A recent survey by Batdongsan.com.vn on the land market in the former areas of Ba Ria Vung Tau province revealed a slight increase in prices compared to two months ago.

Specifically, land prices on the main road in the center of Phu My town, now known as Tan Thanh ward in Ho Chi Minh City, have increased for larger plots ranging from 1,000 to 3,000 square meters. Prices on these main roads in the center have risen from 5.5 to 6.5 million VND per square meter to 7 to 7.4 million VND per square meter.

Land prices in Phuoc Hoa ward and Tan Phuoc ward (formerly of Ba Ria Vung Tau province), now Tan Phuoc ward in Ho Chi Minh City, located near National Highway 51, have also increased over the past two months. Prices have gone up from 10 to 11 million VND per square meter to 12 to 13 million VND per square meter. In the same area, land plots adjacent to National Highway 51, about 1 km from the Bien Hoa – Vung Tau expressway, have seen their prices rise from 14 to 15 million VND per square meter to 16 to 17 million VND per square meter.

Land prices in wards that were formerly part of Ba Ria city, now wards of Ho Chi Minh City (Long Toan, Phuoc Hung, Phuoc Nguyen, and Phuoc Trung), have also increased. Prices for land on larger roads, suitable for business activities, have risen from 45 to 48 million VND per square meter to 47 to 51 million VND per square meter. Land on the busy Cach Mang Thang 8 road has also increased in price, from 44 to 45 million VND per square meter to 46 to 47 million VND per square meter. In Long Huong ward, where land plots can reach several thousand square meters, prices have risen from 13 to 15 million VND per square meter to 14 to 16.5 million VND per square meter. Similarly, land on the large Nguyen An Ninh road has seen a price increase from 27 to 28.5 million VND per square meter to 28 to 30 million VND per square meter. Land prices along the National Highway 56 bypass have also increased, from 11 to 13 million VND per square meter to 13 to 15 million VND per square meter.

According to Batdongsan.com.vn’s survey, land prices in the former areas of Ba Ria Vung Tau province range from 40 to 65 million VND per square meter in the center and around 25 to 35 million VND per square meter in coastal areas. These prices are expected to continue rising in the medium and long term, making this region an attractive destination for investors.

Not only have prices increased, but there has also been a significant influx of investors into Ba Ria Vung Tau, especially since the announcement of the merger with Ho Chi Minh City.

Land in the newly merged areas, such as Ba Ria Vung Tau, is becoming an attractive prospect for investors due to its strategic location, tourism potential, and the ongoing development of inter-regional infrastructure.

Even before the merger, Ba Ria – Vung Tau province had already attracted significant investment. In the first six months of 2025, according to the province’s Planning and Investment Department, the province attracted more than 24,000 billion VND in investment capital in the real estate sector, a 35% increase compared to the same period last year. Vung Tau city alone accounted for over 60% of the newly registered capital, with numerous large-scale residential and resort projects being initiated and restarted.

Investors Favor Land in the Merged Areas

Mr. Le Bao Long, Marketing Director of Batdongsan.com.vn, shared the results of their survey, which indicated that in the first six months, the most popular real estate types among consumers were land (33%), apartments (30%), and detached houses (21%), meeting the actual housing needs of the majority of consumers.

For investment purposes, investors are prioritizing primary real estate with a medium to long-term holding strategy. A significant majority (64%) of investors plan to invest in primary real estate, while only 36% prefer secondary real estate.

When investing in primary real estate, investors consider the following factors essential: project legal status (78%), infrastructure connectivity (71%), utility systems (66%), landscape and design (47%). Notably, there has been a decrease in the intention to flip properties compared to last year, with only 12% of investors planning to hold real estate for less than a year. Instead, a considerable 49% of investors intend to hold their assets for three to ten years.

Interestingly, 47% of investors expect real estate prices to increase after the merger. These investors believe that the factors influencing post-merger real estate prices include transportation infrastructure development, new urban planning, regional development, population growth and housing demand, investor expectations, investment incentives, and FDI or labor migration.

