Following a streak of vigorous trading sessions with record-breaking liquidity, the VN-Index has consecutively reached new historical peaks. Market valuation is now a key focus for investors.

Sharing his insights on the current market valuation, Mr. Dang Tran Phuc, Chairman of AzFin Vietnam, stated that the positive second-quarter financial results for 2025 have contributed to reducing the stock market’s valuation. As of July 29, the VN-Index’s P/E ratio was approximately 14.5, and the P/B ratio was 1.91, which is in the middle range compared to the past 15 years.

Given Vietnam’s positive macroeconomic landscape, coupled with promising business prospects for enterprises in the latter half of 2025 and 2026, this valuation remains attractive for value investors with a 2-3 year investment horizon.

When analyzing specific sectors, the valuation of banking, steel, and real estate industries is also considered affordable for investors. In reality, while the market has been on an upward trajectory, the growth has not been evenly distributed, with significant differentiation between industries and even among stocks within the same sector.

According to Mr. Nguyen The Minh, Director of Research and Retail Client Development at Yuanta Securities Vietnam, the P/E ratio of the VN-Index has almost reached the 10-year average as the index peaked. However, this valuation is still lower than the peak in 2021 during the COVID-19 pandemic when money was cheap, and in 2018 when there was an IPO wave.

In contrast, the year 2025 presents a confluence of factors, including a cycle of monetary policy easing, ambitious GDP growth targets for 2025-2030, and stock market upgrades. Therefore, Mr. Minh anticipates the P/E ratio to surpass the 10-year average soon.

“The nearest resistance level for the P/E ratio is 18, after which it will surpass the 10-year average, implying that the VN-Index could reach 1,858 points. Nonetheless, in the short term, the 10-year average serves as a strong resistance level, which was also the resistance during 2023-2024,” explained Mr. Minh.

Analyzing the performance of the VN-Index in August over the years from 2001 to 2024, Mr. Minh noted that the index has historically averaged a 1.6% increase with a 61% probability of an upward movement.

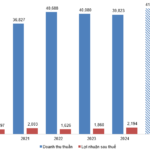

In their recent market outlook update, analysts from Rong Viet Securities (VDSC) also commented that after reflecting the second-quarter earnings for 2025, the market’s EPS improved by about 8% from the previous quarter, leading to a decrease in the VN-Index’s P/E ratio to 13.8x at the closing price on July 31, 2025.

Over the next three months, VDSC maintains a target P/E range of 13.3x to 14.7x. The upward re-rating of P/E will be supported by expectations of continued EPS improvements in the coming quarters, bolstered by accommodative monetary policies and market upgrade prospects.

On the other hand, unexpected adverse factors could exert downward pressure on the market, pushing it towards the lower boundary of approximately -1 standard deviation from the 3-year median.

As of the second quarter of 2025, the VN-Index’s cumulative EPS for the last four quarters was approximately VND 108.7 per share and is projected to improve to VND 112. With these factors, VDSC maintains a target valuation range of P/E from 13.3x to 14.7x, corresponding to a trading range for the VN-Index in the next three months of 1,445 – 1,646 points.

Regarding investment strategies, Mr. Phuc advised that finding opportunities in stock valuations is a safe and effective long-term approach, but it is not straightforward. Therefore, investors should consider the following factors: First, focus on leading enterprises in their respective sectors. In the context of a booming economy, especially after Resolution 68 on promoting the private sector, it is evident that well-established leading companies will reap the most benefits.

Second, avoid short-term value traps set by companies with short-lived abnormal profits, as these abnormal profits should be excluded from the analysis to gain a more accurate perspective and reasonable valuation.

Third, while the stock market is deemed attractive and promising, it also presents short-term pitfalls and corrective phases. Investors should be prepared with different scenarios and strategies, such as always keeping a certain amount of cash to take advantage of dips to invest in good stocks at attractive valuations, and maintaining a certain proportion of stocks to seize opportunities to lock in profits when valuations are high.

The Stock Market Surge: Banking Sector Leads VN-Index to New Heights

The market slowed down and turned volatile in the afternoon session, but ultimately finished on a positive note. The VN-Index rose 1.72% to 1573.71, closing at a new all-time high. This achievement was largely driven by TCB, VCB, and the banking sector as a whole, which propelled the index beyond its previous peak.

Market Beat: Green Dominance, VN-Index Extends Gains

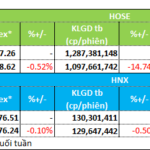

The trading session concluded with significant gains, as the VN-Index surged by 26.56 points (+1.72%), closing at 1,573.71. Meanwhile, the HNX-Index also witnessed a robust increase of 2.54 points (+0.95%), ending the day at 268.66. The market breadth was strongly positive, with 529 advancing stocks versus 254 declining ones. This bullish sentiment was echoed in the VN30 basket, where 28 stocks climbed while only 2 witnessed losses.

Stock Market Insights: Can the Uptrend Persist?

The VN-Index rallied for the third consecutive session, hovering near the upper band of the Bollinger Bands and setting yet another record high. The MACD indicator flashed a buy signal as it crossed above the signal line, while the Stochastic Oscillator remained upward-bound following its previous buy signal. Should these indicators continue to strengthen in upcoming sessions, the positive short-term trajectory is likely to persist.

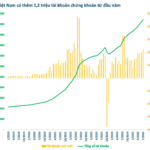

The Stock Market Frenzy: Investors Rush to Open Accounts as VN-Index Soars to New Heights

The number of new securities accounts opened in July hit an 11-month high, marking a significant surge in investor activity.