2018, the STIC investor group from South Korea acquired a 9.8% stake in Vietnam-Australia Seafood at a price of 764,843 VND per share, valuing the “shrimp fry king” at approximately 7,400 billion VND. The current market capitalization of Minh Phu (MPC), the leading company in the shrimp industry, is around 6,500 billion VND.

The extraordinary EPS performance of Vietnam-Australia Seafood came to an end in 2022 when the company paid a “huge” 120% stock dividend, meaning that for every share held, shareholders received 12 shares as dividends. The source of this dividend was from retained earnings.

A Challenging Second Quarter: PSH Reports a Loss of Over VND 300 Billion in the First Half of the Year

The repercussions of the forced tax invoice at the end of 2023 continue to plague the Petroleum Trading and Investment Joint Stock Company (UPCoM: PSH). The company reported yet another quarter of significant losses, this time for the second quarter of 2025, amounting to hundreds of billions of dong.

Profitable Quarter: An Gia’s Q2 Profits Surge to Over Three Times the Previous Year’s

“An Gia has successfully trimmed costs and ramped up its consulting prowess, resulting in a remarkable threefold increase in net profit for Q2 2025 compared to the same period last year.”

The Green Airport: CEO Group’s Profitable Venture into Industrial Park Development

“CEO Group reports a doubling of profits for the second quarter of 2025, attributed to successful cost-cutting measures. The Group’s quarterly profits soared to 39 billion VND. During this period, CEO Group also invested 50.5 billion VND in its newly established subsidiary, which has a charter capital of 450 billion VND.”