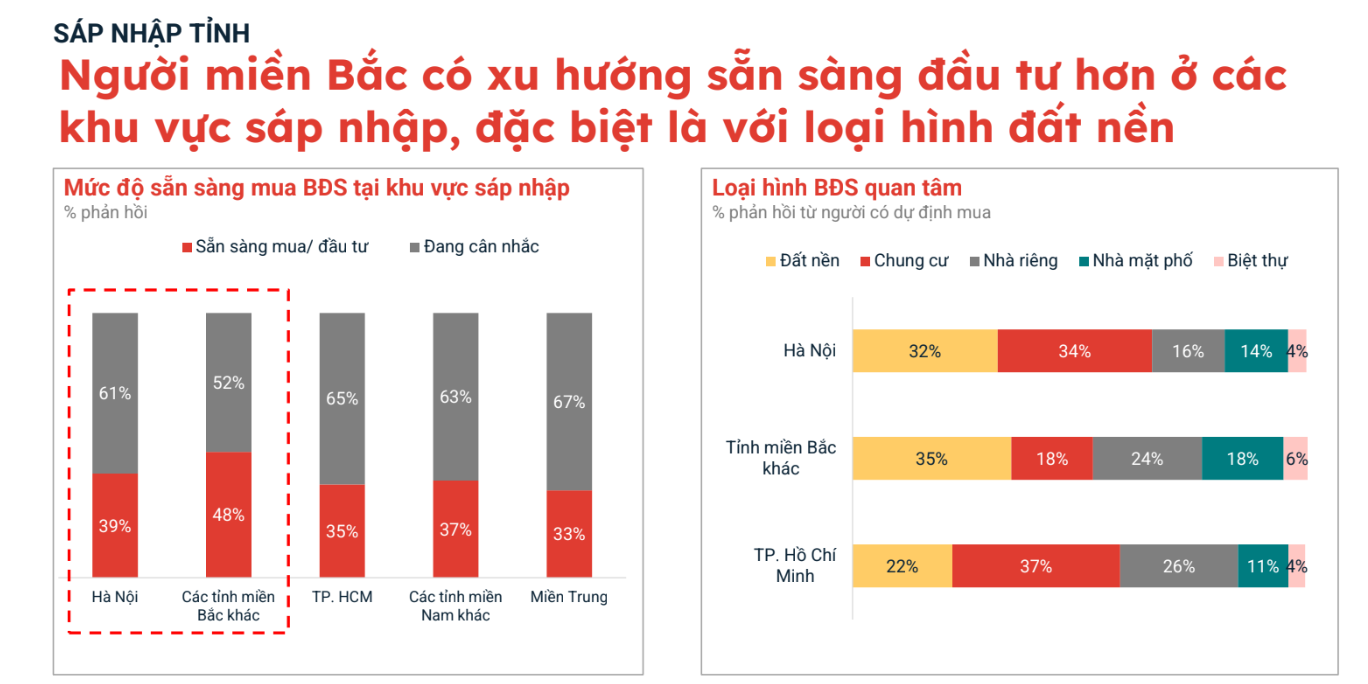

Notably, investors from Northern Vietnam tend to be more inclined to invest in the merged areas, especially in land. 39% of investors are from Hanoi, and 48% are from other Northern provinces. In contrast, only about 35% of investors are from Ho Chi Minh City, and 37% are from other Southern provinces. This indicates a higher level of interest in land investment in the merged areas among Northern investors.

Mr. Long emphasized that while most investors are interested in the new administrative center, there are concerns about investment risks. The main concerns revolve around artificial price inflation (35%), unclear planning and legal risks (28%), slower-than-expected infrastructure development (16%), and potential liquidity issues when needing to sell (16%).

“Phát Đạt Repositions Its Investment Portfolio, Focusing on the Southern Market to Embrace the New Growth Cycle.”

As the real estate market enters a more selective and substantive recovery phase, businesses must reshape their strategies to adapt. Phat Dat Real Estate Development Corporation (HOSE: PDR) is demonstrating a clear and aggressive shift to capture the significant movements in planning, policies, capital flows, and consumer trends.

Unlocking the Secrets of Task Force 5013: Unraveling the Number of Real Estate Projects

After eight months of operations, Task Force 5013 has facilitated the development of 176 commercial housing projects by conducting 33 meetings. These efforts have directly addressed issues pertaining to an impressive 108,170 residential units, including apartments, houses, land lots, officetel spaces, shops, and an additional 1,247 diverse properties.

Thunderstorms Hit Ho Chi Minh City, Disrupting Flights

Due to a thunderstorm in Ho Chi Minh City on the evening of August 5, several flights to and from Tan Son Nhat Airport had to be rescheduled or delayed.